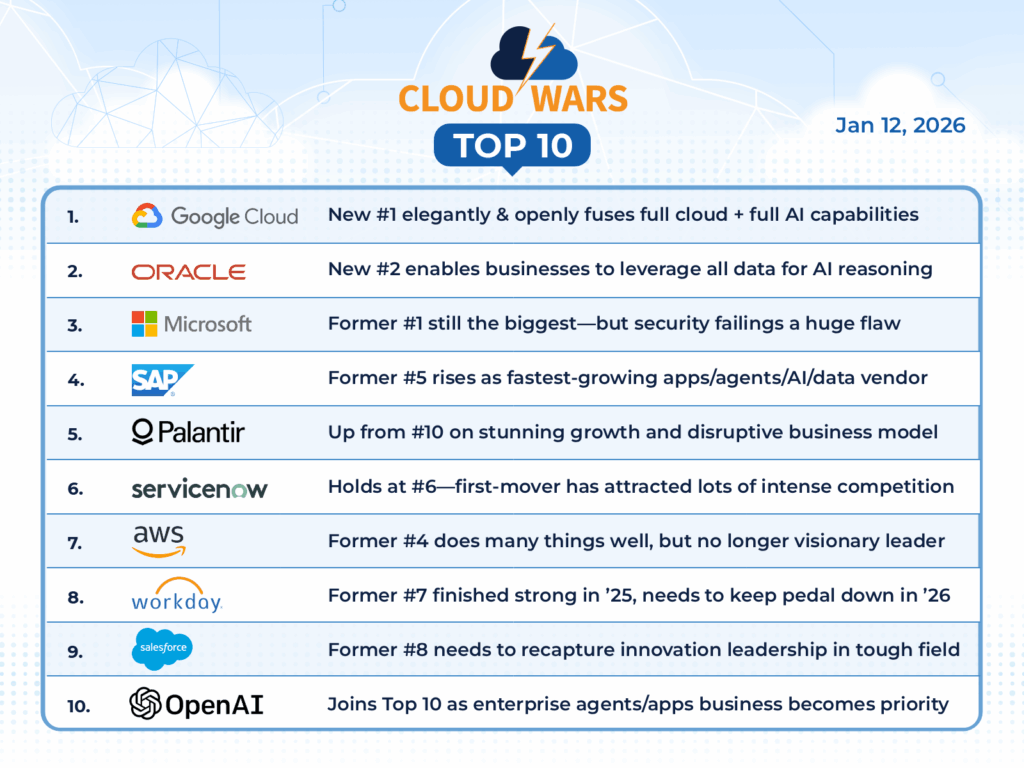

As the AI Revolution reframes the role of enterprise technology, one-time king of the cloud AWS has tumbled to #7 on the Cloud Wars Top 10 while enterprise-apps/agents/data leader SAP climbs to #4 and wildly disruptive Palantir rockets from #10 to #5.

In combination with yesterday’s announcement that Google Cloud has become #1 and Oracle #2 on the weekly rankings while long-time former #1 Microsoft slides to #3, the decline of AWS and the ascent of both SAP and Palantir — plus the arrival of OpenAI in the #10 spot — reveal a very different Cloud Wars Top 10 lineup that reflects the new dynamics of the nascent AI Economy.

Here’s a look at the new lineup:

As I described in yesterday’s analysis of Google’s ascent to #1 and Oracle’s parallel leapfrogging of Microsoft, size as measured by revenue still matters very much in the Cloud Wars — but while it’s a big thing, it’s not the only thing:

- revenue growth rates are a powerful indicator of which cloud and AI vendors are meeting customer needs;

- RPO and/or backlog growth rates have become enormously important in my rankings because those financial metrics show which vendors customers are choosing for the AI future, rather than simply reflecting whom they’ve worked with in the past;

- business-innovation mindsets are critical for this new era in the Cloud Wars Top 10, as customers lean more aggressively into highly strategic cloud and AI vendors capable of helping those customers build their AI-centered future rather than just polish and perfect their old-world past;

- CEO vision expressed in business outcomes has become enormously important in an industry where there’s still way too much focus on technical details rather than the corresponding customer-side business innovation and growth;

- enterprise acceleration is critical because while everything around us is changing, these AI-centered business transformations have to take place in quarters, not years; and

- the ability to stay indispensably relevant as the dynamics of the global economy become more demanding, more future-oriented, less forgiving, and more rewarding is a quality that customer CEOs are demanding.

So, against that broad backdrop, let’s take a look at the changes that have taken place within my new rankings for the world’s most-powerful, influential, and often largest cloud and AI vendors. To watch an in-depth analysis of the new rankings, please check out this fireside chat I did with my business partner and CEO John Siefert.

