Ratcheting up the intensity on its 25,000 on-prem customers to convert to the cloud, SAP reported Q3 revenue of $3.82 billion with its S/4HANA Cloud ERP suite cracking $1 billion in quarterly revenue for the first time.

SAP is facing huge pressure from heavyweights Oracle and Workday for those 25,000 businesses that have not yet made the full move into the cloud, and a number of smaller players are also doing everything in their power to snatch some of those customers.

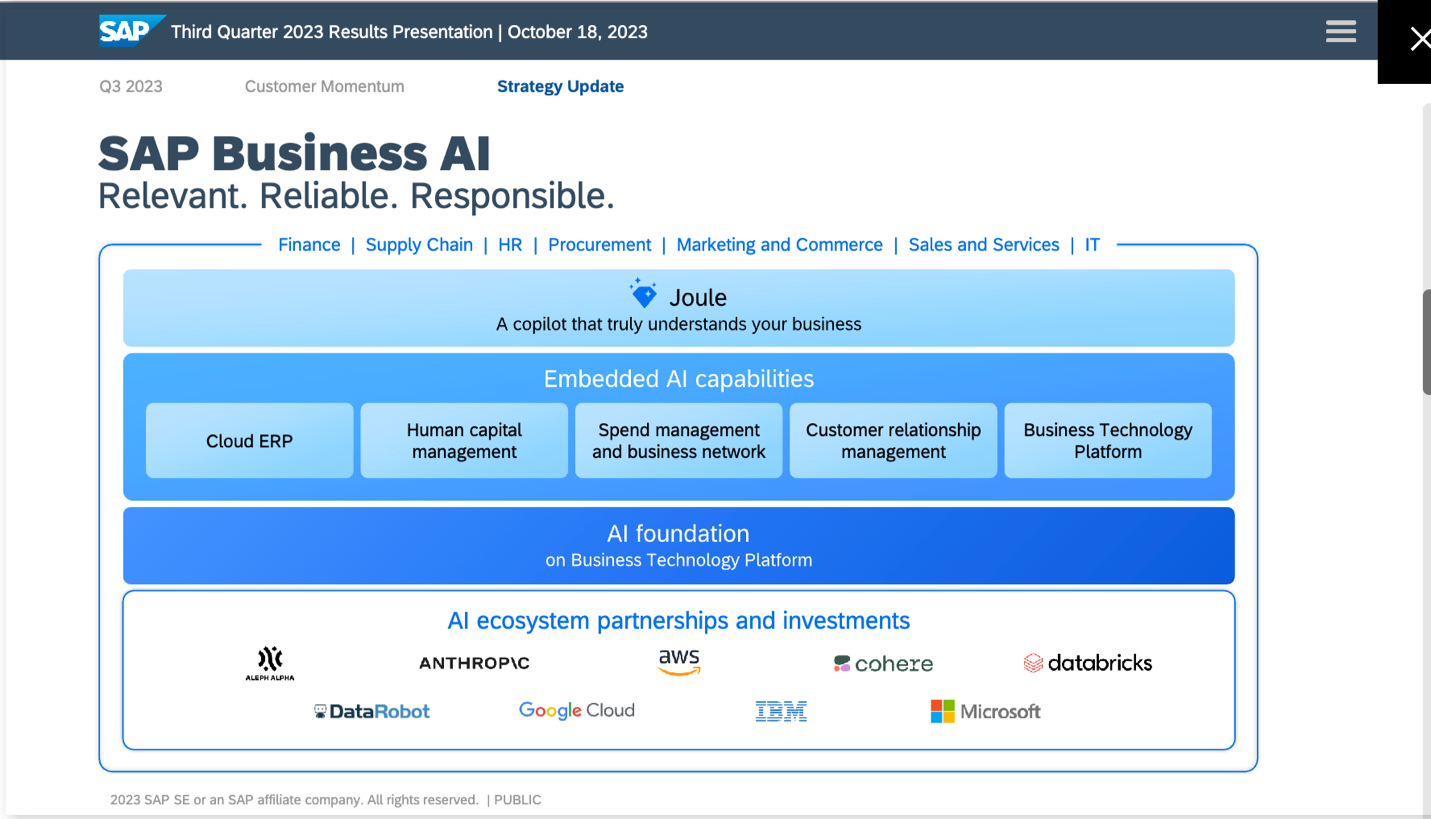

So the strong Q3 numbers indicate that SAP is continuing to convert that massive installed base while also rolling out a new set of what it calls SAP Business AI solutions and services to further entice those 25,000 on-prem organizations to stick with SAP. In a moment, I’ll share a graphic depicting how SAP presents its new artificial intelligence (AI) portfolio to the world.

But first, here’s a quick snapshot of the Q3 numbers that jumped out at me — and next week, I’ll have some additional analysis following SAP’s earnings call with analysts.

- total cloud revenue of $3.82 billion, up 23% in constant currency (I’m trying to stay humble, but did somebody out there predict exactly that result?? Here’s my projection from last week: “SAP Q3 Preview: Cloud Revenue Will Climb 23% to $4.45 Billion.”)

- current cloud backlog of $13.5 billion, up 25%: a powerful indicator that plenty of customers are committing to SAP for the future.

- S/4HANA Cloud revenue of $1.05 billion, up 77% in constant currency and topping $1 billion for the first time, and comprising more than a quarter of SAP’s total cloud revenue.

- S/4HANA Cloud current backlog of $4.62 billion, up a whopping 66% and offering another impressive indicator of long-term customer commitment to SAP’s cloud ERP solution.

- Platform-as-a-Service (PaaS) revenue of $614 million, up 46% as SAP’s Business Technology Platform continues its torrid growth rate and demonstrates that customers are looking at SAP and BTP as a strategic foundation for the future.

- RISE, which is SAP’s comprehensive go-to-market program for helping on-prem customers move to S/4HANA Cloud, now has more than 4,300 customers. As I explained in a recent Cloud Wars Minute video, RISE is the core component of SAP’s plans to help its 25,000 on-prem customers migrate to the cloud, which SAP sees as a $27.5-billion opportunity: “SAP’s $27.5B Vision: Expand RISE to Entice On-Prem Customers.”

- GROW, a parallel program aimed at first-time SAP customers, is now being used by more than 440 customers across 80 countries, showing that mid-sized and small organizations around the globe are signing up with SAP for the first time.

CEO Christian Klein is nearing the end of his fourth year as the sole CEO of SAP, and I believe Klein has the company well-positioned to convince those 25,000 on-prem customers to stick with SAP for their move not only into the cloud but also into the tumultuous world of AI-powered digital business.

The latest big move from Klein and his team is the rollout of an end-to-end set of AI solutions that includes but is not limited to generative artificial intelligence (GenAI) technology. As the chart below shows, the new SAP Business AI portfolio spans all of SAP’s solutions and is topped by its new Joule copilot.

Gain insight into the way Bob Evans builds and updates the Cloud Wars Top 10 ranking, as well as how C-suite executives use the list to inform strategic cloud purchase decisions. That’s available exclusively through the Acceleration Economy Cloud Wars Top 10 Course.