Riding powerful generative artificial intelligence (GenAI) momentum to a blowout Q3, ServiceNow has jumped into the #2 spot on the Cloud Wars list of the world’s fastest-growing cloud vendors with Q3 subscription revenue rising 27% to $2.22 billion.

Trailing only #1 Oracle and its 30% cloud-revenue growth rate, ServiceNow cited not only powerful demand for its GenAI solutions and technologies but also massive growth in federal contracts as well as huge increases in high-volume private-sector deals.

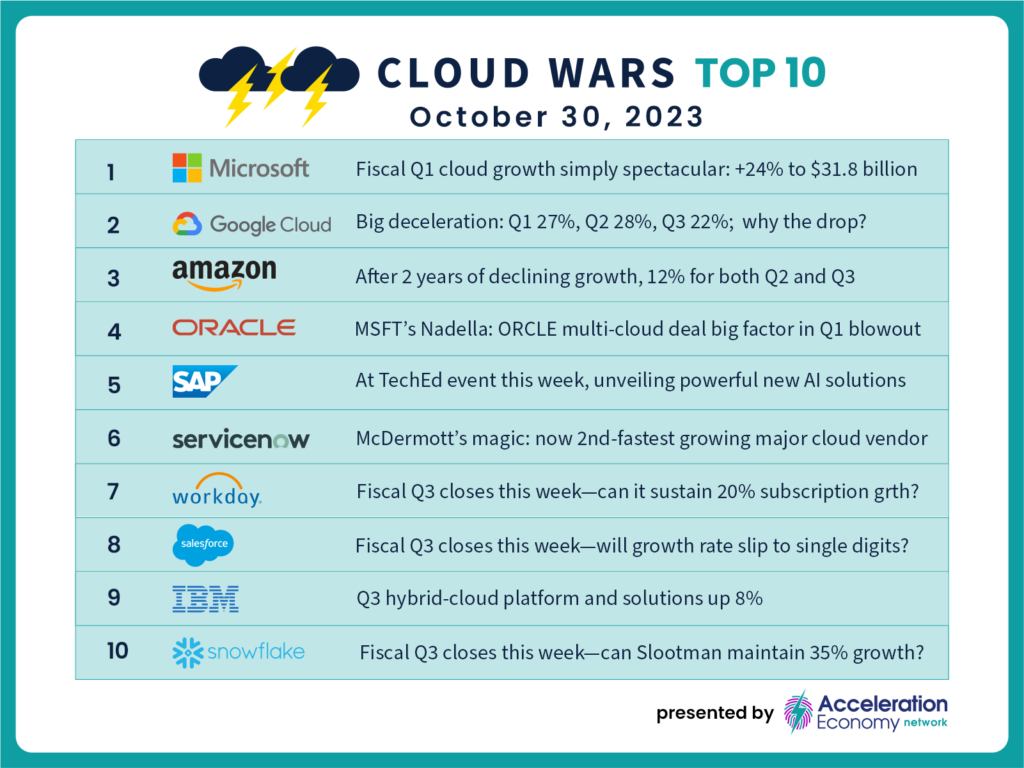

The #2 spot on the Cloud Wars Growth Chart marks an all-time high for ServiceNow, mirroring its move a few months ago to the #6 spot on the Cloud Wars Top 10.

And before I get to some ServiceNow highlights, I want to give you some perspective on ServiceNow’s neighbors in the high-flying cloud community, so here’s a list of the five fastest-growing companies on my updated Cloud Wars Growth Chart. I’ll be posting the complete 1-through-10 Cloud Wars Growth Chart within the next week or so.

#1 Oracle, 30%: its cloud-infrastructure business is booming as the AI-training sector accelerates, its line of business (LOB) software-as-a-service (SaaS) business is growing on all fronts, and its industry-specific business is surging as well.

#2 ServiceNow, 27%: CEO Bill McDermott from Oct. 25 Q3 earnings call: “GenAI represents a tailwind of growth for ServiceNow. We have over 300 customers in our pipeline from every industry, every buying center, in every stage of testing.”

#3 Microsoft, 24%: for a business this big ($31.8 billion in fiscal-Q1 cloud revenue) to be growing this fast is breathtaking — particularly considering that growth accelerated from the previous quarter’s 21%!

#4 SAP, 23%: Hmm, call me crazy, but does this mean that three of the four fastest-growing cloud vendors are from the “legacy” camp? You know, the ones that the self-proclaimed experts said could never make it in the cloud??

#5 Google Cloud, 22%: I have to admit that this one surprised me — I had predicted that Google Cloud would post Q3 revenue growth of 27%, following strong performances in Q1 (27%) and Q2 (28%).

To round out ServiceNow’s ascension to the #2 spot among cloud high-flyers, let’s take a look at a few of their notable Q3 accomplishments from the Oct. 25 earnings call as offered by CEO McDermott.

- GenAI potential: “In the last year, ServiceNow has doubled down on our AI investments. Our Vancouver release includes generative AI-powered Now Assist for every workflow. Others issued press releases; we released products,” McDermott said. “Gartner forecasts that $3 trillion will be spent on AI and gen AI between 2023 and 2027. GenAI represents 36% of AI spending overall. We believe every dollar of global GDP will be impacted by AI over the next several years. This isn’t a hype cycle; it is a generational movement.”

- Partner Power: “Looking holistically at our business, we see progress everywhere. We have an aspiration to significantly increase the percentage of net new revenue sourced by our partners in the coming years. This is about partners making the ServiceNow platform the core of their emerging business models.”

- Addressing CEO Priorities: “What’s unique about ServiceNow is digital transformation can deflect so many of the cost-intensive, labor-intensive procedures companies must deal with to properly serve their markets. On top of that, you have one-third of the productivity of knowledge workers getting torn apart by swivel-sharing between about 13 individual applications a day. Then you add the productivity tailwind of generative AI on this once-in-a-generation ServiceNow platform and you have achieved a very important business transformation. And I think, right now, CEOs are focused on business transformation.”

- Federal Business Booms: “Our federal business had its biggest quarter in ServiceNow’s history with 75% year-over-year growth in NNACV [Net New Annual Contract Value], and we had 19 deals over $1 million, including three over $10 million with the U.S. Air Force as the third-biggest deal in the history of ServiceNow. And what we’re seeing is federal agencies are looking to consolidate contracts, point solutions, the messy middle, and they really want to standardize on a platform with a core set of products that they can grow with. And our GenAI offerings are reinforcing our ability to help accelerate their transformation journeys.”

- More Very Large Deals: “In America, the number of $5-million-plus deals actually more than quadrupled year over year and the number of $10-million-plus deals doubled…. In EMEA [Europe, Middle East, and Africa], our $1-million-plus deals grew 70% year over year.”

Final Thought

As impressive as this Q3 performance was for ServiceNow, I think the company’s just getting warmed up. Its ambitious moves, announced a few months ago, into the enterprise resource planning (ERP) space via financials and supply chain will give ServiceNow the chance to exploit what McDermott referred to a couple of times as the expansion from “intra-company deals to inter-company deals.”

Well done, ServiceNow!