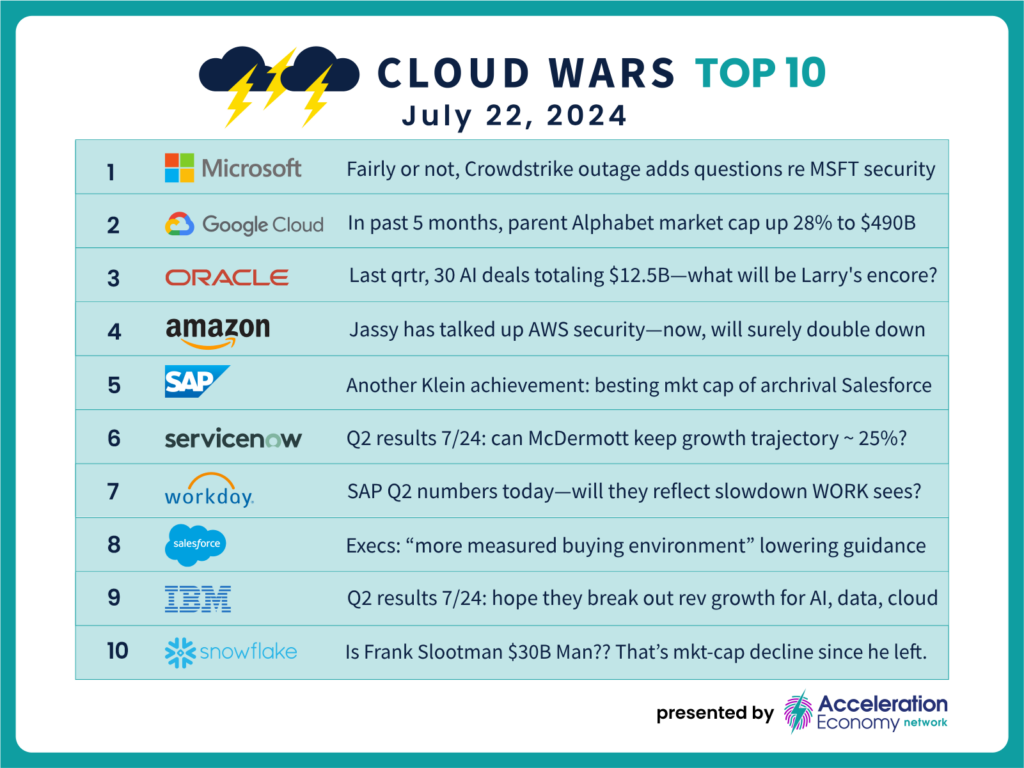

The Cloud Wars Cloud & AI Confidence Index has jumped almost $1 trillion in the past five months, rising 12.5% to $8.76 trillion led by huge increases in the market valuations of Google Cloud parent Alphabet, Oracle, and SAP.

The index — built on the market caps of the Cloud Wars Top 10 companies — reflects the confidence that business leaders and investors have in the ability of the world’s 10 largest and most-influential tech vendors to meet the huge expectations businesses have for the cloud and AI to drive successful business transformations and usher in major advances in everything from healthcare to education to entertainment to digital manufacturing.

My last posting about the Cloud & AI Confidence Index was five months ago on Feb. 20, when the combined market cap for the Cloud Wars Top 10 companies came in at $7.79 trillion, up 8.3%.

Ask Cloud Wars AI Agent about this analysis

You can see the latest market-valuation changes for each company in the nearby graphic, based on market-cap figures from late last week. Here are some highlights — and if some of these numbers seem almost unfathomably large, I assure you they’re not misprints:

- Alphabet, parent of Google Cloud: Over the past five months, its market cap soared by $490 billion — almost half a trillion dollars! — as the company dramatically sharpened its AI strategy, unleashed a huge portfolio of AI products and services, and proved to be perhaps the most-open and most-secure cloud and AI provider. Its market valuation has risen 28% in those five months to $2.24 trillion.

- Oracle: On the strength of its booming cloud-infrastructure business and that unit’s incredible success with the world’s top AI players, Oracle saw its market cap surge by to $385 billion, up 26%. For an example of that astonishing AI appeal, chairman Larry Ellison said that in its fiscal Q4 ended May 31, Oracle signed 30 AI deals valued at $12.5 billion.

- SAP: Ah yes, another of the “legacy” tech companies is achieving unprecedented success in the AI Revolution as investors, impressed with the huge demand among business customers for SAP’s applications and AI services and potential, drove SAP’s market cap 19% higher to $245.5 billion. In what must be considered a huge achievement for SAP, its market cap is now higher than that of rival Salesforce: “SAP Surpasses Salesforce in Market Cap as Revenue Grows 2X as Fast.”

- Microsoft: Squarely in the realm of the nearly unfathomable, Satya Nadella’s company saw its market cap climb by a staggering $270 billion over the five-month period. But because back in February Microsoft’s market cap was already $3.0 trillion, its increase by $270 billion equates to “only” 9%. And in a market where single-digit growth rarely draws more than a “meh,” there’s a case where 9% never looked so good!

- Workday: On the not-so-good-news side, Workday saw its market cap tumble 23% to $61.1 billion following the comments two months ago from CEO Carl Eschenbach that many customers have begun delaying purchase decisions and in some cases cutting the size of the purchases they’d been planning.

- Snowflake: Our last posting of the index came in late February, just days before legendary Snowflake CEO Frank Slootman announced he was stepping down as CEO. The market took the news very badly, immediately stripping out about $25 billion from Snowflake’s market cap and knocking it down at that time to about $50 billion. Late last week, Snowflake had a valuation of $45 billion, down 40% over the five-month period.

Final Thought

As I wrote back in February in my previous analysis of the Index’s results,

Now, I realize that you might be wondering why any of this matters: other than tossing around some titillating big numbers, what’s the point of the Cloud & AI Confidence Index? Most important, why should you care? Let me share my view on why these numbers — these incredibly big numbers — are vitally important for business executives.

First and foremost, I believe that in these extraordinary times, the index serves as highly credible proxy for the level of confidence business leaders have in the Cloud Wars Top 10 companies for those world-shaping vendors to help those leaders harness the full power and potential of the GenAI Revolution.

In the tech industry, market caps are largely a barometer for growth potential. And these stratospheric valuations reflect enormous confidence among business leaders that GenAI will live up to its promise as a once-in-a-generation phenomenon that will forever redefine how the world lives, works, plays, and creates.

Anybody see a $9-trillion total for the next posting of the Cloud Wars Cloud &AI Confidence Index?