Yes, Amazon’s AWS has seen its growth rate tumble over the past 18 months.

Yes, its competitors are growing much faster than AWS — and not just the smaller ones like Google Cloud, and Oracle but also its much-larger and primary cloud rival, Microsoft.

But since the otherworldly financial dynamics of the Cloud Wars are quite different than those in the rest of the world — the enterprise cloud is, lest we forget, the greatest growth market the world has ever known — please take a look at this Quick Quiz. (It’s an open-book quiz, and you can grade yourself.)

From this list of a dozen global corporations that I’ve listed in random order, please pick the one with the highest annual revenue:

- Procter & Gamble

- Siemens

- Boeing

- Disney

- Amazon Web Services

- Citigroup

- T-Mobile

- Sony

- Wells Fargo

- Hitachi

- Nissan

Wonderful companies one and all, but the revenue leader in this group is AWS, which in calendar 2023 will generate more than $90 billion. All of those others are likely to finish the year with somewhere between $70 billion and $90 billion.

And while I did not have time to explore the growth rates for each of those dozen corporations, I would be very surprised — shocked — if any will match the 12% growth rate that AWS is likely to produce for the year.

My point is to underscore that while AWS is not keeping pace in the rarified air of the Cloud Wars, it’s doing just fine back on Planet Earth relative to other world-class corporations.

And it has reached these heights in just 17 years.

So that’s one of the five reasons I’m offering for why lots of people still do love and certainly should love AWS: It has achieved enormous scale, success, and potential in a remarkably short period of time.

And here are my choices for four more reasons why many customers will continue to invest heavily in AWS for years to come.

2. AWS remains the dominant leader in cloud infrastructure.

While the cloud today is far more than infrastructure, and while many customers are putting more emphasis on the non-infrastructure layers of the cloud (data, applications, platform, databases) to drive essential differentiation in the world of digital business, there’s no question that AWS is still the big dog in that infrastructure category.

As Amazon CEO Andy Jassy said on the company’s Q2 earnings call early this month, “AWS remains the clear cloud infrastructure leader with a significant leadership position with respect to number of customers, size of partner ecosystem, breadth of functionality, and the strongest operational performance. These are important factors for why AWS has grown the way it has over the last several years and for why AWS has almost doubled the revenue of any other provider” (emphasis added).

3. Leveraging the Amazon fixation on delighting customers.

Again, Jassy from the Q2 earnings call: “I’ve talked to many AWS customers over the years and continue to do so. And while all these factors I mentioned have been big drivers of the business’s success, AWS customers tell us that, as importantly, they care about the very different customer focus and orientation in AWS they don’t see elsewhere.

“As the economy has been uncertain over the last year, AWS customers have needed assistance in cost-optimizing to withstand this challenging time and reallocate spend to newer initiatives that better drive growth. We’ve proactively helped customers do this.”

I believe that advantage was more significant in the past than it is today. In the early days, the other cloud providers were all intensely focused on getting new cloud products out the door, and only after that did they turn their attention to creating world-class, go-to-market, and customer-success organizations. So if Jassy wants to keep this on his list of strategic differentiators, he’s going to have to find some additional new approaches.

4. Doubling down on helping customers drive business innovation.

Here, Jassy outlines another area in which AWS was no doubt the first mover. And I believe it is still making big contributions here — but, as with the customer experience capability described above, AWS’s competitors are doing some amazing things in this space as well, so if Jassy and AWS want to keep winning the trust of customers, they’ll need to ratchet up the innovation more aggressively than ever before.

“The AWS team continues to innovate and change what’s possible for customers at a rapid clip,” Jassy said on the earnings call. “You can see this across the array of AWS product categories where AWS leads in compute, networking, storage, database, data solutions, and machine learning, among other areas, and the continued invention and delivery in these areas is pretty unusual.

“For instance, a few years ago, we heard consistently from customers that they wanted to find more price-performant ways to do generalized compute. And to enable that, we realized that we needed to rethink things all the way down to the silicon and set out to design our own general-purpose CPU chips. Today, more than 50,000 customers use AWS’ Graviton chips and AWS Compute instances, including 98 of our top 100 Amazon EC2 customers, and these chips have about 40% better price performance than other leading x86 processors.”

5. Joining the generative artificial intelligence (AI) revolution.

I believe AWS has an ambitious and customer-oriented Gen AI strategy, but I don’t believe the company has done a great job in articulating that to the business world. And as every other Cloud Wars Top 10 company surges into the Gen AI market with some very impressive capabilities and visions for the future, Jassy and AWS will have to do better at explaining exactly why the category king in cloud infrastructure has a solid chance to be the Gen AI king as well.

Referring to its ambitious achievements in chips, Jassy said, “The same sort of reimagining is happening in generative AI right now. Generative AI has captured people’s imagination, but most people are talking about the application layer, specifically what OpenAI has done with ChatGPT. It’s important to remember that we’re in the very early days of the adoption and success of generative AI and that consumer applications is only one layer of the opportunity.” Great point — and one that Jassy and AWS need to hammer home more effectively.

“We think of large language models in generative AI as having three key layers, all of which are very large in our opinion and all of which AWS is investing heavily in.”

Final Thought

The future is coming at us faster than it ever has before, and business leaders today must contend with not only that pace of change but also the intensity of that change. Entire industries that plodded along in much the same way for centuries are now being reconstituted in a few years, radical new business models are becoming commonplace, workforce dynamics are evolving more quickly than most companies can manage, and customers — whether consumers or businesses —are becoming relentlessly more demanding and more fickle.

In such an environment, what a cloud vendor has done in the past is relevant if and only if it can be seamlessly tied to the customer needs of tomorrow. AWS certainly has a magnificent past, and if it wants to have an equally successful future, it had better make sure that it becomes totally obsessed with these five reasons why customers might still love it in the Gen AI age.

Because anything less than total obsession to that cause will come up short.

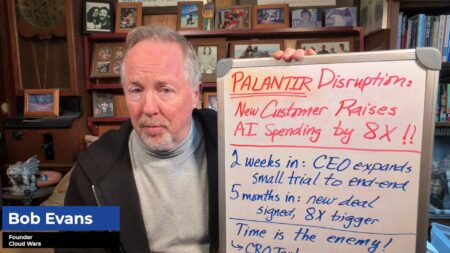

Gain insight into the way Bob Evans builds and updates the Cloud Wars Top 10 ranking, as well as how C-suite executives use the list to inform strategic cloud purchase decisions. That’s available exclusively through the Acceleration Economy Cloud Wars Top 10 Course.