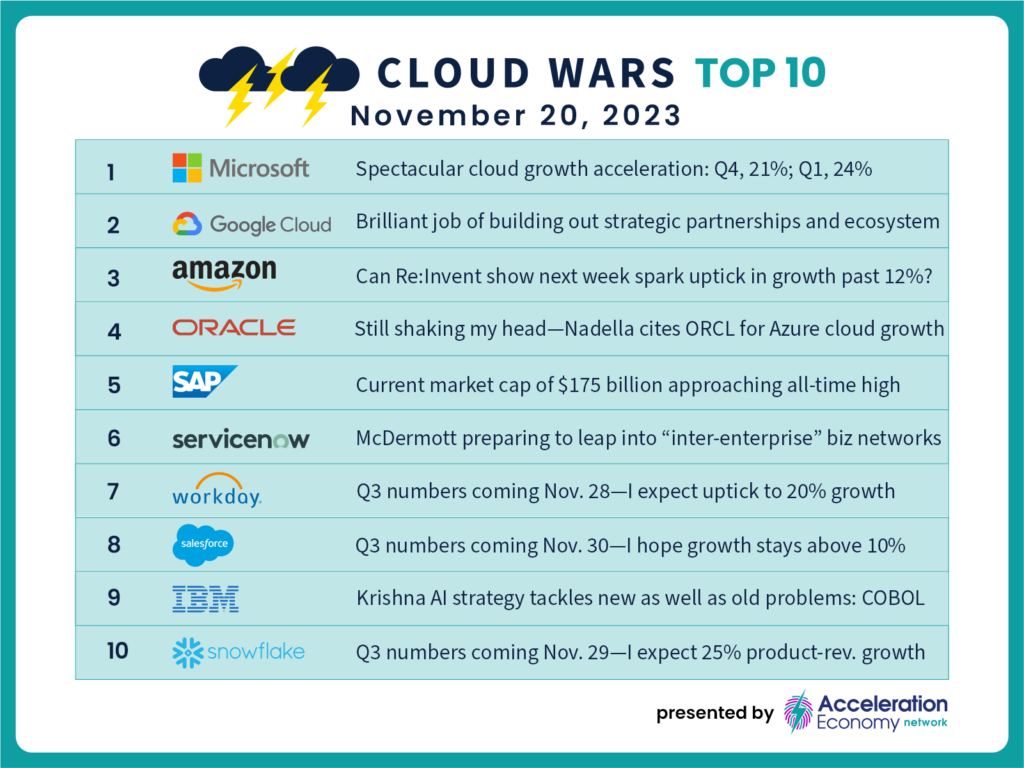

Riding the broad momentum of the generative artificial intelligence (GenAI) Revolution, Oracle, ServiceNow, and Microsoft top the Cloud Wars Top 10 list of the world’s hottest major cloud vendors through the end of calendar Q3.

And while the growth-rate metric I use unequivocally puts Oracle at #1 with 30%, ServiceNow #2 at 27%, and Microsoft #3 at 24%, I have to point out that Microsoft’s last quarter (its FY24 Q1) was in my estimation the greatest quarter any cloud vendor has ever had.

In saying that, I take nothing away from the most-recent accomplishments of Oracle and ServiceNow, each of which is pushing aggressively and successfully into new AI-centric areas to anticipate and meet the emerging needs of businesses and other large organizations in these fast-changing times. Both had excellent quarters and are poised for much more success in the future.

But Microsoft’s quarter was almost other-worldly:

- That 24% growth rate came on top of last year’s calendar-Q3 cloud-revenue base of $25.7 billion. Has any company of that scale ever grown at that rate?

- Relative to its fiscal-Q1 a year ago, Microsoft generated $6.1 billion in incremental cloud revenue for this year’s comparable quarter. That quarterly revenue increase — not the quarterly total, but just the quarterly increase — would make it the world’s fourth-largest cloud vendor.

- In Microsoft’s previous quarter — its fiscal Q4 — Microsoft’s cloud growth rate was 21%. That means that as some other Cloud Wars Top 10 companies are citing “optimization” trends among customers for declining growth rates, Microsoft’s cloud growth re-accelerated by an astonishing three points.

