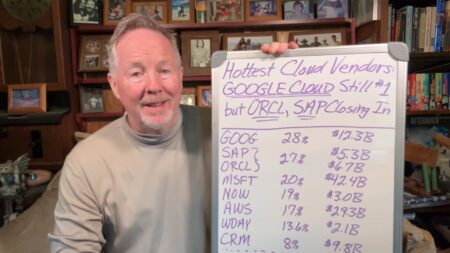

Oracle and SAP have rebranded themselves as cloud-first AI powerhouses, rivaling Google Cloud’s dominance.

Cloud Revenue

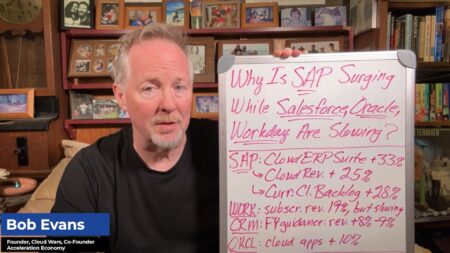

The latest Cloud Wars update reveals strong growth across major cloud providers, with shifting dynamics that signal an increasingly competitive and evolving market.

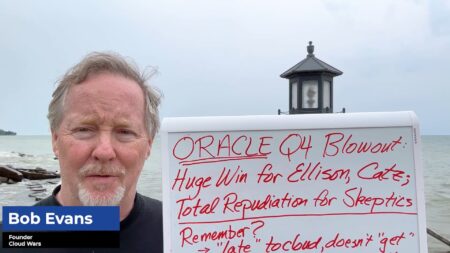

Once doubted, Oracle’s cloud strategy pays off big as it reports a 41% RPO surge and forecasts FY26 cloud growth over 40%, led by relentless AI infrastructure demand.

Oracle’s Q4 results stunned the market, with Safra Catz projecting $35B in cloud revenue and 100% RPO growth in FY26.

Oracle’s blowout RPO numbers hint at massive contract-to-revenue transitions.

Despite Microsoft’s dominance in current cloud revenue, Oracle’s 63% RPO growth signals a potential reshaping of the Cloud Wars power dynamic.

With cloud revenue rivaling AWS and Google Cloud combined, Microsoft silences talk of an AI slowdown.

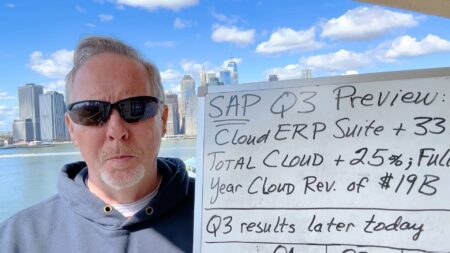

SAP dominates the enterprise cloud race in Q1, outperforming rivals with rapid growth in cloud and ERP revenue.

SAP is significantly outpacing its major competitors in cloud-based enterprise applications, driven by strong growth across its cloud portfolio and strategic platform integration.

Google Cloud, though much smaller than AWS and Microsoft, led Q3 in new customer growth, reflecting a shift in market dynamics.

SAP is outpacing major competitors with a 34% increase in Cloud ERP Suite revenue and aggressive growth plans fueled by new customer acquisitions and a strong focus on AI offerings.

SAP’s increasingly modular cloud ERP suite, covering financials and supply chain, is saw a 33% growth rate in Q2, which is expected to continue in Q3.

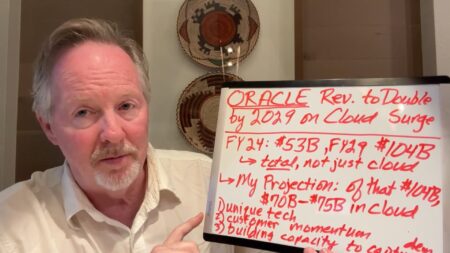

Oracle is capitalizing on its booming cloud infrastructure and strategic multicloud deals to drive substantial revenue growth and innovation across its portfolio.

Oracle is aggressively expanding its cloud infrastructure and data center capabilities, projecting significant revenue growth driven by robust demand and strategic multicloud partnerships.

Oracle reported strong fiscal Q1 performance with significant growth in cloud infrastructure, RPO, and a new multi-cloud agreement with AWS.

Microsoft’s impressive cloud revenue growth in Q4 contrasts sharply with CEO Satya Nadella’s vague and insufficient updates on its embattled security business.

Despite Microsoft’s strong financial performance, CEO Satya Nadella’s inadequate focus on addressing security issues during the Q4 earnings call is a significant missed opportunity.

SAP’s strong Q2 performance stands out as it maintains robust growth while competitors face a slowdown in demand.

Oracle’s rapid cloud infrastructure growth, driven by high demand for AI services and a lucrative multi-cloud partnership with Google Cloud, is constrained by its ability to expand data center capacity,

Oracle’s multi-cloud deals with strategic partners, massive AI and data center investments, and soaring bookings are reshaping the Cloud and tech landscape.