As its massive RPO backlog begins to convert to quarterly revenue, Oracle saw its Q2 cloud growth jump to 34%, pulling it into a tie with Google Cloud for the #2 spot behind Palantir on the Cloud Wars Growth Chart.

Palantir, which hammered its way into the Cloud Wars Top 10 several months ago after exceeding $1 billion in quarterly revenue, is setting a dizzying pace with its 63% growth in Q3 as revenue reached $1.12 billion.

Of course, we’ll get some howlers out there who will gnash their teeth and rend their garments over what they perceive as the unfairness of my approach because, they love to say, it is easier for a company with a relatively small revenue base to grow at a higher rate than a company with a big revenue base.

I concede the point, and acknowledge it represents a concept most of us probably mastered in 7th grade. Instead, I focus on the idea that regardless of how big or small a tech vendor is here at the tail end of 2025 and in the formative days of the AI Economy, a cloud and AI company’s growth rate is a direct indication of customer demand, which is the ultimate metric here at Cloud Wars.

Over the past 18 months, I have consistently argued that Google Cloud and Oracle are the leading disruptors and innovators among the four hyperscalers (for example, from late last year: “In AI Era, Disruptors Google Cloud and Oracle Racing By Microsoft and AWS“).

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

And today we see those two companies winning more and more future-looking business as Oracle’s RPO was up 433% to $532 billion while Google Cloud’s backlog jumped 82% to $155 billion.

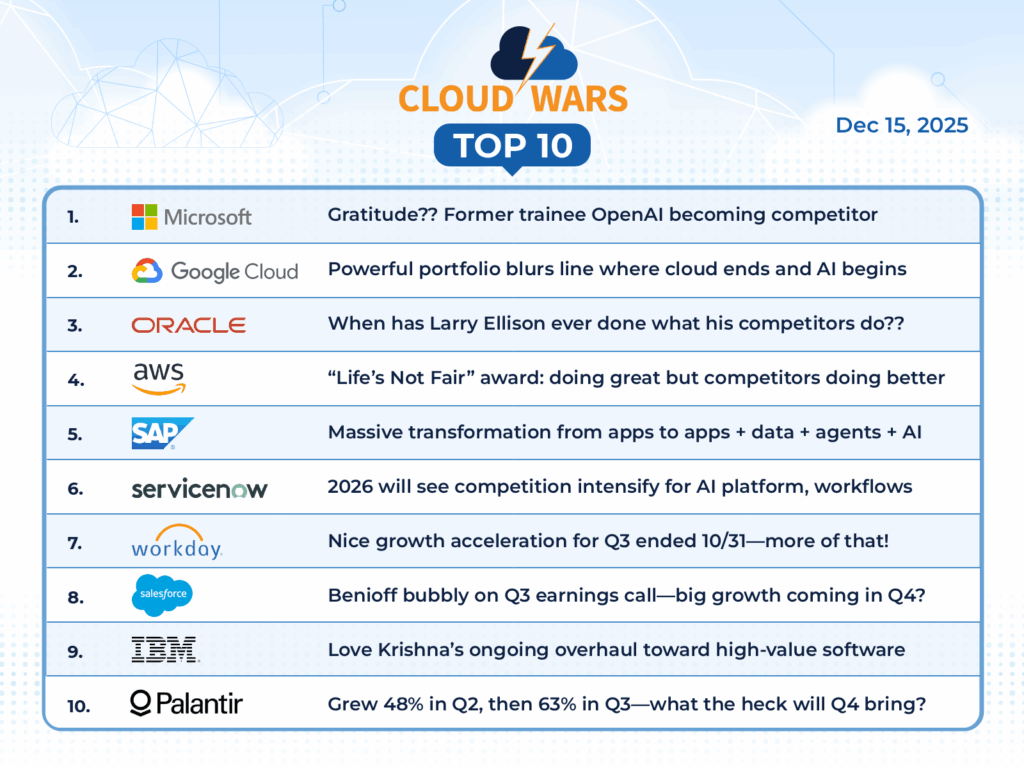

Overall, five of the nine Cloud Wars Top 10 companies that break out cloud revenue (IBM does not) saw those numbers accelerate relative to thei previous quarter: Palantir from 48% to 63%, Google Cloud from 32% to 34%, Oracle from 28% to 34%, AWS from 17.5% to 20%, and Workday from 14% to 14.6%.

Among the four companies whose growth rates slipped from the previous quarters, the declines were slight: SAP from 28% to 27%, Microsoft from 27% to 26%, ServiceNow from 22.5% to 21.5%, and Salesforce from 10% to 9%.

So all in all, I think it’s very safe to conclude that with the explosive emergence of the AI Revolution, the Cloud Wars remain the greatest growth market the world has ever known. Here’s a look at each company:

| Rank | Company | Latest Qtr Growth Rate | Quarterly Cloud Revenue | Previous Qtr Growth Rate |

|---|---|---|---|---|

| 1 | Palantir | 63% | $1.12B | 48% |

| 2 | Google Cloud | 34% | $15.2B | 32% |

| 2 | Oracle | 34% | $8.0B | 28% |

| 4 | SAP | 27% | $6.14B | 28% |

| 5 | Microsoft | 26% | $49.1B | 27% |

| 6 | ServiceNow | 21.5% | $3.3B | 22.5% |

| 7 | AWS | 20% | $33B | 17.5% |

| 8 | Workday | 14.6% | $2.24B | 14% |

| 9 | Salesforce | 9% | $10.3B | 10% |

| 10 | IBM | ??? | ??? | ??? |