While the cloud phenomenon of the past decade has conditioned us to think of “the hyperscalers” as homogenous triplets, the Q3 results from Microsoft, Google Cloud, and AWS reveal with great clarity that these are three distinctly unique companies currently performing at wildly different levels.

And the last vestiges of that perceived homogeneity are crumbling as the extraordinary upheavals and transformations in the business world and among billions of consumers require that modern tech vendors be able to adapt and mutate and evolve just as rapidly as the customers they serve.

Over the past 12-18 months, Microsoft, Google Cloud, and AWS have all had to deal with sharp cutbacks in new cloud purchases, a trend brought on by global economic uncertainty and broadly described as “optimization,” as in “instead of buying lots more new cloud stuff, we’ll fine-tune what you’ve sold us over the past couple of years.”

And while the leaders of each of those three companies have, over those past 12-18 months, deployed that “optimization” term countless times to describe (or rationalize) their quarterly performances, the financial results of each company reveal quite starkly which vendor has been most successful at, if you will, optimizing all that optimization.

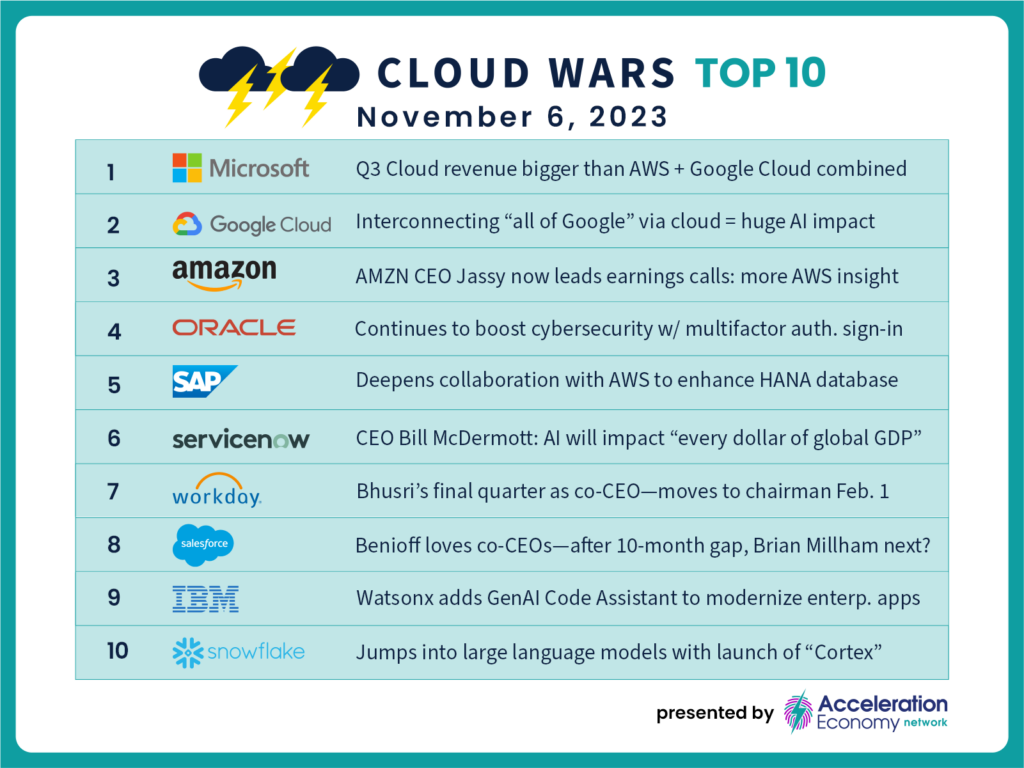

To illustrate that claim, let’s look at the third-quarter results from each company that came out last week in comparison with the Q3 results from a year ago, spanning a 12-month period when all that “optimization” was the big thing. And I’ll roll them out in the order in which they’re ranked on my Cloud Wars Top 10 list. (I’ve using calendar Q3 as the designation here, although for Microsoft that corresponds to its fiscal Q1.)

| Company | Cloud Growth Rate Q3 ’22 | Q3 ’23 | Cloud Revenue Q3 ’22 | Q3 ’23 |

|---|---|---|

| #1 Microsoft | 24% | 24% | $25.7B | $31.8B |

| #2 Google Cloud | 37% | 22% | $6.9B | $8.4B |

| #3 AWS | 27% | 12% | $20.5B | $23.1B |

Let’s start with the revenue numbers, which show that Microsoft Cloud’s revenue is bigger than Google Cloud’s plus AWS’s combined.

Inside Microsoft Cloud’s $31.8 Billion Q3 (its FY24 Q1)

If there were a Hall of Fame for quarterly corporate results, Microsoft Cloud’s performance for the 3 months ended Sept. 30 would be a first-ballot shoo-in. On a year-earlier revenue base of a whopping $25.7 billion, Microsoft grew its cloud revenue by 24% to $31.8 billion, which means that on a year-over-year basis, quarterly cloud revenue jumped by an astonishing $6.1 billion.

Now, some folks totally ensnared in the Silicon Valley Bubble will whine, “It’s unfair to compare Microsoft with AWS because Microsoft sells applications, and AWS doesn’t!” And my response to that is, “Well maybe AWS should get more deeply into software because that’s what customers want!”

