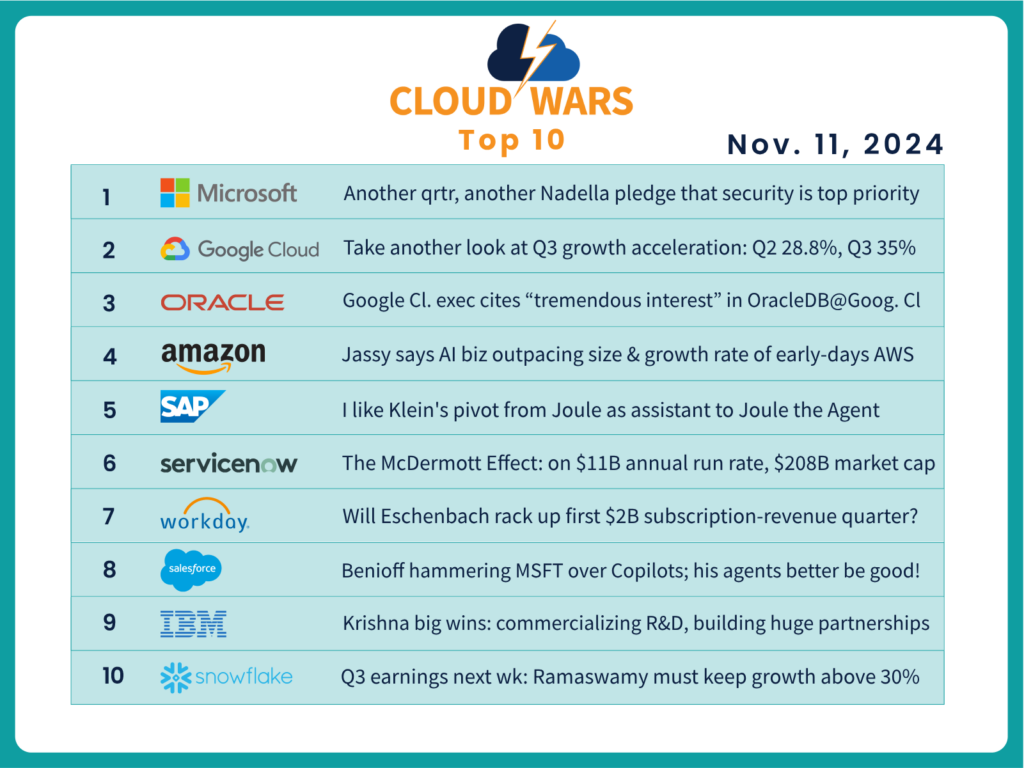

Google Cloud’s blowout Q3 growth rate of a whopping 35% makes it once again the world’s fastest-growing major cloud vendor, followed by SAP at 25% and ServiceNow at 23%.

In the latest iteration of my Cloud Wars Growth Chart below, you can see how the Cloud Wars Top 10 companies fare when stack-ranked by growth rate. And next month at this time, I’ll be following up with the next iteration after the latest quarterly numbers come in from Oracle, Workday, Salesforce, and Snowflake over the next few weeks.

While Google Cloud has held the #1 spot on the Cloud Wars Growth Chart for the past few quarters, I believe its most-recent achievement stands out for a few reasons:

- First of all, the competition is fierce — it is “A-gile, MO-bile, and HOS-tile” as a long-ago football commentator liked to say about top-level players.

- Second, Google Cloud in Q3 delivered one of the biggest quarter-to-quarter growth-rate accelerations — from Q2’s 28.8% to Q3’s 35.0% — that I can recall from my six years of analyzing the results of the Cloud Wars Top 10.

- Third, that huge growth spurt from Thomas Kurian and company comes amidst a time of massive disruption and upheaval in the tech space triggered by AI bursting onto the scene, and the correspondingly huge changes among customers that have taken place and will continue to take place for years to come as they seek to become AI-first organizations. From the magnitude of Google Cloud’s growth spurt, it appears the company is doing a masterful job of not only creating great new AI technologies and services but also putting them into the service of delivering significant and tangible business outcomes for customers.

In second place on this latest version of the Cloud Wars Growth Chart is SAP, which continues to dramatically outpace all other applications providers by a wide margin. And making SAP’s achievement even more impressive is that (a) it has maintained that pace for the past few quarters and expects to remain at that level throughout 2025 and (b) SAP is much larger than all of the other cloud-app vendors except Salesforce. Despite its size, SAP is still growing anywhere from 50% to 2X or even 3X faster than its top competitors.

Coming in third on our newest Growth Chart is ServiceNow, whose subscription revenue grew 23% in Q3 as Bill McDermott has done a terrific job of positioning ServiceNow as “the AI platform for business transformation.”

Paced by those three, here’s the full Cloud Wars Growth Chart–and please note that until Snowflake’s quarterly revenue reaches $1 billion, I’m isolating it in the #10 spot:

| Company | Latest Growth Rate | Quarterly Cloud Revenue | Quarter Ended |

| 1. Google Cloud | 35% | $11.4 billion | Sept. 30 |

| 2. SAP | 25% | $5.6 billion | Sept. 30 |

| 3. ServiceNow | 23% | $2.7 billion | Sept. 30 |

| 4. Microsoft | 22% | $38.9 billion | Sept. 30 |

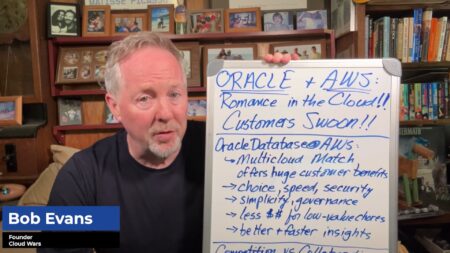

| 5. Oracle | 21% | $5.6 billion | Aug. 31 |

| 6. AWS | 19% | $27.5 billion | Sept. 30 |

| 7. Workday | 17% | $1.9 billion | July 31 |

| 8. IBM (Red Hat) | 14% | $1.63 billion | Sept. 30 |

| 9. Salesforce | 8% | $9.33 billion | July 31 |

| **10. Snowflake | 30% | $829 million | July 31 |

Final Thought

If this is the first time you’ve seen one of my Cloud Wars Growth Charts, please be assured I fully realize it’s harder for companies with high revenue bases to grow as rapidly as companies with smaller revenue bases. That’s one of the reasons I recently began tracking and comparing incremental quarter-over-quarter revenue — and there again, Google Cloud stood out by gaining more new business than its relative size versus Microsoft and AWS would have led us to believe.

Finally, all this competition is great for customers who are always — always — the biggest winners in the Cloud Wars.