With its Cloud ERP Suite posting a 31% growth rate in Q1, SAP is by far the world’s fastest-growing major enterprise-apps vendor, followed by Microsoft at 23%, Workday at 19%, Salesforce at 12%, and Oracle at 10%.

You can see more detail below in the Cloud Wars Growth Chart for Enterprise Apps, but first let me offer a few perspectives:

1. Customers cutting back on apps? Within the past couple of weeks, two of these major apps vendors (Workday and Salesforce) released quarterly earnings accompanied by top executives saying that customers have begun delaying purchases of enterprise applications. Workday and Salesforce executives also said that in some cases, customers are not only delaying their buying decisions but are also cutting back on deal sizes.

2. Will that trend extend to SAP and Microsoft? Will that trend extend to customers of SAP’s Cloud ERP Suite and Microsoft’s Dynamics 365? We’ll get those answers about a month from now, when those two companies release results for the quarter ending June 30.

3. Oracle apps growth declined, but no mention of buyer slowdown. The subject simply did not come up on last week’s earnings call because of all the focus on Oracle Cloud Infrastructure. My guess is that Oracle felt some of the same effect as cited by Workday and Salesforce. However, Oracle did say that within its overall Q4 apps revenue, Fusion Cloud ERP revenue was up 14%, and NetSuite Cloud ERP was up 19% — so it’s possible that Oracle’s mainstream apps continue to do well and that Oracle’s overall software as a service (SaaS) revenue is being bogged down by the sluggishness in the Cerner healthcare business.

Okay — so here are the most-recent results for the five big Cloud Wars Top 10 apps vendors based on each company’s most-recent quarterly growth and revenue figures for their apps businesses. In the case of Microsoft, the results are specifically for Dynamics 365.

CLOUD WARS GROWTH CHART: ENTERPRISE APPS

| Company | Growth Rate | Revenue | Quarter Ended |

| 1. SAP | 31% | $3.58 billion | March 31 |

| 2. Microsoft | 23% | $1.5 billion (est.) | March 31 |

| 3. Workday | 19% | $1.82 billion | April 30 |

| 4. Salesforce | 12% | $8.59 billion | April 30 |

| 5. Oracle | 10% | $3.3. billion | May 31 |

Looking forward, here are a couple of my thoughts on each company’s prospects in the wickedly competitive enterprise-apps space.

- SAP: The figures shown above for the Cloud ERP Suite mark the first time SAP has released publicly that cumulative total. However, SAP has been tracking that combined number internally, and said the Q1 growth rate of 31% marks the ninth consecutive quarter of growth of 30% or more for SAP’s core enterprise applications. Plus, the backlog figures SAP released during its mid-April earnings announcement indicate strong ongoing customer demand. So we’ll find out in 4-5 weeks if the slowdown bug has bitten SAP, but my guess is we’ll see a Q2 growth rate of 26% for Cloud ERP Suite.

- Microsoft: Over the past couple of years, Microsoft has dropped occasional hints about the size of its Dynamics 365 revenue, and based on those I’m offering a rough estimation of quarterly revenue of $1.5 billion, giving it an annualized run rate of $6 billion. Plus, Microsoft’s been aggressively launching purpose-built Copilots for the various apps within Dynamics 365, and I suspect the company will reveal in late July that Dynamics 365 revenue grew 21% for the quarter ending June 30 (Microsoft’s fiscal Q4).

- Workday: Here’s what CEO Carl Eschenbach said on the company’s fiscal-Q1 earnings call last month: “But we also closed fewer large deals than last Q1, notably in EMEA. When purchase decisions are being made, our win rates remain strong. But within the quarter, we experienced increased deal scrutiny as compared to prior quarters” [emphasis added]…. And we are seeing customers committing to lower headcount levels on renewals compared to what we had expected. We expect these dynamics to persist in the near term, which is reflected in our revised FY ’25 subscription-revenue guidance.” (For more on that, please see “As Workday Customers Slow-Walk Purchases, CEO Eschenbach Remains Bullish.”)

- Salesforce: On the company’s fiscal-Q1 earnings call last month, CFO and president Amy Weaver said she expects the current pullback on buying to extend through the entire year: “We did continue to experience measured buying behavior, which is reflected in the moderated Q1 bookings…. On the buying environment, we’re assuming that the conditions we saw in Q1 continue throughout our fiscal year,” which ends Jan. 31. As a result, Weaver said, Salesforce is projecting growth for that fiscal year to be just 8% to 9%.

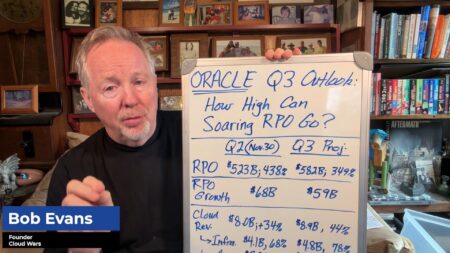

- Oracle: On its fiscal-Q4 earnings call last week, CEO Safra Catz said, “Our strategic back-office SaaS applications now have annualized revenue of $7.7 billion and were up 16%.” That grouping includes but is not limited to the Fusion and NetSuite ERP numbers noted above. Overall, this is an interesting time for Oracle as its applications business appears to be taking a back seat to its booming cloud-infrastructure (the key driver behind Oracle’s RPO surging 44% to $98 billion) and its cloud-database business, which is gaining significant customer momentum.

Final Thought

This collection of the world’s top five enterprise-apps vendors reflects the wildly disruptive times we live in:

- Microsoft is a giant in cloud infrastructure and, at the other end, makes its own tablets and is deeply into gaming;

- Salesforce talks more and more like it wants to be known as a data company that also just happens to have some widely used apps; and

- Oracle is intensely focused on fueling its runaway OCI business, with chairman Larry Ellison saying it’s very possible that every single Oracle customer could have an Oracle Cloud data center within the customer’s data center.

So that leaves SAP and Workday as the only two pure-play enterprise-apps companies. And in several weeks, we’ll see if the customer slowdown first brought to light by Workday has touched SAP as well.

The AI Ecosystem Q1 2024 Report compiles the innovations, funding, and products highlighted in AI Ecosystem Reports from the first quarter of 2024. Download now for perspectives on the companies, investments, innovations, and solutions shaping the future of AI.