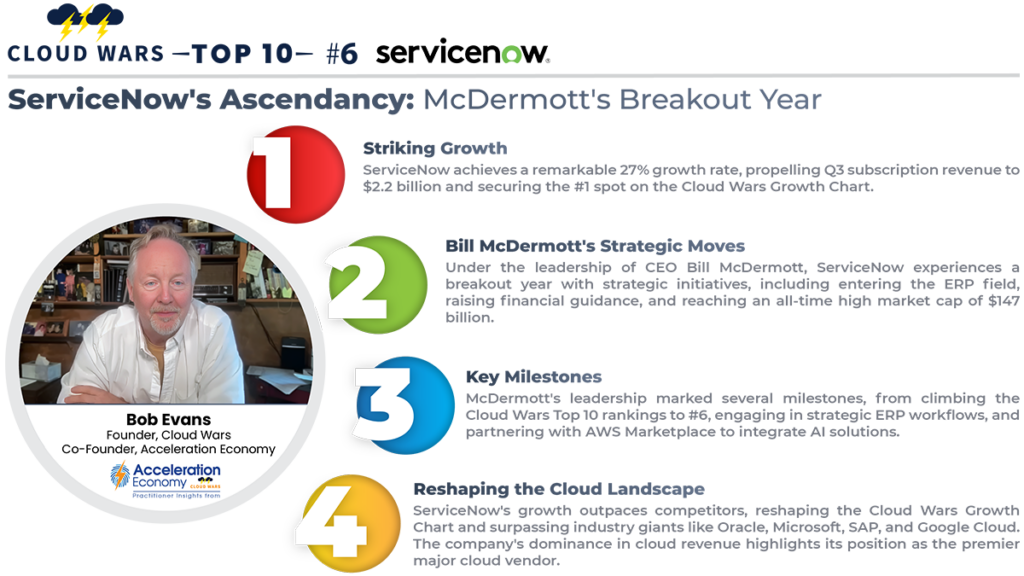

With its growth rate accelerating while all but one of the other Cloud Wars Top 10 companies saw theirs fall, ServiceNow boosted Q3 subscription revenue by 27% to $2.2 billion to claim the #1 spot on the list of the world’s fastest-growing major cloud vendors.

The move into the top spot on the Cloud Wars Growth Chart represents the latest triumph for ServiceNow CEO Bill McDermott in what has clearly been a breakout year of ascendancy for the high-flying intelligent platform company. Some highlights from the year:

- in June, vaulted from #10 to #6 in my weekly Cloud Wars Top 10 rankings;

- entered the huge and highly strategic ERP field in mid-year with new workflows for Supply Chain and Financials;

- raised financial guidance in the face of a challenging economic environment;

- this week, saw its market cap reach an all-time high of $147 billion;

- last month, agreed to offer its solutions on the AWS Marketplace, a move that also includes co-developed solutions as “an integral part of our efforts to help customers put AI to work for the business”; and

- in late October, moved up to the #2 spot on the Cloud Wars Growth Chart.

Coming into this week, Oracle sat atop that Cloud Wars Growth Chart with 30% cloud-revenue growth for its fiscal Q1 ended Aug. 31. But on Dec. 11, Oracle disclosed that fiscal-Q2 cloud revenue dropped to 25%, opening the door for ServiceNow to grab the top spot.

So with McDermott & Co. now the world’s hottest major cloud vendor, here’s how the latest Cloud Wars Growth Chart looks:

CLOUD WARS GROWTH CHART

| Company | Growth Rate | Cloud Revenue | Quarter end |

| 1. ServiceNow | 27% | $2.2 billion | Sept. 30 |

| 2. Oracle | 25% | $4.8 billion | Nov. 30 |

| 3. Microsoft | 24% | $31.8 billion | Sept. 30 |

| 4. SAP | 23% | $3.8 billion | Sept. 30 |

| 5. Google Cloud | 22% | $8.4 billion | Sept. 30 |

| 6. Workday | 18% | $1.69 billion | Oct. 31 |

| 7. Amazon | 12% | $23 billion | Sept. 30 |

| 8. Salesforce | 11% | $8.7 billion | Oct. 31 |

| 9. IBM | 9% | (Red Hat) ??? | Sept. 30 |

| 10. Snowflake** | 34% | $699 million | Oct. 31 |

(**Because Snowflake is so much smaller than the other Cloud Wars Top 10 vendors, I’m isolating it in the #10 spot until its quarterly revenue exceeds $1 billion, at which time it will be mainstreamed.)

Final Thought

In my recent analysis called “Cloud CEO Scorecard: Rating the Cloud Wars Top 10 CEOs,” I offered this broad overview of a key growth initiative for McDermott and ServiceNow:

As the former CEO of SAP begins his fifth lap around the sun with high-flying ServiceNow, Bill McDermott is driving the company into the high-stakes ERP sector — already populated but very large and deeply entrenched competitors — and expects to be able to collaborate with rather than having to slug it out with SAP, Oracle, and Workday.

Many times, McDermott has described ServiceNow’s unique market position by saying, “In order for us to win, nobody else has to lose.” If he’s able to translate that expectation into reality in the ERP space with new supply-chain and finance workflows, it will represent a massive win for ServiceNow’s customers.

If that comes to pass, ServiceNow will gain a very nice opportunity to hold on to that #1 spot on the Cloud Wars Growth Chart for quite some time.

But at least for now, well done, ServiceNow!

Interested in more AI Insights? Take our AI Ecosystem course available on demand. Discover how AI has created a new ecosystem of partnerships with a fresh spirit of customer-centric cocreation and renewed focus on reimagining what is possible.