Oracle’s hypergrowth cloud-infrastructure business is fueling its extended stay at the top of the Cloud Wars Top 10 growth chart, complemented by its large cloud-applications business and its surging Industries unit. And while we’re discussing Oracle and Microsoft, I’d be remiss if I didn’t point to a couple of recent analyses I’ve done on the deepening partnership they’ve created under the very hands-on leadership of Microsoft CEO Satya Nadella and Oracle chairman Larry Ellison because these developments offer profound lessons for all leaders in all industries:

- WATCH: “Larry Ellison and Satya Nadella Turbocharge Generative AI Revolution“

- “The Larry and Satya Show: Microsoft, Oracle Rewire the Business World“

- “Larry Ellison Teased $1.5 Billion AI-Training Deal with Hyperscaler: Is It for Microsoft Bing?“

- WATCH: “Larry Ellison Predicted $1.5B AI-Training Deal with Hyperscaler: Is It Microsoft?“

ServiceNow capped off its strong Q3 results by boosting guidance for the year, marking another Cloud Wars Top 10 vendor that is refusing to participate in the slowdown affecting some others. You can get the full story on that in my analysis from last month headlined “ServiceNow Vaults to #2 Among World’s Hottest Cloud Vendors.”

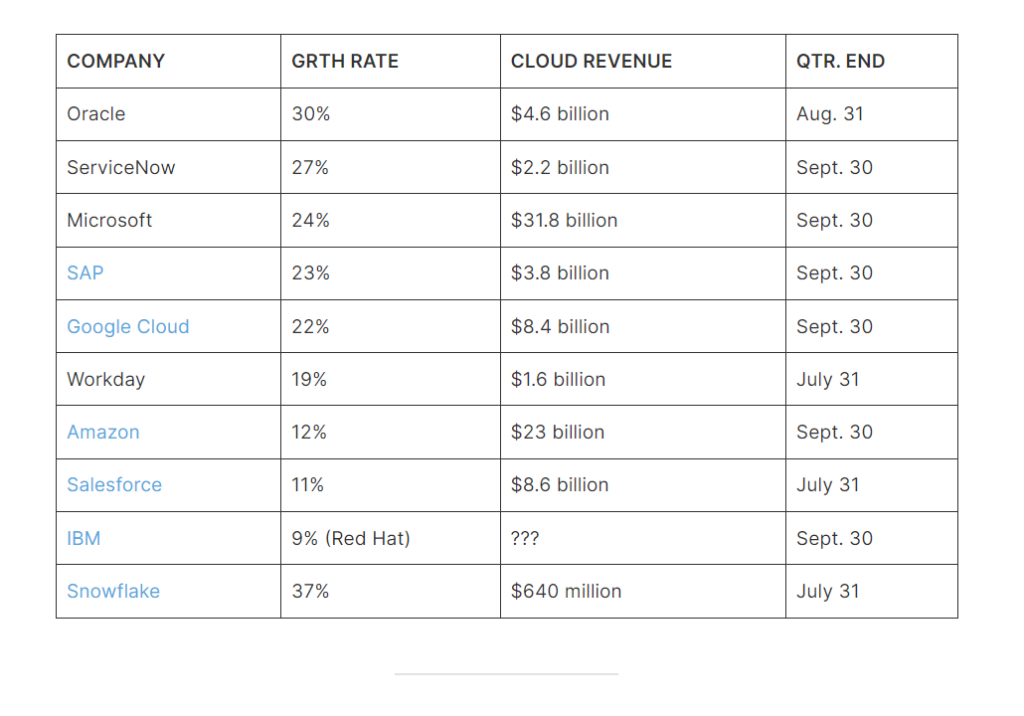

And here’s the complete and most-recent Cloud Wars Top 10 Growth Chart. Within the next 10 days, Workday, Salesforce, and Snowflake will all post fiscal-Q3 results, and Oracle’s fiscal-Q2 numbers will be released in early December. As those roll out, I’ll be sharing the update lists.

| COMPANY | GRTH RATE | CLOUD REVENUE | QTR. END |

| Oracle | 30% | $4.6 billion | Aug. 31 |

| ServiceNow | 27% | $2.2 billion | Sept. 30 |

| Microsoft | 24% | $31.8 billion | Sept. 30 |

| SAP | 23% | $3.8 billion | Sept. 30 |

| Google Cloud | 22% | $8.4 billion | Sept. 30 |

| Workday | 19% | $1.6 billion | July 31 |

| Amazon | 12% | $23 billion | Sept. 30 |

| Salesforce | 11% | $8.6 billion | July 31 |

| IBM | 9% (Red Hat) | ??? | Sept. 30 |

| Snowflake | 37% | $640 million | July 31 |