Such ankle-biting aside, the key point is that one of Microsoft’s strengths is its extraordinary breadth of offerings, a capability that CEO Satya Nadella often describes as his company’s ability to address all facets of its customers’ “digital estates.” Microsoft does that more effectively and more widely than any other cloud vendor, and that’s a huge competitive advantage. If some folks want to whine about how that’s “unfair,” well, they’re certainly free to do so but that is a totally irrelevant and useless commentary.

In its FY Q1, Microsoft saw significant gains across Azure, Power Platform, Dynamics 365, Teams, Security, GitHub, industries, and more.

On top of that technological breadth, Microsoft has also become a bold leader in go-to-market approaches, specifically around partnerships with other Cloud Wars Top 10 companies including Oracle, SAP, ServiceNow, Workday, and Snowflake.

In the case of its multicloud partnership with Oracle that the two companies recently dramatically, Nadella said on Microsoft’s Q1 earnings call that the expanded Oracle alliance has triggered immediate and significant financial impact. Here’s what Nadella said about that, as I originally noted in my recent analysis called “Microsoft Cloud Shocker: Oracle Major Driver Behind Blowout Q1 Numbers!:”

“For example, take cloud migrations. A good reminder of where we are in even the core cloud migration story is the new Oracle [multi-cloud] announcement. Once we announced that the Oracle databases are going to be available on Azure, we saw a bunch of unlock from new customers who have a significant Oracle estate that have not yet moved to the cloud because they needed to rendezvous with the rest of the app estate in one single cloud. And so we’re excited about that.”

Inside Google Cloud’s $8.4 Billion Q3

I was surprised to see Google Cloud’s Q3 growth rate come in at 22% — I was expecting it to be more like 27% because in Q1 it was 28% and Q2 also came in at 28%. Ruth Porat of parent company Alphabet went so far as to describe Google Cloud’s Q3 performance as one that did not qualify for the term “meaningful growth” as she said Alphabet’s overall Q3 results were “driven by meaningful growth in Search and YouTube, and momentum in Cloud.”

The problem, according to Alphabet CEO Sundar Pichai, was the ongoing trend among some big customers to continue to “optimize” past cloud investments rather than spending aggressively on new ones. You can read all about that in “Google Cloud Q3 Growth Falls to 22%; Alphabet CEO Pichai Blames ‘Optimization’.”

However, Google Cloud continues to grow much more rapidly than AWS — 22% versus 12% — and I believe Google Cloud is ideally positioned to not only extend (and perhaps increase) its cloud momentum but also became a top-tier play in the booming market for GenAI.

Because of those advanced and deep AI capabilities plus its powerful presence across all layers of the cloud, I believe Google Cloud is well-positioned for another great year in 2024.

Inside AWS’s $23.1 Billion Q3

My overall feelings on this are summed up in the headline I wrote for a piece last week after the AWS numbers came out: “AWS Good News, Bad News: Q3 Growth ‘Stabilizes’ at 12%.” On the plus side, $23.1 billion for the quarter means AWS is on an annualized run rate of $92 billion, and not many companies in any industry ever reach that scale, let alone one that’s less than 20 years old. And as CEO Andy Jassy pointed out on the earnings call, AWS added an incremental $919 million in revenue from Q2 of this year to Q3.

It’s a superb brand, widely recognized, widely deployed, and widely trusted.

But the inescapable fact is that operating in the exact same market and selling to the exact same set of enterprise customers, AWS grew at only 12% while Google Cloud grew 22% (admittedly on a smaller base, but still…) and Microsoft Cloud — whose revenue is 38% higher than AWS’s, grew 2X as fast as AWS.

As a closing perspective on AWS, let me offer this excerpt from the analysis cited above, “AWS Good News, Bad News: Q3 Growth ‘Stabilizes’ at 12%“:

The core premise of Christensen’s The Innovator’s Dilemma is that highly disruptive companies, after unleashing wildly different and successful products and approaches, become ensnared in their own success and are unable or unwilling to respond to a next wave of upstarts that triggers a fresh cycle of disruption.

What AWS has accomplished over the past 18 or so years is breathtaking, and tens of thousands of companies and other large organizations the world over are better off because they tapped into AWS’s world-shaking technologies and ideas.

But as the cloud has evolved at an extraordinary pace and has become as much about highly differentiating software as it is about infrastructure and hardware, is AWS becoming ensnared in its own amber? Is its intense focus on infrastructure — including its new generation of chips — precluding it from more successfully exploiting the remarkable new innovations made possible from software?

“Stabilization” can be a fine thing in many contexts. But I would say that in the hyperactive world of the Cloud Wars, it is more of a vice than a virtue.

Final Thought

As if the competition triggered by these three phenomenally powerful, wealthy, and influential companies wasn’t enough, don’t forget that Larry Ellison has pushed Oracle into the picture as well as the fourth hyperscaler. And in a very short period of time, Oracle has built an infrastructure business on which thousands of customers are investing billions of dollars because those customers believe Oracle is delivering superior value.

Proving, once again, that in the Cloud Wars, the ultimate winners are always the customers.

Discover how AI has created a new ecosystem of partnerships with a fresh spirit of customer-centric cocreation and a renewed focus on reimagining what is possible. The Acceleration Economy AI Ecosystem Course is available on demand.