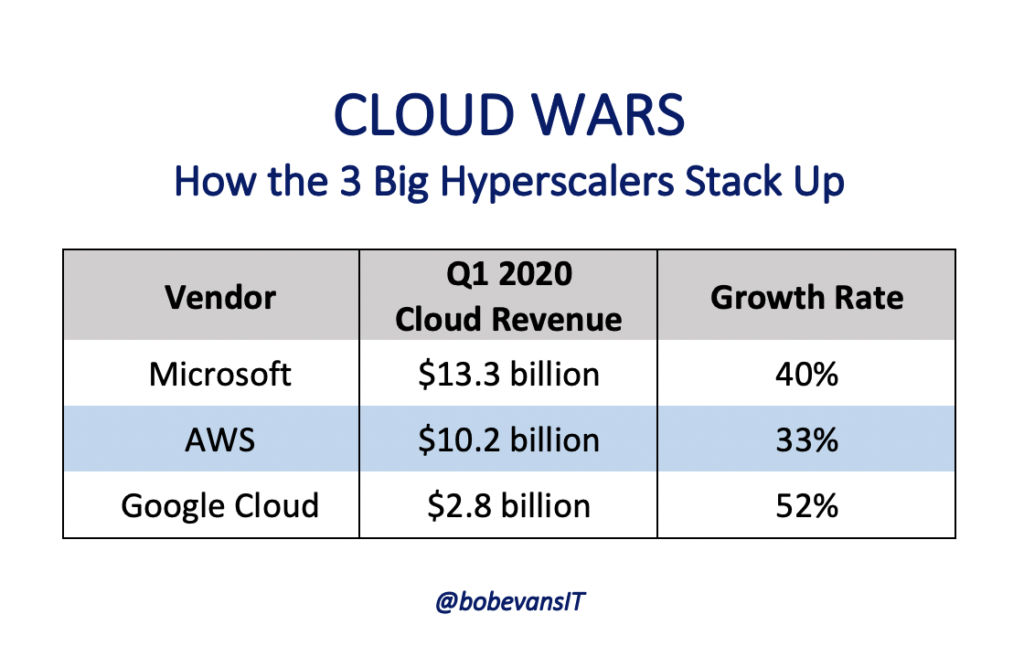

The cloud industry’s 3 big hyperscalers generated Q1 revenue of $26.3 billion, with Microsoft contributing half of that and AWS and Google combining for the other $13 billion.

Growth rates for all three cloud powerhouses continue to be impressive as well:

- Google Cloud (#4 on the Cloud Wars Top 10) at 52%;

- Microsoft (#1 on the Top 10) at 40%; and

- AWS (#2 on the Top 10) at 33%.

Of course, Q2 will be the real challenge to this type of ongoing growth as the global economic impact of the coronavirus crisis is reflected in that full 3-month period.

But because the enterprise cloud has been one of the primary tools that has helped businesses across the globe stay up and running with remote workers and reconfigured supply chains and rapidly transformed delivery models, it is possible that these companies will come through Q2 in fairly good shape.

For Microsoft, that was certainly the case for the 3 months ended March 31. “In the third quarter of fiscal year 2020, COVID-19 had minimal net impact on the total company revenue,” Microsoft said in its earnings press release. For more on that, please see Microsoft & Amazon Lead Top 5 Beyond $150 Billion in Cloud Revenue in 2020.

At Amazon, CFO Brian Olsavsky said on last weeks’ earnings call that AWS’s vast base of customers across every industry helped it maintain a very respectable growth rate. The company also topped $10 billion in quarterly revenue for the first time.

Highlights from the Amazon Q1 earnings call

Asked about the impact of COVID-19 in Q1, Olsavsky replied, “What we’re seeing kind of post-COVID is it varies by industry. We think we’re well-positioned in that we have such a breadth of customers—there’s millions of active customers from start-ups, enterprises, the public sector. So there’s a lot of variance and again in what individual industries are seeing right now.

“Things like video conferencing, gaming, remote learning, and entertainment are all seeing much higher growth and usage. And things like hospitality and travel certainly have contracted very severely and very quickly.”

Later in the earnings call, when asked again about the COVID-19 impact, Olsavsky reiterated an optimistic outlook for AWS.

“Our backlog of future contracts continues to build and I still think the basic value proposition of AWS that we’ve always pointed to — things like having the most functionality and largest and most vibrant community of customers and partners, having really proven operational and security experience, and building what customers need in the areas of machine learning, artificial intelligence and other really key areas — has not been impeded by this COVID crisis yet,” Olsavsky said.

“Yes, we are seeing different performance in different industries. But our sales force is still there to help not only with current capacity, but also as people make that journey on to the cloud and then expand their use of the cloud.”

Highlights from the Alphabet Q1 earnings call

For Google Cloud, I was particularly struck by two comments during the recent Alphabet earnings call, with the first being that Google Cloud continues to be the fastest-growing player in the Cloud Wars Top 10, at 52%. (Please see Google Outpaces Microsoft, Amazon in Cloud-Revenue Growth.)

But it was the second comment that really stood out. It framed the rapidly growing presence of impact and relevance of Google Cloud within its massive parent in terms the company has never come close to expressing before.

In his opening remarks, Alphabet CEO Sundar Pichai said (and I’ve added the italics for emphasis), “There are two key aspects of our business that give us confidence about the future. First, as we saw after 2008, one of the strongest features of Search is that it can be adjusted quickly, so it’s relatively easier to turn off and then back on and marketers see it as highly cost effective and ROI based. Second, our business is more diversified than it was in 2008. For example, cloud.”

Only 3 quarters ago, Alphabet didn’t even break out financial details for Google Cloud. Instead, it was lumped in an “other”-type category.

But here in early 2020, we see more evidence of the massive impact Thomas Kurian has had on Google Cloud in his 16 months as CEO. Alphabet recognizing GC as one of the primary factors that give it “confidence about the future” is big.

We’ll keep a close eye on Q2 developments as the world shakes off the vestiges of the global pandemic and the private sector once more becomes the engine of growth to get hundreds of millions of people across the globe who lost their jobs during the crisis back to work.

RECOMMENDED READING

How Bill McDermott’s Magic Touch Has Made ServiceNow a Cloud Superstar

Microsoft CEO Satya Nadella: 10 Thoughts on the Post-COVID-19 World

Google Outpaces Microsoft, Amazon in Cloud-Revenue Growth at 52%

Microsoft & Amazon Lead Top 5 Beyond $150 Billion in Cloud Revenue in 2020

How IBM’s New CEO Plans to Beat Microsoft, Amazon & Google in Cloud

Microsoft Will Stomp Amazon in Cloud Revenue, but Media Will Insist Amazon #1 in Cloud

Marc Benioff: The Extraordinary Ascendancy of a Global Leader

Google Cloud Unveils Massive, Wide-Ranging Global Response to COVID-19

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive and it’s great!