While Oracle’s Q4 cloud-revenue growth rate slipped to 20%, its RPO soared 44% to a stunning $98 billion as Larry Ellison’s company continues to win huge cloud-infrastructure deals for AI training while also forming what will surely be a massively lucrative multi-cloud partnership with Google Cloud.

In the category of “Problems Everyone Would Love To Have,” Oracle’s biggest challenge continues to be that the astonishing demand among many of the world’s top technology companies for Oracle’s cloud-infrastructure services is outstripping Oracle’s ability to add data-center capacity at a pace that no other tech company except perhaps NVIDIA has ever confronted.

Here’s how Ellison described the situation during Oracle’s fiscal-Q4 earnings call this week.

“I’m going to start by repeating something Safra said: In Q4, Oracle’s company-wide RPO increased 44% to $98 billion. In AI alone, we signed contracts with 30 different customers for $12.5 billion in new AI business,” he said in reference to the company’s remarkable Q4, whose results triggered a 13% overnight jump in Oracle’s market cap to an all-time high of $384 billion.

I’ll offer a few details on that in a moment, but first want to touch on the landmark multi-cloud deal between Oracle and Google Cloud, a pairing that I first advocated almost two years ago: “Why Oracle and Google Will Do the Multi-Cloud Boogaloo.”

This is a fantastic opportunity for customers to work more productively, seamlessly, and (relatively) painlessly with the two most-innovative and disruptive hyperscalers, both of which are fully devoted to working with customers and partners to create the cloud of the AI future rather than perpetuate the lift-and-shift cloud of the past.

While the multi-cloud partnership between Google Cloud and Oracle involves multiple capabilities, the masterstroke is the opportunity for Google Cloud customers to purchase, deploy, and manage Oracle database services through the Google Cloud. Along with that, Oracle customers gain simpler and full access to Google Cloud’s world-class AI services centered on its Gemini model.

From the Google Cloud announcement of the partnership: “It provides a rich set of interoperable solutions that make it easy for our joint customers to migrate, modernize, and manage their Oracle-based applications in the cloud. With unified engineering, product, and commercial model, these integrated solutions deliver choice and flexibility backed by the end-to-end enterprise-class collaborative support model that our joint customers have relied on over the years. At the core of this partnership is the Oracle Database@Google Cloud. Oracle will directly host, operate, and manage Oracle database services natively within and from the Google Cloud data centers, beginning with regional footprints in North America and Europe, and plans to rapidly expand globally.”

So, as was the case several months ago when Oracle and Microsoft launched a similar multi-cloud partnership, this results in a huge win for customers looking to use more than one cloud without having to get caught in the nasty crossfire between huge and aggressive competitors that, in the past, rarely chose to take any steps to make life easier for customers looking to use another vendor’s products.

For Google Cloud and Oracle, the benefits should also be significant as customers will reward those two companies for making it simpler for those customers to carry out their strategic deployments of cloud and AI services. Executives from both companies said the rollout of a complete range of services will take place much more rapidly than was/is the case with the Oracle-Microsoft multi-cloud agreement.

For Ellison and Oracle, that all adds up to even more momentum on top of the lusty RPO numbers for Q4.

While Oracle reported very strong Q4 and full-year results for many of its product lines, Ellison said the unquestioned driver behind the bookings boom is Oracle Cloud Infrastructure, or OCI.

“So who are the companies choosing to use Oracle Cloud services and Oracle data centers? Well, here are a few names: NVIDIA, Microsoft, . . . xAI, OpenAI, Coherent, and dozens more,” Ellison said.

“In other words, the world’s largest cloud companies and the world’s most successful and accomplished AI companies choose to use Oracle Cloud services and data centers.”

Customers are looking to Oracle rather than the three original hyperscalers — Amazon, Microsoft, and Google — and others for four primary reasons, Ellison said: speed, security, cost, and range of deployment options.

Now, I’m sure every one of the hyperscalers cites some or all of those attributes as reasons for why it is doing so well in the marketplace. But what continues to impress me about the inroads Oracle is making in the cloud-infrastructure business — particularly around AI training — is that just a few years ago, Oracle had at best a miniscule share of that infrastructure category.

Since then, however, OCI growth has been phenomenal as its only constraint has been the company’s ability to build out new data centers fast enough to keep up with demand.

Final Thought

Oracle’s desire to turn that demand into services for customers and revenue for Oracle by adding data-center capacity as rapidly as possible is reflected in some capex figures cited by CEO Safra Catz:

- For all of FY24 ended May 31, Oracle spent $6.9 billion on capital expenditures, primarily data centers.

- In Q4, Oracle spent $3.5 billion on capex, or more than it spent in the first three quarters.

- For FY25, capex “will probably be double what it was” in FY24, Catz said.

So these new data centers don’t come cheap. But because they’ll be the means through which Oracle converts its whopping RPO into services for customers and revenue for Oracle, that $14 billion in FY25 capex will be money well spent.

Because, Catz said during the earnings call, “I expect fiscal-year 2025 cloud infrastructure services to grow faster than the 50% we reported this year.”

Yes indeed — those are the sort of problems we would all love to have.

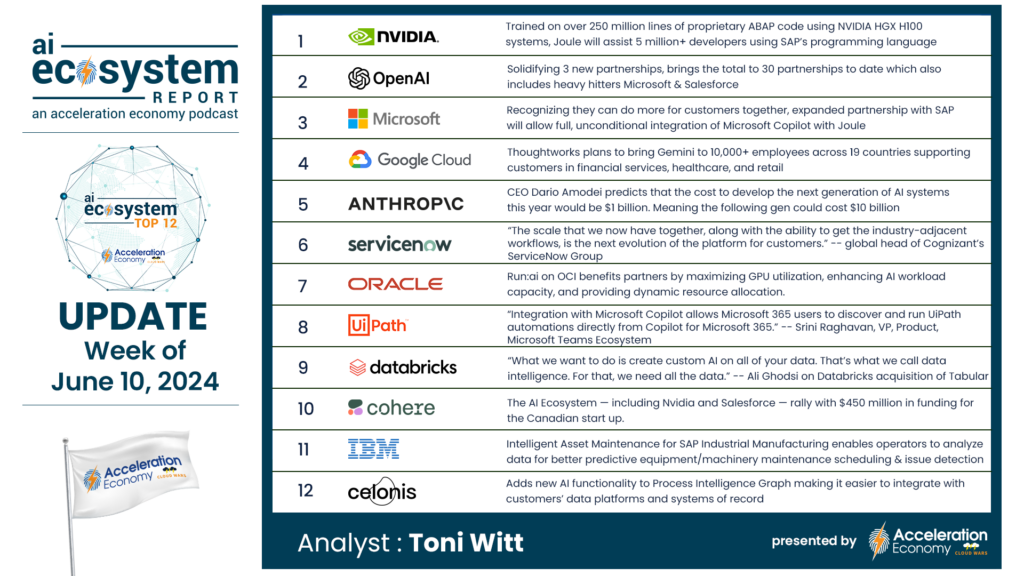

The AI Ecosystem Q1 2024 Report compiles the innovations, funding, and products highlighted in AI Ecosystem Reports from the first quarter of 2024. Download now for perspectives on the companies, investments, innovations, and solutions shaping the future of AI.