First, a very quick recap of the top three positions, then I’ll go into more details for companies four through 10:

- #1 Google Cloud completes an astonishing rise to the top that began seven years ago with the arrival of CEO Thomas Kurian, and you can learn more about that here and here;

- #2 Oracle also leapfrogs Microsoft on the strength of its explosively growing Oracle Cloud Infrastructure business, its unmatched portfolio of deployment options, its very large and completely retooled for AI apps/agents business, and its new AI Database and AI Data Platform, all of which has Larry Ellison pursuing what he says are the two largest and fastest-growing markets the world has ever seen; and

- #3 Microsoft is ousted from the #1 spot after a four-year run at the top — Nadella is focusing on a range of technology challenges with the primary one being cybersecurity.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

AWS Tumbles, SAP Rises, Palantir Rockets, OpenAI Joins

I’ll give SAP the big props it richly deserves in a moment, but I first want to highlight the tumble by former #4 AWS down to #7. As I’ve said many times, AWS is an outstanding company doing great work for many customers, and it has a storied history that few companies can ever equal. But, the simple fact is that Amazon CEO Andy Jassy has not forced AWS to change as rapidly as the world around it. As a result, the former “king of the cloud” was overtaken by Microsoft several years ago, and then two-and-a-half years ago by both Google Cloud and Oracle as all of those competitors understood that cloud is much more than infrastructure and that customers want and need the high-value differentiation that applications and agents and modern databases can deliver.

Again, AWS is a terrific company — and perhaps it is the runaway winner in the “Life Is Not Fair” competition because it happens to exist at and compete in a time when its three arch rivals are even more terrific than it is. So, I’ve moved AWS down from #4 to #7, representing a very steep fall from the #1 spot it forcefully held when I launched the Cloud Wars Top 10 nine years ago.

SAP Rises to #4

Ah yes, another “legacy” company shows the foolishness of the attempt in years past by some “experts” to proclaim that world-class tech companies cannot adapt to sudden and severe marketplace change. SAP has adapted brilliantly to the disruption first of the cloud and then of AI and the ultimate proof of that is the 25% growth rate it has consistently generated. Because that growth rate is an absolute reflection of customer demand — and those customers have lots and lots of alternative vendors from which to choose.

So, unlike AWS, SAP has thrived in the face of intensified competition, and that unwavering ability to win the hearts, minds, and wallets of an outsized portion of customers is why I have moved it up from #5 to #4 on the Cloud Wars Top 10.

Palantir Rockets to #5

Can unicorns become unicorns when they’re 22 years old? Answer’s gotta be yes, because that’s what happened to Palantir last year when it transformed from intriguing and quirky analytics company to explosive-growth AI platform vendor. Several months ago, I added Palantir to the Cloud Wars Top 10 in the #10 spot — they replaced Snowflake. And the company’s Q3 results certainly justified Palantir’s inclusion on the list: for its Q3 ended Sept. 30, Palantir said total revenue grew 63% to almost $1.2 billion, propelled by growth in its U.S. commercial business of 121% to $400 million (here’s my analysis of their Q3 results and outlook).

So, in addition to its traditional strengths in government and defense, Palantir is emerging as a very serious enterprise player by combining its hard-to-categorize software capabilities — that must drive the “but what box are you in??” wonks crazy! — with a wildly counterintuitive approach to customer engagements: during that explosive growth in Q3, the size of Palantir’s sales force actually went down!

Palantir’s novel technology, novel approach to customer engagements, and novel philosophy about traditional software categories are proven winners — and I’m very eager to see what sort of very big numbers they share when they release Q4 results later this month.

Big hat-tip to Palantir for earning the huge jump from #10 to #5.

OpenAI Debuts at #10

The company that ignited the GenAI boom with its launch of ChatGPT three years ago has evolved and grown radically since that momentous introduction. OpenAI is the first privately held company that I’ve allowed on the Cloud Wars Top 10 — I’ve wanted to focus exclusively on public companies because their financial performance reflects customer interest and demand, and those are key factors in my evaluations. So, while OpenAI is not publicly traded and therefore not required to disclose key financial information, its presence and even more so its potential are so significant to the entire cloud/AI category that I’ve chosen to make this exception.

