With Salesforce Q1 revenue growth coming in at 11%, but the company guiding to fiscal-year growth of 8% to 9%, the company is clearly signaling that growth for its next three fiscal quarters is likely to plummet to as low as 7%.

While Q1 revenue reached $9.1 billion and profits exceeded expectations, the stock market — which for the past year has been hugely supportive of Marc Benioff’s major pivot from growth to margins — reacted savagely to Salesforce’s lackluster revenue outlook by slashing $49 billion from its market cap ($272 billion to $223 billion).

On the company’s recent fiscal-Q1 earnings call, Benioff and other Salesforce executives said the primary factor behind the tepid expectations was a rather sudden pullback in customer spending. Chief operating officer Brian Millham and CFO Amy Weaver both repeatedly cited the onset of what they called a “measured buying environment” and “measured buying behavior” among customers.

Because Salesforce expects that restrained spending to continue through the January 31 end of its fiscal year, Weaver offered guidance for full-year revenue growth of 8% to 9%. And with Q1 coming in at 11% growth, then growth will have to fall below that guidance range somewhere across the next three quarters to pull the full-year total down.

As I see it, Salesforce and its iconic CEO face some very challenging questions:

- Where’s the AI revenue dividend? Over the past few quarters, Benioff has repeatedly described an upcoming once-in-a-generation spending boom among customers eager to equip themselves with the technologies necessary to excel in the AI Era. But despite his own effusive declarations of a surge in IT spending, Benioff’s projections for his own company’s growth have not shown any upward indications of its ability to participate in that boom.

- Where’s the Data Cloud boost? Kudos to Benioff and Salesforce for the runaway success of the Salesforce Data Cloud, which he says is the fastest-growing organic product in his company’s storied 25-year history. But, as is the case with Benioff’s forecasts for an IT spending orgy tied to the AI Revolution, this surge in Data Cloud revenue has not triggered any upward movement in Salesforce’s revenue expectations.

- How flat are the Sales Cloud and Service Cloud businesses? And we can certainly toss Marketing Cloud and Commerce Cloud into that mix as well, because something is offsetting the huge growth of Data Cloud, and something is preventing Benioff’s forecasts of a spending boom on AI from revealing itself in Salesforce’s growth.

- Has the CRM (customer relationship management) market peaked? For a quarter of a century, Benioff and his company and his customers and partners and investors have ridden the CRM thoroughbred long and hard, assiduously avoiding moving into other enterprise-applications categories and insisting that the sheer enormity of the customer-relationship market would be inexhaustible. But maybe that thoroughbred has — as will all living things — hit a point where it simply can’t sustain the performance and pace of the past.

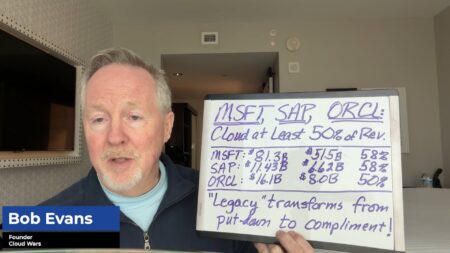

- Has the CRM market morphed into the CX market? That’s surely the conclusion that SAP, Oracle, and Microsoft have all come to. Of course, each company reached that conclusion in large part because of Salesforce’s unquestioned dominance in CRM for more than two decades. But every major enterprise-application category has evolved dramatically over that time, with the “experience” angle moving to the center for categories ranging from customer experience to employee experience to candidate experience and more.

- Has Benioff’s full-blown shift from growth to profits stunted his company’s ability to compete? That might be one of those dancing-angels-on-pinheads questions, but I think the numbers show that Benioff’s pivot to profits corresponds perfectly with the company’s diminishing growth rates. And in the rarified air of the Cloud Wars, there’s simply no denying the fact that if your competitors are growing twice as fast as you are, then you are losing ground in the market regardless of how profitable your business might have become.

- Can Benioff reinvigorate Salesforce by transforming it into a data company that happens to offer some applications? Well, that’s an evolutionary leap that the legendary leader appears to have been not only contemplating but also pursuing. Consider this excerpt from the late-May Q1 earnings call: “The most important thing Salesforce is doing is not just continuing to automate every customer touch point — that’s obviously critical and why we’ve been able to consume this 250 petabytes of information — but the second key point is we’ve rebuilt the way that we are delivering a foundation of data for our customers. Why is that so important? Because as we’ve now rearchitected all of our apps and all of our capabilities to fuel and fund our Data Cloud, going forward our customers will be able to take this Data Cloud and leverage it into their future capability and growth and especially profitability and productivity. And that is where our whole company and our whole industry are going to go.”

Ask Cloud Wars AI Agent about this analysis

Final Thought

Setting aside for a moment the whole growth-versus-margins issue, Salesforce is confronting and grappling with some existential challenges, not the least of which is the ability of its “legacy” clouds to compete with newer competitors whose CX applications are — unlike Salesforce’s —nested within a suite of apps spanning the entire enterprise. That’s a major challenge.

The other one has to do with Benioff’s aspirations to transform Salesforce into a data company, which in itself could be a superb idea. But even if that happens, the same bugaboo arises around Salesforce’s extreme focus on CRM rather than the end-to-end needs of the enterprise: will Salesforce and its CRM-only data be able to compete against SAP and Oracle and Microsoft with the vast stores of end-to-end enterprise data each of those companies has?

As I see it, the complete end-to-end view — and the complete treasure trove of end-to-end data — are what business leaders are looking for here at the dawn of the Era of AI.

The AI Ecosystem Q1 2024 Report compiles the innovations, funding, and products highlighted in AI Ecosystem Reports from the first quarter of 2024. Download now for perspectives on the companies, investments, innovations, and solutions shaping the future of AI.