On August 3, when Amazon releases its Q2 financial results, we’ll find out if AWS has found a way to reverse what is becoming a disastrous decline in its growth rate that, over the past six quarters, has plummeted from 40% to 16%.

Yes, some of that’s due to the law of big numbers that’s affecting most — not all, but most — of the Cloud Wars Top 10 companies, and yes, some of it’s due to corporate customers clamping down on spending in these strange economic times.

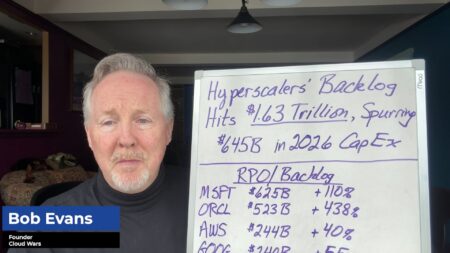

But here’s the big problem for Amazon and AWS that can’t be rationalized or papered over: As AWS growth numbers have been tumbling, two of its biggest competitors (Microsoft and Google) just showed significant strength by matching their prior-quarter growth rates, and the third (Oracle) saw its cloud-revenue growth rate accelerate:

- Microsoft posted FY23 Q4 cloud revenue of $30.3 billion, up 21% (23% in constant currency), which tracks very nicely with its 22% growth in the previous quarter

- Google Cloud said its Q2 revenue reached $8 billion, which is up 28% and matches the 28% growth it reported for Q1

- Oracle said its cloud revenue growth rate soared to 54% for the quarter ended May 31

As a result, the standard excuses and obfuscations for AWS’s sharply declining growth rates have become absurd. Let’s take a look at a few of those.

- Hey, it’s hard for an $85-billion business to grow rapidly! That’s very true — and a 16% growth rate for a business of that size would, in most cases, be cause for celebration. But in the Cloud Wars, it’s never been about business as usual — and companies in the Cloud Wars Top 10 are subject to comparison with each other. And despite being much larger than AWS, Microsoft Cloud managed to grow 22% last quarter and 21% this quarter.

- Don’t you know there’s a worldwide slowdown going on?? There’s no question that most businesses have clamped down on spending, and with the exception of Oracle, every company in the Cloud Wars Top 10 has seen its growth rates moderate. But none has tumbled nearly as far nor as fast as AWS — and Oracle’s cloud growth is accelerating!

- But all the research reports say AWS is still king of the cloud! Yes, many of them do, and those reports are either misleading, misguided, or just goofy. AWS is the infrastructure leader by far — but here in mid-2023, the cloud has evolved into much, much more than just infrastructure. And business customers today have huge appetites for cloud software, an area where AWS is not nearly as strong as its three software-company competitors. So while I won’t say the emperor has no clothes, I will say that Infrastructure AWS is still wearing 2016 styles in a wildly different 2023 environment.

Why Cloud Growth Is So Important…

Unless this is your first time engaging with Cloud Wars, you know that our perspective is that the enterprise cloud is the greatest growth market the world has ever known. And in these heady times when businesses in every industry and in every region of the world are surging into the cloud, it’s easy to say that there’s plenty of business for everybody.

To a degree, that’s true. But while there may be plenty of business, there cannot be plenty of leaders. And I believe AWS has already lost its leadership edge in the overall cloud market — some hard evidence for that belief is my analysis from seven weeks ago called Google Cloud Leapfrogs Amazon to Become #2 on Cloud Wars Top 10 — and is finding it extremely difficult to regain what had been its seemingly invincible momentum.

Look at this striking decline in AWS growth rates over the past 6 quarters, beginning with Q4 of 2021 and ending with Q1 of 2023: 40%, 37%, 33%, 27%, 20%, and 16%.

You can find some additional analysis of the AWS decline in “Can #4 Oracle Overtake #2 Amazon in Cloud Wars Top 10?“

…and Why Falling Behind Is So Dangerous

In the July 20 Cloud Wars Newsletter about why I believe AWS is on dangerous ground, I analyzed whether Amazon or AWS has given all of us any reason to believe it can reverse the growth tailspin in which it’s currently trapped. Here’s an excerpt from that piece:

Has AWS distinguished itself with some breakthrough GenAI solutions or tools? Or vision? Or customers?

Has AWS released a list of customers it has snatched from Oracle, which regularly boasts about the AWS customers moving over to Oracle Cloud?

Has AWS followed up on its compelling move into enterprise apps with the launch earlier this year of AWS Supply Chain? (For more on that, please see Inside AWS SaaS Launch: Meet the VP of AWS Supply Chain.)

And perhaps the most important question of all: have AWS or Amazon executives spoken publicly about changes they’re making to address the fact that the growth slowdown at AWS has been much more dramatic than that experienced by any other Cloud Wars Top 10 vendor?

In the absence of such evidence indicating that AWS is prepared to once again begin grabbing market share, the other challenge it faces is that its world-class competitors — Microsoft, Google, and Oracle — are all thriving, innovating, and expanding their cloud offerings in line with what customers want and need today and into the future.

Final Thought

In a fair world, this article would seem absurd because a company with $85 billion in annual revenue and a growth rate of 16%, and a terrific brand and fabulous global customers would be held up as a model to be emulated.

But the Cloud Wars aren’t always fair — because, just as the stakes and potential rewards are so high, so too are the expectations.

Relative to its competitors — both Microsoft, which is larger and more pervasive, and Google Cloud and Oracle, which are smaller and more innovative — AWS has lost enormous momentum in a brutally unforgiving market.

And when Amazon rolls out its Q2 numbers a week from today, I believe that the growth gap highlighted above will only continue to widen, as I’m predicting AWS growth will slip from the 16% it posted in Q1 to 14% in Q2.

So if you think that losing market share and market momentum is no big deal, then that type of result will be just fine for you.

But to the contestants in the Cloud Wars, such a result will show that more and more customers are taking dollars away from AWS and giving them to Microsoft and Google Cloud and Oracle.

Gain insight into the way Bob Evans builds and updates the Cloud Wars Top 10 ranking, as well as how C-suite executives use the list to inform strategic cloud purchase decisions. That’s available exclusively through the Acceleration Economy Cloud Wars Top 10 Course.