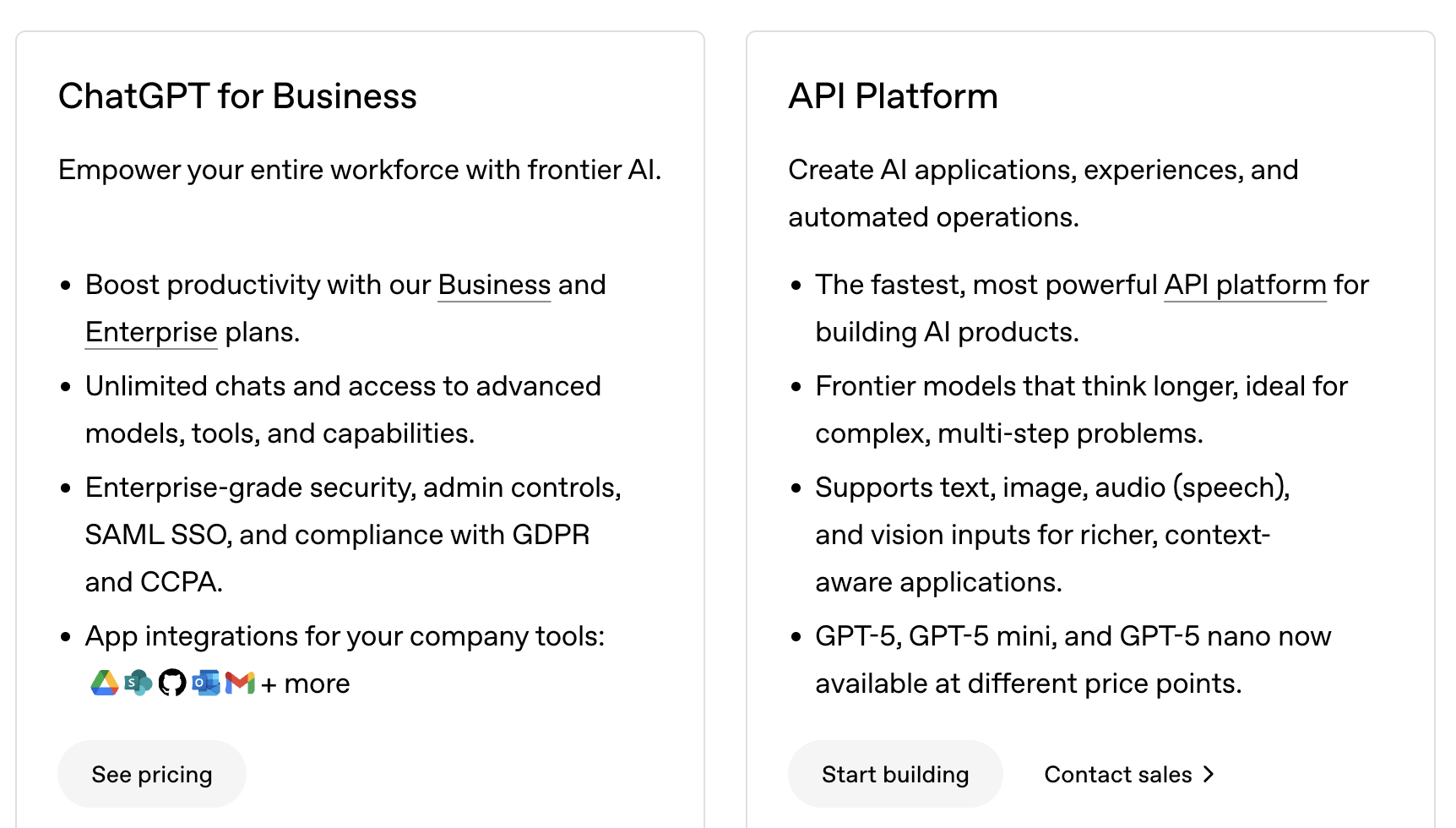

A few excerpts from OpenAI’s website reveal some pretty ambitious intentions regarding enterprise customers:

…..

…..

Well, talk about the camel getting its nose under the tent — ChatGPT is not only a phenomenally popular AI tool but also, per the excerpts above, the “land” part of what is certainly becoming an ambitious “land and expand” foray into the enterprise for OpenAI.

On top of that, the company’s wide range of partnerships plus CEO Sam Altman’s vision make OpenAI a future-creator that business leaders simply must get to know.

ServiceNow, Workday, and Salesforce

ServiceNow holds its spot at #6, and with the big move upward for Palantir, Workday goes from #7 to #8, and Salesforce from #8 to #9. All three companies remain powerful engines for customer innovation and growth and each of the three has great prospects for 2026.

A Fond Farewell to IBM

As I’ve mentioned before on many occasions, Arvind Krishna has done a superb job in his six years as CEO of IBM, restoring stability and purpose and growth to the iconic brand and positioning it nicely for the future — for more on that, check out my interview with Krishna from a year ago. The entire IBM organization has been overhauled, and the crippling culture fostered by previous leadership has been replaced by one focused vigorously on customer innovation.

But, two to three years ago, IBM stopped breaking out its cloud revenue, and it’s no longer possible for me to accurately and (I hope) insightfully analyze IBM’s success among customers relative to its competitors. So, with no second thoughts but with regret, I say farewell to IBM as part of the Cloud Wars Top 10, and I wish the entire organizations — and particularly Krishna — much continued successs. Should the company change its financial reporting in the future to include cloud revenue and growth rates, the door to the Cloud Wars Top 10 remains open.

Final Thought

I might be biased — check that; on this, I am extremely biased — but this is the most extraordinary time in human history to be alive. What these Cloud Wars Top 10 companies are creating in close concert with their customers and partners is improving the lives of and increasing the opportunities for billions of people across the planet.

It’s a fantastic opportunity for me to be able to analyze world-shaping companies like this and I’m deeply grateful to everyone who spends some of her or his precious time with Cloud Wars. I hope the changes outlined yesterday and today provide you with some value and look forward to continuing to share with you my insights into the greatest growth market the world has ever known.

Ask Cloud Wars AI Agent about this analysis