In a clear demonstration that the price of fame and glory is always high and rarely equitable, Google Cloud deserves great credit for posting excellent Q4 growth of 30% to $11.96 billion but is also facing scrutiny for its sequential significant deceleration from Q3’s 35% growth to Q4’s 30%.

On its Q4 earnings call earlier this week, parent company Alphabet said Google Cloud’s Q4 growth decline was due to two primary factors:

- demand for AI-powered products and services outstripped supply; and

- “We are lapping a very strong quarter in AI deployment in Q4 of 2023,” according to Alphabet CFO Anat Ashkenazi.

How significant is that decline? Does it shed any light on customer demand for Google Cloud’s products and services versus those of the other hyperscalers?

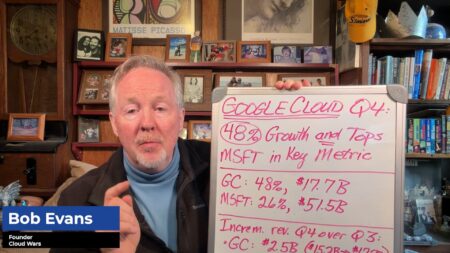

For the sake of comparison, let’s take a look at the growth rates for Microsoft and Google Cloud over the past five quarters (I’m not including AWS because Amazon will release AWS Q4 results later today), starting with the quarter ended Dec. 31 of 2023 and running through the quarter ended Dec. 31 2024:

| Quarter | Q4 ’23 | Q1 ’24 | Q2 ’24 | Q3 ’24 | Q4 ’24 |

|---|---|---|---|---|---|

| Microsoft | 24% to $33.7B | 24% to $35.2B | 22% to $36.9B | 22% to $38.9B | 21% to $40.9B |

| Google Cloud | 25.7% to $9.2B | 28.4% to $9.6B | 28.8% to $10.3B | 35.0% to $11.4B | 30% to $12B |

So while the Google Cloud Q4 growth of 30% could be tied to the two factors cited above — tough comparables for a year ago and constrained capacity — the trendline shows that Thomas Kurian’s company has found ways to overcome similar challenges over the prior four quarters by delivering accelerating growth across each of those (for more on that, please see my analysis from late October headlined “Google Cloud Q3 Blowout Is Fifth Straight Quarter of Accelerating Growth.”)

On the other hand, Google Cloud should be rightfully proud of growing much more rapidly in Q4 than any other major cloud vendor — hyperscalers included — and the company offered a string of compelling reasons to bolster that perspective. Alphabet CEO Sundar Pichai made that case on the Q4 earnings call with these and other comments (my followup thoughts are in italics):

- “In 2024, the number of first-time commitments more than doubled compared to 2023.” This one is particularly impressive to me as it shows that Google Cloud is winning big numbers of new customers.

- “We also deepened customer relationships: last year, we closed several strategic deals over $1 billion, and the number of deals over $250 million doubled from the prior year.” So on top of adding lots of brand-new customers, existing ones are investing heavily in Google Cloud’s capabilities.

- Our partners are further accelerating our growth with customers purchasing billions of dollars of solutions through our cloud marketplace. (Google Cloud has created a powerful and forward-looking ecosystem program under Kevin Ichhpurani.)

- In Q4, we saw strong uptake of Trillium, our sixth-generation TPU, which delivers four times better training performance and three times greater inference throughput compared to the previous generation. (They must continue to drive efficiencies to keep prices down.)

- Our AI developer platform, Vertex AI, saw a 5x increase in customers year over year, with brands like Mondelez International and WPP building new applications and benefiting from our 200-plus foundation models. (Another way of saying 5X is “400%” — either way, very impressive progress among the extremely important developer community.)

- Vertex usage increased 20x during 2024, with particularly strong developer adoption of Gemini Flash, Gemini 2.0, Imagen 3, and most recently, Veo. (True, building on a small base —but 20X is 20X.)

- We’re also seeing strong growth in our AI-powered databases, data analytics, and cybersecurity platforms. Customers, including Radisson Hotels, are now using Gemini to search and analyze multimodal data from across multiple clouds. (With BigQuery and other modern products, data and analytics represent big growth opportunities for Google Cloud as customers must refine their data strategies and capabilities to play successfully in the AI Era.)

- Our AI-powered threat intelligence and security operations products help customers, including Vodafone and AstraZeneca, identify, protect, and defend against threats. (No other hyperscaler is doing anything like this.)

Final Thought

While I must conclude that going from 35% growth in Q3 to 30% in Q4 is a problem, I will also say it’s the type of problem that just about every other company in the Cloud Wars Top 10 would love to have.

Kurian and team are playing the long game — albeit with great urgency in the here and now — so as some of those billion-dollar engagements start to come in and the pace and scale of AI and Cloud innovation continues to race along, I think we’ll see Google Cloud hold its spot as the world’s hottest major cloud provider for at least the next few quarters.

And if I had to pick one company that might knock Google Cloud off that perch, it would be Oracle. But that’s pure speculation, and for now Google Cloud richly deserves that designation.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.