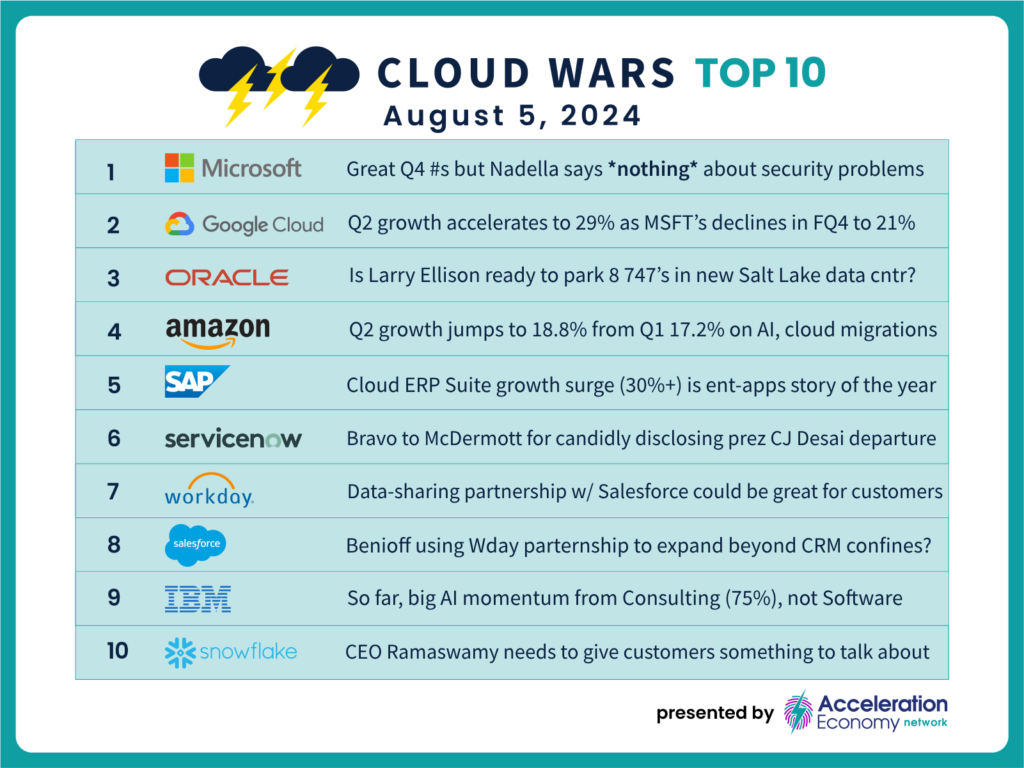

While both Google Cloud and Amazon Web Services boosted their growth rates and delivered stellar Q2 results, Microsoft’s growth rate fell and CEO Satya Nadella appeared tone-deaf on its earnings call by completely failing to address the serious security issues the company is facing.

Amazon’s Q2 results came out late last week so let me share a few highlights regarding AWS’s Q2 performance before comparing and contrasting the results and surrounding commentary from each company:

- AWS Q2 revenue rose 18.8% — up sharply from Q1’s growth rate of 17.2% — to $26.3 billion, which plays out to an annualized run rate of $105 billion.

- AWS Q2 backlog jumped 19% to $156.6 billion, showing strong customer demand for and commitments to AWS services.

- AWS Q2 operating income spiked 80% to $9.3 billion, up from $5.4 billion in last year’s Q2. I don’t typically focus on the profit figures for the Cloud Wars Top 10, but this detail is worth highlighting because it shows that even as AWS is investing massively in its cloud and AI capabilities, it has still been able to boost profits significantly.

On the Amazon Q2 earnings call late last week, CEO Andy Jassy cited three key drivers behind the AWS resurgence:

- Farewell to optimizations: Customers have moved past the optimization phase that triggered significant reductions in cloud investments;

- On-prem migrations: They’re accelerating their migrations from on-prem to the cloud. “This modernization,” Jassy said, “enables builders to save money, innovate at a more rapid clip, and drive productivity in most companies’ scarcest resource: developers.”

- AI investments: And third, Jassy said, “Builders in companies of all sizes are excited about leveraging AI. Our AI business continues to grow dramatically with a multibillion-dollar revenue run rate despite it being such early days.”

Jassy also continued to express bullish optimism on AWS’s growth prospects for the future. In response to a question from a financial analyst on the call, Jassy said, “As I mentioned, it’s now a $105-billion revenue run-rate business with about 90% of the global IT spend still on-premises. And if you believe that equation is going to flip — which I do — there’s a lot of growth ahead of us in AWS as the leader in all those dimensions I mentioned.

