Oracle and SAP have rebranded themselves as cloud-first AI powerhouses, rivaling Google Cloud’s dominance.

Google Cloud

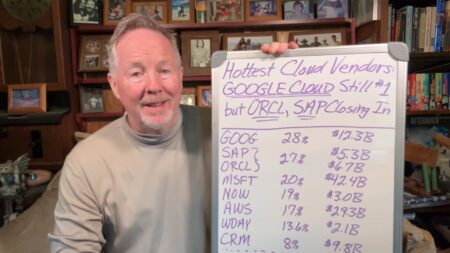

The latest Cloud Wars update reveals strong growth across major cloud providers, with shifting dynamics that signal an increasingly competitive and evolving market.

OpenAI’s new deal with Google Cloud signals a strategic shift to diversify compute capacity and ease growing tensions in its complex partnership with Microsoft.

With CEOs leading the charge, AI is redefining how businesses function across all sectors, and Oracle’s market surge is just the beginning of a seismic economic shift.

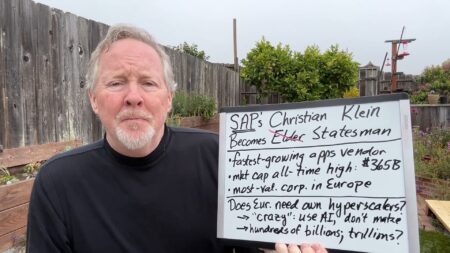

Since taking over during the pandemic, Christian Klein led SAP through massive growth, tripling market cap and driving innovation in AI and cloud while advising Europe to partner smartly rather than replicate US tech infrastructure.

SAP is now Europe’s most valuable company, and CEO Christian Klein is leveraging that position to influence broader policy.

The Cloud Wars Top 10 have secured $915B in contracted future business, signaling extraordinary long-term demand for cloud and AI services.

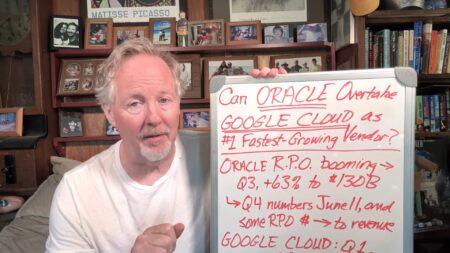

Once doubted, Oracle’s cloud strategy pays off big as it reports a 41% RPO surge and forecasts FY26 cloud growth over 40%, led by relentless AI infrastructure demand.

With the launch of ASOR and its new Agent Partner Network, Workday is enhancing how organizations integrate and manage AI agents alongside human employees securely and efficiently.

Oracle Cloud Infrastructure revenue surged 62% in Q4, showcasing significant demand growth and validating Oracle’s position as a hyperscaler.

Oracle’s blowout RPO numbers hint at massive contract-to-revenue transitions.

Are we witnessing the rise of a new cloud leader? Oracle’s recent performance suggests it could dethrone Google Cloud in growth rankings.

Google Cloud applies AI to data management, integration of widely used developer environments, and enterprise-grade storage.

Google reveals its bold vision for Gemini as a universal AI assistant capable of planning and simulating real-world experiences.

Google reveals its bold vision for Gemini as a universal AI assistant capable of planning and simulating real-world experiences.

C-suite leaders are drawn to AI for productivity boosts, collaboration, and cost savings.

Shortly after releasing A2A, Google is accelerating agent development and communications with updated functionality and support from leading software platform providers.

With momentum on its side, SAP now faces the harder task: proving at Sapphire that it can turn innovation into lasting leadership.

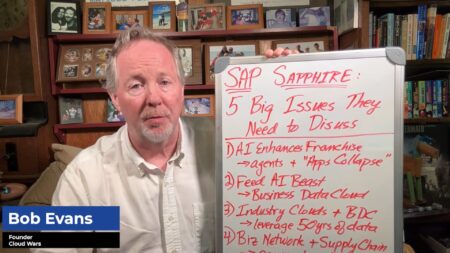

At SAP Sapphire, the company is expected to address five critical issues, including AI’s role in applications, data strategy, and hyperscaler trends, which will determine whether it can sustain its lead as the world’s fastest-growing enterprise software vendor.

Data.world acquisition, partnerships with key enteprise software players, and wide range of new AI agents enhance the company’s objective to be the core enterprise software platform.