The surging and superior results from Amazon’s “traditional” businesses might provide Bezos with the impetus to spin out AWS next year.

Cloud Revenue

Google Cloud retained its claim to being the fastest-growing cloud vendor by boosting its revenue 44.8% in Q3.

The stellar Q1 results posted by Microsoft show they are the biggest and most-influential enterprise-cloud vendor in the world.

I expect Microsoft to post excellent fiscal Q1cloud results and dispense with the notion that the sky above the cloud is falling.

In announcing Q2 growth and earnings last week, Workday execs did not specifically mention Oracle and SAP, but the subtext was clear.

Following its release of quarterly results, cloud leader Salesforce’s shares shot up by 25%, giving it a market cap of almost $250 billion.

In its Q2 earnings presentation, Salesforce included a CRM revenue market-share chart from IDC showing its increased dominance in 2019.

Market-cap valuations can be fleeting, but they provide an objective view of how the global market values companies like SAP, Salesforce and Oracle.

As Salesforce becomes the first SaaS company in history to reach $5 billion in quarterly revenue (for Q2), a preview of its 8/25/20 earnings call.

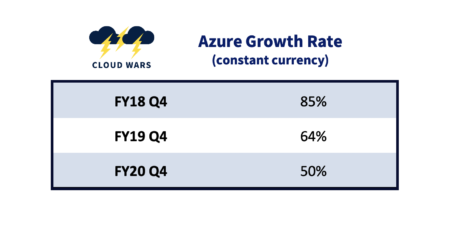

An overview of what we know and don’t know about the high-level details of Microsoft Azure revenue and Microsoft cloud revenue in general.

A few thoughts on why Microsoft, Amazon, Salesforce, and Google top the Cloud Wars list of the world’s largest and most-influential cloud providers.

A few reasons why I believe that Satya Nadella and the Microsoft executive team are extremely pleased with continued hyper growth from Azure.

A look at how Salesforce measures up against Microsoft, SAP and Oracle when it comes to hitting the $5 billion in a quarter mark.

On the recent Amazon earnings numbers, to clarify: anyone who thinks that AWS is “in trouble” or because its growth rate was “only” 29% is nuts.

With a 43% revenue-growth rate that was much higher than those of its larger rivals, Google Cloud continued to be the fastest-growing major cloud vendor.

As Microsoft cloud revenue soared to $51B on the strength of $14.3B in fiscal Q4, Azure led the way as usual with 50% hypergrowth. But there’s more!

CEO Christian Klein specifically called out SAP’s month-old Industry Cloud suite of applications as a “growth driver” in SAP’s preliminary Q2 report.

I expect that when Microsoft releases fiscal-Q4 earnings next month, it will total enterprise-cloud revenue for fiscal 2020 above $50 billion.

For the 3 months ended May 31, the Digital Experience business arm of Adobe posted quarterly revenue of $826 million, up just 5%.

Fiscal Q4 for Oracle, ended May 31, is always the company’s largest—and earnings calls often reveal developing trends for the company’s new fiscal year.