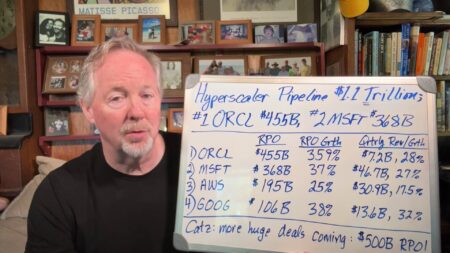

Offering powerful evidence that the AI Revolution is fully upon us, the four hyperscalers have built a combined pipeline of $1.12 trillion as Oracle’s stunning $455 billion RPO total topped Microsoft’s most-recent RPO total of $368 billion by 25%.

While the sheer dollar volumes for the hyperscalers’ RPOs and/or backlogs are striking, what I find even more remarkable are the growth rates associated with those RPO/backlog figures:

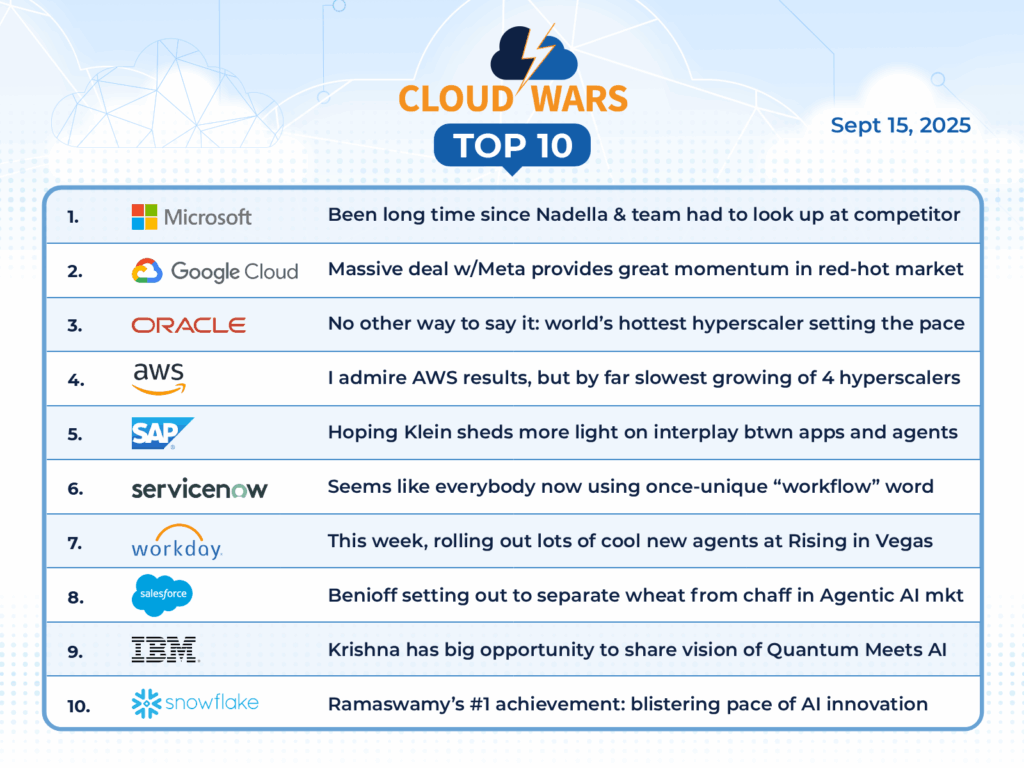

CLOUD WARS TOP 10 RPO SCORECARD Sept. 15, 2025

| Company | RPO / Backlog | Growth | Quarterly Cloud Revenue, Growth |

|---|---|---|---|

| 1. Oracle | $455B | 359% | $7.2B, +28% |

| 2. Microsoft | $368B | 37% | $46.7B, +27% |

| 3. AWS | $195B | 25% | $30.9B, +17.5% |

| 4. Google Cloud | $106B | 38% | $13.6B, +32% |

| Total | $1.124T | — | — |

(Oracle and Microsoft use the term “RPO” while AWS and Google Cloud use “backlog.” No doubt there are some picayune distinctions between those descriptors, but for our purposes I’m treating them as relatively the same.)

