Here in the greatest growth market the world has ever known, what the heck is Oracle doing that’s causing it to outgrow the other superb and world-changing companies in the Cloud Wars Top 10 by 2x, 3x, or even 4x?

Before I dig into that question, let me underscore the remarkable nature of Oracle’s current momentum by asking you to take a gander at the most recent cloud-revenue growth rates for the Top 10 as you ponder the question, “Which one of these is not like the others?”

- Oracle, 54%

- Google Cloud, 28%

- (tie) SAP, 24%

- (tie) ServiceNow, 24%

- Microsoft, 22%

- Workday, 20%

- AWS, 16%

- Salesforce, 11%

- IBM, 10%? (that’s just a guess — IBM no longer discloses that number)

- Snowflake, 50% (sequestered at #10 until quarterly revenue reaches $1 billion)

For a deeper breakdown on this, please see my recent analysis headlined Oracle Crushes Q4 and Remains World’s Hottest Major Cloud Vendor

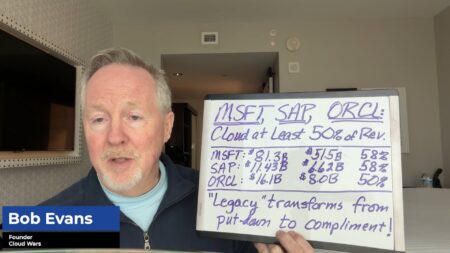

And before any of you good folks at Microsoft or AWS pops a gasket about how much smaller Oracle’s cloud business is than either of yours, let me point out the details: Microsoft Cloud’s quarterly revenue of $28.5 billion is almost 7x bigger than Oracle Cloud’s $4.4 billion, and AWS’s $21.4 billion is almost 5x bigger.

So yes: the law of big numbers tells us that it is easier for a company with a smaller revenue base to grow at a higher percentage than it is for a company with a larger revenue base to grow at those lofty levels.

But still, with that in mind, the fact is that Oracle’s cloud business grew 3.4x faster than AWS last quarter. Anybody think the bigshots at Amazon and AWS are saying, “Oh, please — fuhgeddaboudit! We’re bigger than they are, so it’s irrelevant that they grew by 54% and we grew by 16%!”

No, that’s not how the world works. Oracle right now is unquestionably the hottest major cloud vendor in the world, and the numbers above prove it. And here’s another major proof point: as Oracle’s cloud infrastructure business is getting bigger, it’s growth rate is increasing — but wait: doesn’t that defy that law-of-big-numbers thing? It sure does–and that’s a dynamic that is very difficult to achieve.

So:

- How is Oracle doing this?

- How is Oracle taking cloud-infrastructure business from the supposedly invincible “3 hyperscalers”?

- How has it built a $12-billion SaaS business that’s growing at the rate of 45%?

- What’s the secret?

Well, let’s hear from the two people who have imagined, planned, driven, and optimized this extraordinary performance: chairman and CTO Larry Ellison and CEO Safra Catz. (And you might recall that Catz was named the Cloud Wars CEO of the Year for 2022.)

On Oracle’s June 12 fiscal-Q4 earnings call, Ellison and Catz shared a wide and deep range of perspectives on their company’s blowout performance, which has sent Oracle’s market cap soaring to an all-time high of $315 billion. From those comments, here are the five that I believe reveal the answers to those questions posed above.

1. The Larry Ellison Effect

As Catz concluded her opening remarks — a task she has performed almost 100 times across her 24 years as a top executive at Oracle — she did something that I believe she has never done before. It took only two sentences and 38 words, but it was a very public recognition by one of the world’s top CEOs that her company has an asset no other company in the world can match: Larry Ellison. “And thank you, Larry, our CTO, our chairman, and our founder, for leading with brilliance, determination, and vision, and for allowing us to all be part of this incredible journey which is just getting started. So thanks, Larry.”

Tomorrow is Oracle’s 46th birthday, and Ellison has been the one constant within a company that has changed dramatically, sometimes turbulently, but always successfully. Always the master of the long game, Ellison knew 12 years ago that the journey to major success in the cloud would be long and often misunderstood by many — but as Catz said, his “brilliance, determination, and vision” have prevailed.

In particular, Ellison’s focus is now on what has become a very personal mission for him: the modernization, automation, and digitalization of the entire healthcare industry. And if anybody out there wants to bet against Ellison, let me know.

2. The Safra Catz Commitment

Think about the environment we’re in and have been in for the past 18-24 months: endless talk about economic downturn, recession, drastic cutbacks in corporate spending, drawn-out buying cycles, uncertainty, and more. Even in the extraordinary enterprise-cloud market, we’ve heard plenty of CEOs talking about moderated growth expectations, hesitant customers, smaller commitments, pushed-out decisions, delayed investment plans, and more.

In contrast to that, look at what Catz said about the coming fiscal year (June 1 to May 31) for Oracle:

“Now, before I finish, let me also give you some initial thoughts on fiscal year 2024. As I described and Larry will elaborate in-depth, we are seeing unprecedented demand for our cloud services and especially our AI services. As a result, I expect cloud revenue excluding Cerner will continue growing at at least similar rates to what we experienced in fiscal 2023, even though our base is much bigger, and may be higher. As our high-growth cloud revenues are becoming a larger portion of total revenue, we are seeing an acceleration of our total revenue growth. I expect this trend will continue in fiscal 2024, and of course, we also expect to deliver a higher non-GAAP operating margin percentage this coming year as well.”

