In the wickedly competitive cloud HCM market, Workday has been chosen to replace a large on-premises HCM system from Oracle or PeopleSoft, Workday co-CEO Aneel Bhusri said.

Speaking on Jim Cramer’s Mad Money show late last week after Q2 earnings were out, Bhusri said CVS was “on a legacy system—I don’t know if it was Oracle or PeopleSoft [Oracle owns PeopleSoft]. During the pandemic and during all the change, CVS just decided they needed to get on a modern HR platform, and they needed to work with a company that would scale those systems to meet their needs.

“They’re a huge company, and they chose us. We’re very grateful—it’s an amazing company—they’ve been on the front lines of taking care of all of us and it’s where many of us have gotten vaccinated, so it’s a real honor to be able to serve them.”

Bhusri had cited the win at CVS Health during Workday’s Aug. 26 earnings call when he said, “We are still, in the world of HCM, selling to absolutely the biggest companies in the world, like CVS Health.”

If the legacy system replaced by Workday was indeed PeopleSoft, that would be profoundly ironic. Because way back in December 2004, after a long and extremely bitter takeover battle, Oracle finally succeeded in acquiring PeopleSoft. Before the takeover battle began, Bhusri was PeopleSoft’s vice-chairman and senior vice-president, while Dave Duffield was PeopleSoft’s chairman.

And in 2005, Duffield and Bhusri cofounded Workday.

For Oracle, Workday’s win at CVS comes amid a hot streak for Oracle’s HCM business. The company declined to comment as it is in its quiet period before release of its FY22 Q1 results for the period ended Aug. 31. The CVS situation aside, Oracle’s Fusion HCM cloud business has been on a definite roll: for Oracle’s Q4 ended May 31, the company said Fusion HCM revenue was up 35%, which is a very strong number in its own right and also a huge sequential leap over the 23% growth rate Oracle posted for Fusion HCM in fiscal Q3, which ended Feb. 28. For more details on that, please see Larry Ellison Shows His Cards: Oracle ERP Revenue Could Reach $30B.

In Bhusri’s interview with Cramer, the Workday cofounder summed up his company’s approach this way: “We’ve passed 50% of the Fortune 500 running Workday HCM, and a growing number running Workday Financials. When companies are running Workday Human Capital Management, it means they’re not running another system—there’s only one system of record.

“So to get past that 50% number is a really big deal for us,” Bhusri said, and is a direct result of having “great employees who really take care of our customers.

“Our customer satisfaction rate continues to hover around 97%—and at the end of the day, that’s what we’re in business to do: to have happy customers.”

RECOMMENDED READING

10 Reasons Why Salesforce Buying Slack Is the Deal of the Decade

Salesforce Unleashes Slack and Rocks the Cloud

The Remarkable Larry Ellison: Oracle’s Legendary Disruptor Turns 77

Cloud Wars Top 10 Crush Q2: $60 Billion Led by Microsoft, Amazon, Google

Infor and AWS: CloudSuite Vendor Bets the Company on Amazon R&D

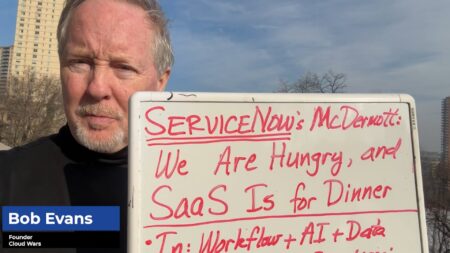

ServiceNow CEO Bill McDermott Playing Dangerous Game w/ SAP, Oracle

Amazon-Workday Kerfuffle: Big Winners Are Workday and Google Cloud

SAP Slaps Back at Larry Ellison: ‘Hundreds’ of Q2 Wins Over Oracle

How Evan Goldberg and Larry Ellison Made Magic—Twice—with NetSuite and Oracle

Disclosure: At the time of this writing, Workday and Oracle were among the many clients of Cloud Wars Media and/or Evans Strategic Communications LLC.

Subscribe to the Industry Cloud Newsletter, a free biweekly update on the booming demand from business leaders for industry-specific cloud applications.