With Q2 serving as the turning point when corporate customers resumed ambitious cloud spending, Oracle remained the world’s hottest major cloud vendor with a growth rate of 54%, followed by Google Cloud at 28% and ServiceNow at 25%.

Here’s what’s particularly notable about those three results plus Microsoft’s cloud performance in Q2:

- Oracle’s growth accelerated even as those of other Cloud Wars Top 10 companies were flat or moderated;

- Google Cloud matched in Q2 the 28% growth it achieved in Q1, indicating strengthening demand from customers;

- ServiceNow’s subscription revenue growth accelerated to 25% in Q2 from 24% in Q1, again showing rising demand; and

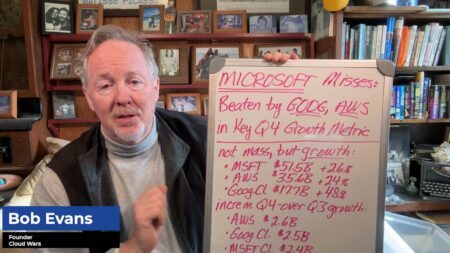

- Microsoft reported growth of 21% for its fiscal Q4 ended June 30, down only one percentage point from the previous quarter and highlighting the company’s enormous scale as fiscal-Q4 revenue reached a whopping $30.3 billion.

The second quarter also saw Amazon Web Services continue its growth slide, as Q2 revenue rose “only” 12% to $22.1 billion. While that marks the seventh straight quarter of declining growth for AWS, Amazon CEO Andy Jassy emphasized on the earnings call that the decline “stabilized” during the three months of Q2 and that he believes better days are ahead.

As with Microsoft, the revenue base at AWS is enormous and in any market segment but the Cloud Wars, 12% on a $20-billion base would be astonishing. But during the same three-month period, Microsoft grew its much-larger cloud business by 21%, which I believe is a result of customers becoming more focused on the software capabilities of the cloud rather than simply infrastructure, which is AWS’s strong suit.

Plus, in the same competitive set, Google Cloud Q2 revenue was 28%, far larger than AWS’s 12%. Some of that is surely due to the Law of Large Numbers — that is unmistakably clear — but the more-vital point in this comparison is that Google Cloud matched in Q2 the growth rate it had in the previous quarter, while AWS’s continued to slide.

Here’s the breakdown for the entire Cloud Wars Top 10, and you’ll see that I’ve noted the quarter-end date for each company because within the next two or three weeks, we’ll be getting fresh numbers from Workday, Salesforce, and Snowflake, all of which had their fiscal-Q2 end on July 31. Also, as with each of these periodic Cloud Wars Growth Charts, I have isolated Snowflake at the bottom of the list in spite of its 50% growth rate because its revenue is so much smaller than all the other vendors’. When Snowflake tops $1 billion in quarterly revenue, it will join the mainstream list.

FASTEST-GROWING MAJOR CLOUD VENDORS IN Q2

| Company | Growth Rate | Cloud Revenue | Quarter End |

| 1. Oracle | 54% | $4.4 billion | 5/31 |

| 2. Google Cloud | 28% | $8.0 billion | 6/30 |

| 3. ServiceNow | 25% | $2.1 billion | 6/30 |

| 4. Microsoft | 21% | $30.3 billion | 6/30 |

| 5. Workday | 20% | $1.53 billion | 4/30 |

| 6. SAP | 19% | $3.68 billion | 6/30 |

| 7. AWS | 12% | $22.1 billion | 6/30 |

| 8. Salesforce | 11% | $8.25 billion | 4/30 |

| 9. IBM | (cloud revenue not disclosed) | ||

| 10. Snowflake | 50% | $590 million | 4/30 |

Final Thought

When Oracle reports its fiscal Q1 numbers in mid-September, we’ll get a look at its first fully loaded year-on-year comparison since the acquisition of Cerner in June 2022. That will likely result in Oracle falling from hypergrowth numbers to somewhere around 32% growth, which means it will still be the fastest-growing major cloud vendor because of its strength in applications and its very fast-growing infrastructure business.

And the biggest issue of all is whether customer spending continues to tilt upward as noted in the top of this piece — that’s certainly the expectation of Microsoft CEO Satya Nadella and ServiceNow CEO Bill McDermott, which all rolls up to mean that life in the Cloud Wars will remain anything but dull.

Gain insight into the way Bob Evans builds and updates the Cloud Wars Top 10 ranking, as well as how C-suite executives use the list to inform strategic cloud purchase decisions. That’s available exclusively through the Acceleration Economy Cloud Wars Top 10 Course.