No talk of nervous customers, smaller deals, slippery commitments, or “macro” uncertainty. And for those who have tried to explain away Oracle’s year-long surge as simply a matter of the Cerner acquisition a year ago, take another look at this line from Catz: “I expect cloud revenue excluding Cerner will continue growing at at least similar rates to what we experienced in fiscal 2023 — even though our base is much bigger — and may be higher.”

So while declaring that Oracle’s cloud revenue without Cerner “will continue growing at at least similar rates to what we experienced in fiscal 2023,” Catz also amplified that by saying it “may be higher.” That means that setting Cerner aside, Oracle’s organic cloud business is likely to grow even faster in the coming 12 months than it did in the past 12 months, during which time the company beaome the hottest big loud vendor on Earth.

3. Technological Superiority

Ellison opened his prepared remarks by jumping right into what he’s been saying for the past 2-1/2 years: after an early and aborted attempt at building the same types of cloud infrastructure used by Microsoft and AWS and Google, Oracle has built and is deploying cloud infrastructure of a fundamentally different — and better — kind.

“The hardware and software in Oracle’s Gen2 Cloud is fundamentally different than other hyperscalers’ clouds. The CPUs and GPUs we rent to customers are interconnected using an ultra-high-performance RDMA network plus a dedicated set of cloud-controlled computers that manage security and data privacy. Oracle’s unique set of hardware and software building blocks enable our Gen2 Cloud to deliver much higher performance than any of our cloud competitors. And in the cloud, since you pay by the minute, if you run twice as fast — and we do — you pay only half as much. What is especially interesting in today’s world is that all of our Oracle Cloud data centers have a high bandwidth, low latency, RDMA network that is perfectly optimized for building the large-scale GPU clusters that are used to train generative large-language models. NVIDIA themselves are doing AI development in the Oracle Gen2 Cloud. And we are partnering with NVIDIA to build the world’s largest high-performance computer and AI computer with 16,000GPUs.”

Anybody out there think that sounds like a guy who “doesn’t get the cloud”?

4. Huge Differentiator: Offering Both Apps and Infrastructure

Continuing to hammer home the performance advantages Oracle holds over its cloud competitors, Ellison said, “The biggest strategic difference between Oracle Cloud and everyone else’s cloud is actually not the RDMA network — that’s just a technical difference. The biggest strategic difference is that we do both cloud apps and cloud infrastructure: we use our own infrastructure, and we build applications with it. So we learn a lot about how we can improve our infrastructure by building lots of applications — enterprise-scale applications — on top of our infrastructure. And so we’re able to create this continuous feedback loop: we’re building applications, obtaining insights, and making improvements in our productivity.

“We also have a new programming language,” Ellison said in making his case for why Oracle’s able to do what other cloud providers cannot. “We have Java, and we love Java, and we use it a lot for building applications. But we have this other low-code application-development tool called Apex, and we’re now building a lot of our applications in Apex. And our productivity gains are again a factor of ten: we build the applications in one-tenth the time, or with one-tenth the amount of people, or at one-tenth the cost. But these are not typical low-code applications. Rather, these are applications that can scale to millions of users and all over the world. Most low-code applications are built for small projects, but we use it for applications we’ve rolled out globally. Also, the Apex development environment — the underlying database for Apex is the Oracle Autonomous Database — has made our application developers dramatically more productive. It’s one of the reasons why we bought into the idea that we could rewrite a whole suite of medical applications in a very, very short period of time, and why we believe we can redo Cerner very, very quickly because of these underlying tools.”

5. Catz reveals Oracle’s “Secret Weapon”!

Asked about the impact Oracle’s industry-specific applications are having on its overall SaaS business, Catz said, “There’s no question that our secret weapon is the fact that we have vertical applications also. Many of our customers end up wanting to buy a vertical application and Fusion together. And it’s industry by industry. We will be posting online some of our wins for the quarter and what you’ll see is when we have existing customers in a segment and a vertical application in that, we truly are without a doubt the most popular, whether it’s healthcare with all of our existing customers, including Cerner. The fact that we have all of the horizontal Fusion applications — ERP and HCM, SCM, CX — as well as the vertical applications, well, that just makes us very tough to beat.”

Catz said that Q4 customer wins included companies in healthcare, financial services, retail, hospitality, with some of those customers “wanting to buy their entire set of solutions from us.”

As a result, Catz said, “That really makes us very sensitive to their needs, and we can meet those needs much better. So that’s been a big winner for us.”

Final Thought

As Ellison said, Oracle’s big differentiation in the cloud is not purely about technology. Its focus on industries, and on playing at all levels of the cloud, and on evangelizing innovations such as the multi-cloud interconnect with Microsoft, and on being willing to tackle monstrously complex challenges such as modernizing and automating the entire healthcare industry have all combined to be key factors behind that astonishing gap between Oracle Cloud’s growth rate and that of all those other world-class companies.

But in my mind, Oracle’s essential and indispensable point of differentiation is Larry Ellison. He may not always be right — no one is — but he’s built a track record that few people in the past or present can match, and Ellison tends to thrive in times of turmoil, confusion, and uncertainty.

Ergo, Catz’s declaration that over the next 12 months, Oracle (excluding Cerner) expects to maintain or even increase the growth arc of its cloud business even as it’s getting much, much bigger.

So buckle up tight, folks–as tumultuous as the Cloud Wars have been over the past several years, I think the fun’s just beginning!

To understand the shifting sands of how mid-market and enterprise CXOs are making purchase decisions to modernize technology, consider Acceleration Economy’s “Selling to the New Executive Buying Committee,” a Course designed to assist vendors, partners, and buyers in this process.