More than a year ago, I began tracking RPO numbers closely because, while they don’t yet represent actual revenue figures, they clearly offer powerful insights into future customer demand. These RPO and backlog numbers represent contracted business that’s not yet been recognized as revenue, and as such they’re extremely reliable indicators of future growth profiles for the Cloud Wars Top 10 vendors.

In combination with quarterly revenue figures and growth rates that reflect the recent past, these forward-looking RPO and backlog numbers give us a complementary view into the future regarding big bets being made by customers.

This latest RPO snapshot shows us a number of key developments:

- With the four hyperscalers combining for a total pipeline figure of $1.12 trillion, it is clear that (a) demand among business customers is exceptionally strong and (b) their belief in the power and potential of AI is equally strong.

- As noted above, the associated growth rates are astonishing, particularly given the massive revenue bases upon which all that future growth is being built. Even putting aside the other-worldly and one-time-only 359% explosion, look at the others: Google Cloud 38%, Microsoft 37%, and AWS 25%, with each company already topping $100 billion in RPO.

- Over the past several quarters, I’ve noted that while Oracle’s quarterly cloud revenue is much smaller than those of its competitors, its RPO numbers have been booming — and that’s before the current Q1 results and the explosive RPO growth. What that tells me is that Oracle is and has been winning a disproportionate share of future business, and that the yawning gap between its current quarterly revenue figures and those of the three original hyperscalers is going to shrink.

- While I applaud AWS for posting 25% backlog growth and a total backlog of $195 billion, the 25% figure shows once again that AWS is growing significantly more slowly than its competitors. Compare both the RPO/backlog numbers in the chart above along with the quarterly figures, and it is clear that the others are all growing much more rapidly than AWS.

- I’m sure some folks will attempt to downplay or even dismiss Oracle’s spectacular RPO growth by referring to published reports that the huge jump is due mostly to a single massive contract from OpenAI. Two thoughts on that: first, if those reports are true, does that mean that Oracle should have said “no thanks” to Sam Altman‘s offer to pay Oracle $30 billion a year for 10 years? Second, in Oracle’s Q1 earnings call last week, CEO Safra Catz made it clear that Oracle is experiencing wide-ranging success with not only OpenAI but also many of the world’s other largest AI players.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

Near the top of her prepared remarks, Catz said, “We have signed significant cloud contracts with the who’s who of AI, including OpenAI, xAI, Meta, NVIDIA, AMD and many others. At the end of Q1, remaining performance obligations, or RPO, now top $455 billion. This is up 359% from last year and up $317 billion from the end of Q4. Our cloud RPO grew nearly 500% on top of 83% growth last year.”

And a few minutes later, she again emphasized that Oracle is winning big deals with multiple major AI players, with that momentum likely to push Oracle’s RPO above half a trillion dollars.

“Now, before I dive into specific Q2 guidance, I’d like to share some of the overarching thoughts on fiscal year 2026 and the coming years,” Catz said.

“Clearly, it was an excellent quarter, and demand for Oracle Cloud Infrastructure continues to build. I expect we will sign additional multibillion-dollar customers and that RPO will likely grow to exceed $0.5 trillion. The enormity of this RPO growth enables us to make a large upward revision to the Cloud Infrastructure portion of our financial plan.”

Final Thought

For some pretty juicy details on that “large upward revision,” please see “Oracle Q1 Stunner: RPO Explodes by 359% to $455 Billion.” As I see it, revenue growth is somewhat interesting in what it means for the vendor, but where growth rates really take on relevance is when they are evaluated in terms of where customers are choosing to put their money in a market crammed with superb suppliers.

And right now, anybody who thinks Oracle’s not the hottest game in town should probably think again.