Despite its massive size and proud history — or perhaps because of them? — Amazon’s AWS cloud unit has become a slow-growth plodder relative to the surging performances and relentless customer-focused innovations of fellow hyperscalers Microsoft, Google, and Oracle.

Let me begin this analysis by openly acknowledging the size disparity among the four cloud powerhouses and clearly noting that AWS is more than 2.5X as big as Google Cloud and almost 5X the size of Oracle’s cloud business. Here are the most-recent quarterly figures for each company. For AWS, I’m using a projected figure because their actual Q4 numbers come out later today:

- Microsoft Cloud: $33.7 billion for quarter ended Dec. 31

- AWS: $24 billion projected for quarter ended Dec. 31 (based on 12% growth rate AWS reported by AWS for both Q2 and Q3)

- Google Cloud: $9.2 billion for the quarter ended Dec. 31

- Oracle: $4.8 billion for the quarter ended Nov. 30

A couple of thoughts on each of those performances:

Microsoft just posted a phenomenal quarter, with cloud revenue up a whopping 24% to $33.7 billion, which is 40% higher than the $24 billion I’m projecting for AWS for the same quarter. For Microsoft, that’s the second straight quarter of 24% growth on those enormous revenue figures. So not only is Microsoft Cloud 40% larger than AWS, it is also growing twice as fast as AWS!

Google Cloud had an excellent quarter as well, with growth accelerating to 25.7% for Q4 from the 22% it posted in Q3. So, while its revenue base is smaller, customers are rewarding Google Cloud’s innovation and customer-centric mindset with a growth rate that is more than 2X that of AWS.

Oracle had a very strong quarter ended Nov. 30, with cloud revenue up 25%. Unlike AWS, Oracle has a large and fast-growing cloud-apps business — including a highly strategic vertical portfolio across all major industries — and its cloud database business is just starting to take off. In the cloud-infrastructure business, Oracle has come from nowhere just a few years ago and is now winning billion-dollar cloud deals that in the recent past could very possibly have gone to AWS.

Ask Cloud Wars AI Agent about this analysis

‘Okay, but Still, AWS Is so Much Bigger!!’

In light of those relative revenue figures, how in the heck can I conclude that AWS is “falling farther behind” Google Cloud and Oracle, two competitors that as noted are much smaller than AWS? And whose cloud-infrastructure market shares are dwarfed by that of AWS?

The primary reason is that the cloud and AI industry is all about where the business world is headed and how it will get there, rather than where it has been and who paved the way to that past. And while AWS was, until a few years ago, an absolutely perfect example of the disruptive and competitively destructive newcomers at the core of Clayton Christensen’s classic “The Innovator’s Dilemma,” its performance over the past several quarters suggests that it has become or is becoming one of the stagnant disruptees rather than a chaos-inducing disruptor.

In the Cloud Wars, winners and losers are chosen by the free marketplace: the customers. In the early days of the Cloud Wars Top 10 — back in 2018 and 2019 — AWS was at the top of the heap because it was the undisputed category creator and leader in what was then all the rage for customers: cloud infrastructure.

But today, while cloud infrastructure is still vitally important to customers, they — quite understandably — want and need more: applications, AI services, databases, distributed cloud, cybersecurity, and more of the software stuff that drives differentiation and innovation and speed for those customers.

And I would argue that relative to Microsoft, Google, and Oracle, AWS — while still an excellent company and a major force in the marketplace — is simply not keeping pace. But hey, don’t take my word for it — let’s look at how customers have been voting with their wallets. Here are the cloud-revenue growth figures for each of the four hyperscalers for the past six quarters, starting in calendar Q3 of 2022 and concluding with calendar Q4 of 2023:

- Microsoft: 24%, 22%, 22%, 21%, 24%, 24%

- AWS: 27%, 20%, 16%, 12%, 12%, *12% projected*

- Google Cloud: 38%, 32%, 28%, 28%, 22%, 25.7%

- Oracle: 45%, 43%, 45%, 54%, 30%, 25% (big drop from 54% to 30% due to annual lapping of Cerner acquisition)

So while Microsoft and Google Cloud have maintained strong growth numbers throughout over that 18-month period and even accelerated in Q4, AWS’s has dropped like a stone. And on Amazon’s past couple of earnings calls, CEO Andy Jassy — the de facto founder and former CEO of AWS — has centered his comments about the outlook for AWS around “stabilizing” the growth-rate decline at 12%.

Final Thought

There are very few companies with a $100-billion run rate, and AWS is one of them. Of that small list, I suspect that very few are growing at 12% — so by from every perspective except one, AWS must be applauded for its record of achievement and growth. But — that one exception is a giant one: AWS plays in the Cloud Wars, where the traditional laws of financial physics don’t apply and customers are far less interested in what a supplier did in the past than in what it will do in the future.

So before making any changes at the top of the Cloud Wars Top 10 rankings — which now breaks out as #1 Microsoft, #2 Google Cloud, #3 AWS, #4 Oracle — I will wait to see what kind of Q4 growth AWS delivers and what kind of comments Jassy makes about its future.

Maybe AWS will show I’m a moron and deliver Q4 growth of 20% or 22% or 24%. Maybe it’ll squeak above its current 12% level to 13% — which would mean that its competitors are “only” growing almost 2X as fast.

And maybe AWS will report growth of 12% to $24 billion and confirm that while it is still huge and powerful and well-entrenched, it can simply no longer keep up with the new generation of hyperscalers building the foundation of the AI-powered digital economy: Microsoft, Google, and Oracle.

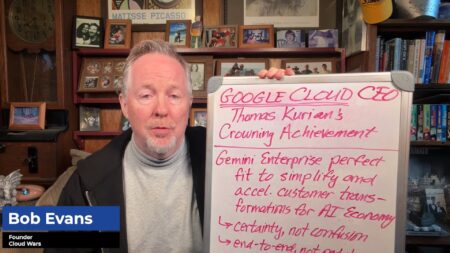

Register for Acceleration Economy’s Cloud Wars CEO Outlook 2024 Course, now available. Featuring exclusive interviews on strategy, AI, and customers with the CEOs of Cloud Wars Top 10 companies.