“But I also think that generative AI itself and AI as a whole is going to be really large. It’s not something we originally factored when we were thinking about how large AWS could be. And unlike the non-AI space where you’re basically taking all of this infrastructure that was built on-premises over a long period of time and working to help migrate customers to the cloud — which is a lot of work, by the way — in the generative AI space, it’s going to get big fast, and it’s largely all going to be built from the get-go in the cloud, which allows the opportunity for those [AWS] businesses to continue to grow.”

Who’s Soaring, Who’s Roaring, Who’s Snoring

In the context of the three biggest hyperscalers — Oracle is the fourth and is the fastest-growing at better than 50%, but its cloud-infrastructure business is by far the smallest of the four — those numbers and Jassy’s outlook explain why I noted in the headline that Amazon is roaring.

And late last month when Alphabet reported its Q2 results, Google Cloud saw its growth rate accelerate to 29% from Q1’s 28%, enabling Google Cloud to retain its position as the world’s fastest-growing major cloud vendor. You can see my analysis of that in this Cloud Wars Minute video, which makes the case that Google Cloud is continuing to soar.

So what’s behind my contention that Microsoft is snoring, snoozing, asleep at the wheel? After all, didn’t Microsoft report last week that its fiscal-Q4 cloud revenue was up 21% to $36.8 billion, and that fiscal-year cloud revenue was up 23% to $135 billion?

Yes, they did indeed post those stunning numbers. But unlike the accelerating growth that both Google Cloud and AWS reported from calendar Q1 to Q2, Microsoft’s growth rate declined over that same period: from 22% in calendar Q1 (Microsoft’s fiscal Q3) to 21% in its fiscal Q4.

Now you might say, “But wait — what about seasonality? Don’t forget, Evans, that not all quarters are created equal.”

That’s certainly true — but in Microsoft’s case, that seasonality should have resulted in stronger results because the quarter ended June 30 was the close to Microsoft’s fiscal year, and its sales org would have had massive incentives to bring in every possible piece of business to close out the year with a boom.

So that’s one factor behind the “snores” tag — but it is by no means the primary factor.

No, the biggest reason behind my disappointment in how Microsoft handled its fiscal-Q4 earnings results was the utter failure by CEO Satya Nadella to speak clearly and candidly about the extremely serious security challenges dogging his company. Among boards of directors, CEOs, CIOs and CTOs, the two primary tech-related issues today are AI and cybersecurity — and while Nadella eloquently and thoroughly covered Microsoft’s AI and GenAI strategies and plans, he said the bare minimum about its security business — and absolutely nothing about its dangerous and embarrassing cybersecurity lapses. (You can read all about those in my analysis from a few months ago headlined “Can Satya Nadella Repair Microsoft’s Badly Broken Security Culture?“.)

I had some very harsh words last week for Nadella’s failure to address those issue in both a Cloud Wars Minute video and a detailed analytical article, so I won’t rehash that again here except to say this: the late and very great Peter Drucker famously said that “Culture eats strategy for breakfast.” His premise, of course, was that companies and leaders can create whatever strategy and vision they want, but unless they also help create and foster a culture that allows that strategy to flourish, then the inadequate culture will tank the big plans every single time.

In May, both Nadella and EVP of Microsoft’s security business Charlie Bell outlined in great detail the widespread and deep problems with how Microsoft approaches security from the varied and vital perspectives of culture, workflows and processes, investment priorities, and technology. And a damning report earlier this year from the Department of Homeland Security’s Cyber Safety Review Board blasted Microsoft’s culture regarding security as the primary factor behind the company’s disastrous breach in China in 2023. (I analyzed that in depth in “Microsoft Cybersecurity Disaster Triggers Customer Doubt, Competitor Opportunity.”)

And yet, Microsoft CEO Satya Nadella — one of the most influential, successful, visible, and influential business leaders in the world — chose to say absolutely nothing on last week’s earnings call about Microsoft’s serious and ongoing security vulnerabilities, choosing instead to point out how big his security business has become.

Oh wait Nadella also said this: “We continue to prioritize security above all else.”

As I think about that, maybe the somnambulant actor on the earnings call wasn’t Nadella after all —maybe, in the minds of Nadella and Microsoft, it is Microsoft’s customers who are asleep at the wheel, dozing, sleepwalking, grabbing a nap, and are generally clueless about what’s going on.

And maybe Satya Nadella thought that by saying nothing about his company’s glaring and extremely dangerous security problems, he was just trying not to wake us up and was allowing us to remain asleep in blissful ignorance.

Well, folks, I’d say it’s high time to let Nadella and Microsoft know that you’re wide awake, and fully aware of the game Microsoft is playing with your company’s security and your company’s future.

–