In a vibrant Q2 stoked by booming AI demand, Google Cloud remained the world’s fastest-growing major cloud vendor as all but one of the Cloud Wars Top 10 companies reported accelerated growth.

In what was certainly a robust Q2, the nine Top 10 companies that break out their cloud revenue —IBM continues to break my poor heart by withholding that total — added a combined total of $9.1 billion in Q2 versus Q1, with Microsoft’s extraordinary fiscal Q4 accounting for almost half ($4.3 billion) of that incremental gain. (In the chart below, you can see the results across the Cloud Wars Top 10 for Q2 growth rates, Q1 growth rates, Q2 revenue, and revenue gains in Q2 over Q1.)

While Google Cloud earns big kudos for its stellar growth rate of 32% with Q2 revenue totaling $13.6 billion, I would be remiss if I did not mention Snowflake’s excellent showing as it also reported quarterly growth of 32%, with revenue of about $1.1 billion.

As noted in the headline above, I’m also calling out Oracle and Microsoft for their most-recent quarterly results, although the two tech icons have earned that attention for different reasons.

- Microsoft wrapped up its fiscal 2025 with an astonishing growth rate of 27% — up from the previous quarter’s 20% — and revenue of $46.7 billion, which equates to roughly $500 million — half a billion dollars! — in cloud revenue every single dang day!

- Oracle, meanwhile, posted solid but much more-modest Q2 results — cloud revenue up 28% to $7.2 billion — but also posted an absolutely breathtaking RPO total of $455 billion, up 359%, as its Oracle Cloud Infrastructure unit continues to win massive multibillion-dollar contracts with many of the world’s leading AI vendors for AI training and AI inferencing.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

And as you can see in the chart below, red-hot Google Cloud made huge inroads during the quarter versus AWS by generating $1.34 billion in incremental revenue over Q1 while AWS added $1.6 billion. That means that while AWS posted Q2 revenue more than 2X as big as Google Cloud’s —$30.9 billion vs. $13.6 billion — Google Cloud came fairly close to matching the much-larger AWS in new business earned in the quarter.

In the same vein, look at the growth-rate differentials in both absolute terms and in the Q2 rate versus Q1’s, and it is unmistakably clear that AWS is by far the slowest-growing hyperscaler:

- Absolute: Google Cloud grew 32% in Q2 while AWS grew 17.5%, and while it’s true that Google Cloud is working from a significantly smaller base, that differential does not fully account for a nearly 2X ratio.

- Q2 versus Q1 growth rates: While AWS saw its growth rate inch upward from 17% in Q1 to 17.5% in Q2, Google Cloud posted a very impressive acceleration from Q1’s 28% to Q2’s 32%.

Here’s the full Cloud Wars Top 10 Growth Chart as of mid-September:

Cloud Wars Top 10 Growth Chart Sept. 16, 2025

| Company | Q2 Cloud Growth Rate | Q1 Cloud Growth Rate | Q2 Cloud Revenue | Cloud Revenue Gain Q2 over Q1 |

|---|---|---|---|---|

| 1. Google Cloud | 32% | 28% | $13.6B | +$1.34B |

| 1. Snowflake | 32% | 26% | $1.1B | +$100M |

| 3. Oracle | 28% | 27% | $7.2B | +$500M |

| 4. Microsoft | 27% | 20% | $46.7B | +$4.3B |

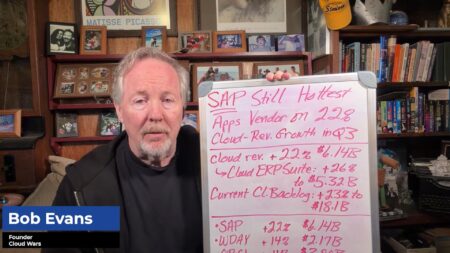

| 5. SAP | 24% | 27% | $6.0B | +$610M |

| 6. ServiceNow | 22.5% | 19% | $3.11B | +$110M |

| 7. AWS | 17.5% | 17% | $30.9B | +$1.6B |

| 8. Workday | 14% | 13.4% | $2.17B | +$111M |

| 9. Salesforce | 10% | 8% | $10.2B | +$400M |

| 10. IBM | ??? | ??? | ??? | ??? |

Final Thought

As Q3 begins to draw to a close, these recent revenue figures reflect powerful ongoing demand for cloud and AI services. And while anything and everything are possible, the financial trends shown above show an unquestionably robust market with only SAP showing a declining growth rate for Q2 relative to Q1.

On top of that, the RPO numbers that I’ve been following for the past 18 months show enormous customer demand for and confidence in the offerings of the Cloud Wars Top 10 as the primary building blocks for the AI Revolution. And to get the latest insights on how the hyperscalers stack up on the RPO front, please check out my analysis from yesterday: “Oracle Blows Past Microsoft in RPO Race as Hyperscaler Pipeline Hits $1.12 Trillion.”

Ask Cloud Wars AI Agent about this analysis