Representing a combined market cap of $8.6 trillion, the Cloud Wars Top 10 is not only the greatest growth market the world has ever known but also exerting more influence on the global economy of today and tomorrow than any collection of 10 companies ever has.

Now, you might think that’s all a bit overdone and I should put the pipe down for a while, but no matter what direction we look, we can see the world-shaping influence of the cloud and AI: healthcare, education, entertainment, commerce, logistics, scientific research, manufacturing, supply chains, and much much more.

So when I make my annual selection of the CEO of the Year, my objective goes well beyond who earned the most money or who blew away revenue expectations or pulled off the biggest acquisition — although each of those achievements is certainly fine in its own right.

Rather, the Cloud Wars CEO of the Year represents a leader whose vision for what the world could be like inspires other leaders to think less about perfecting the past and more about creating the future; who believes that technology’s true potential is to turn human dreams into reality; and whose aspirations help all of us blur the line between what was forever impossible but is now becoming wholly possible.

Against that backdrop, I’d like to share some thoughts on the CEOs of each of the Cloud Wars Top 10 companies and — here’s the important part — request your input on who the CEO of the Year for 2024 should be, and why. Please share your input with me via email at bob@accelerationeconomy.com or on LinkedIn.

Ask Cloud Wars AI Agent about this analysis

I’ll do this in two installments — five CEOs today, and five tomorrow — with the rollout in alphabetical order by company. So today that’s Amazon, Google, IBM, Microsoft, and Oracle; and for tomorrow, it’ll be Salesforce, SAP, ServiceNow, Snowflake, and IBM. And just as a reminder, the CEO of the Year for 2022 was Safra Catz of Oracle, and for 2023 was Christian Klein of SAP.

(Arranged in alphabetical order by company)

1. Amazon Web Services CEO Matt Garman. Taking over as CEO of AWS on June 3, Garman has presided over the much-needed reacceleration of AWS’s growth rate, which in Q2 climbed to 19.2% after a two-year free-fall under former CEO Adam Selipsky. Now, how much of that long decline can be pinned on Selipsky and what portion of the recent comeback can be laid at the feet of Garman remains to be seen, but I’ve always believed in the old adage attributed to NFL coach Bill Parcells: “You are what your record says you are.” I also give Garman tremendous credit for taking two bold steps as part of the landmark multi-cloud agreement AWS signed last month with Oracle: First, that the agreement itself was signed showed great courage, pragmatism, and customer advocacy; and second, Garman underscored all of those positive traits with his willingness to go into the belly of the beast by appearing onstage with Oracle chairman Larry Ellison at Oracle CloudWorld to showcase the partnership. Now: when Amazon releases its Q3 numbers in a couple of weeks, will we see AWS delivering a growth rate of 20%?

2. Google Cloud CEO Thomas Kurian. As anybody who’s at all familiar with Cloud Wars knows, g-r-o-w-t-h is The Big Thing around here, and Kurian has propelled his company to the #1 spot on the Cloud Wars Growth Chart many times during his six years as CEO. Along the way — from 2019 through 2023 — Google Cloud increased its revenue 5x in five years, a feat that Kurian has said is unmatched in the tech world. Over the past 18 months, Google Cloud has become a powerhouse in AI, a world leader in data analytics, a pioneer in cybersecurity, and a strategic partner to scores of global corporations that have signed billion-dollar multi-year business-transformation contracts with Kurian’s company. As if that’s not enough, Kurian has pushed Google Cloud into a potentially massive new market for industry-specific applications, most notably its Contact Center as a Service solution. And on a global scale, Kurian was the first Cloud Wars Top 10 CEO whom I heard speak compellingly about the need for sovereign clouds, and he drove Google Cloud’s multi-cloud partnership with rival Oracle.

3. IBM CEO Arvind Krishna. Wrapping up his fifth year as the head of IBM, Arvind Krishna had to devote the first three or four of those years to mopping up the messes he inherited in haphazard product focus, fragmented org structures that had sales teams battling over clients, mismatched development initiatives, and a badly damaged brand. But in the past year or so, Krishna and IBM have begun to reap the fruits of all that unglamorous clean-up work and the market has certainly taken notice: IBM’s market cap now stands at about $215 billion, up a whopping 51% since the beginning of 2024. And while IBM has certainly gotten its cost structure under control, that market-cap upturn is due to the prospects of growth that Krishna’s hard decisions and wise investments have engendered as IBM’s portfolios for AI, cloud, and data have begun to flourish due in part to Krishna’s pragmatic decision to partner across the Cloud Wars Top 10 rather than trying to simply compete against every single one of those companies.

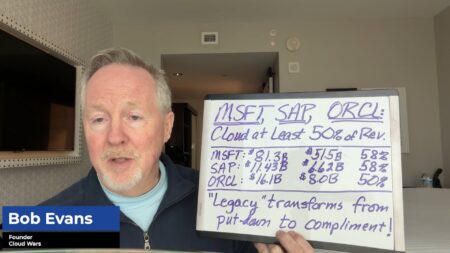

4. Microsoft CEO Satya Nadella. It can be difficult to gauge Microsoft’s track record because few companies have ever matched its scale, let alone the combination of that scale plus its impressive growth rates, particularly in the cloud. But now that the cloud represents a clear majority of Microsoft’s total revenue — for the quarter ended June 30, cloud revenue of $36.8 billion was 57% of total revenue of $64.7 billion — I have to wonder if the sheer mass of Microsoft’s cloud business is becoming unwieldy. Over the past few years as cybersecurity has become an existential threat for businesses, Nadella allowed Microsoft’s very large security business to become so bloated and rudderless that six months ago he had to mandate the overhaul of everything the entire organization does. Plus, Microsoft is facing anticompetitive complaints in Europe where, if the claims recently raised by Google Cloud are true, the company could face painful consequences. Does Nadella — whose accomplishments at Microsoft over the past 10 years have often been astonishing — still have the same passion for the job that he had a decade ago?

5. Oracle CEO Safra Catz. For all of Safra Catz’s many accomplishments in her 25 years at Oracle, perhaps the greatest is how she has made Oracle one of the world’s fastest-growing major providers of cloud and AI infrastructure in spite of a few fairly meaty obstacles:

- Oracle having been almost exclusively a software company;

- its first cloud infrastructure product line was killed shortly after it was launched; and

- it had to take share away from three of the world’s most-powerful and wealthiest corporations: Amazon, Microsoft, and Google.

But last quarter, Oracle reported that its RPO (remaining performance obligation, which is contracted business not yet recognized as revenue) soared 53% to $99 billion — a breathtaking result revealing massive pipeline growth for Oracle for years to come. On top of that, Catz has engineered an overhaul of the company’s culture that’s now predicated on customer success in parallel with breakthrough technologies and unmatched deployment models. As a result, Oracle’s market cap has soared about 71% since the beginning of the year — from $285 billion to $486 billion — and has a good chance to hit half-a-trillion dollars by year end.

Coming tomorrow: Salesforce’s Marc Benioff, SAP’s Christian Klein, ServiceNow’s Bill McDermott, Snowflake’s Sridhar Ramaswamy, and Workday’s Carl Eschenbach.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.