While 45-year-old Christian Klein is certainly not ready to be dubbed an “elder statesman,” his recent achievements and influence with not only high-flying SAP but also the continent of Europe reveal the far-ranging new role he’s undertaking that extends beyond the confines of his company.

Let’s first take a quick look at the extraordinary job Klein has done since taking on the sole CEO role at SAP just over five years ago, which just happened to coincide precisely with the onset of the global pandemic. And bear in mind that as Klein took on that role and and had to lead his first earnings call, the pandemic had disrupted SAP’s business so severely that the company could not, for one of the first times in its storied history, offer guidance on what its future would look like. But since that wildly challenging start, Klein has:

- totally transformed SAP’s technology strategy and business model in ways that have made it one of the enterprise-tech world’s fastest-growing and most-influential companies;

- positioned SAP beautifully to capitalize on the three hottest trends in the business-technology world: AI, cloud, and data;

- made SAP by far the world’s fastest-growing major enterprise-apps vendor;

- raised profit margins by using its own technology to showcase the productivity potential of AI, cloud, and data;

- earned recognition as Cloud Wars CEO of the Year for 2023;

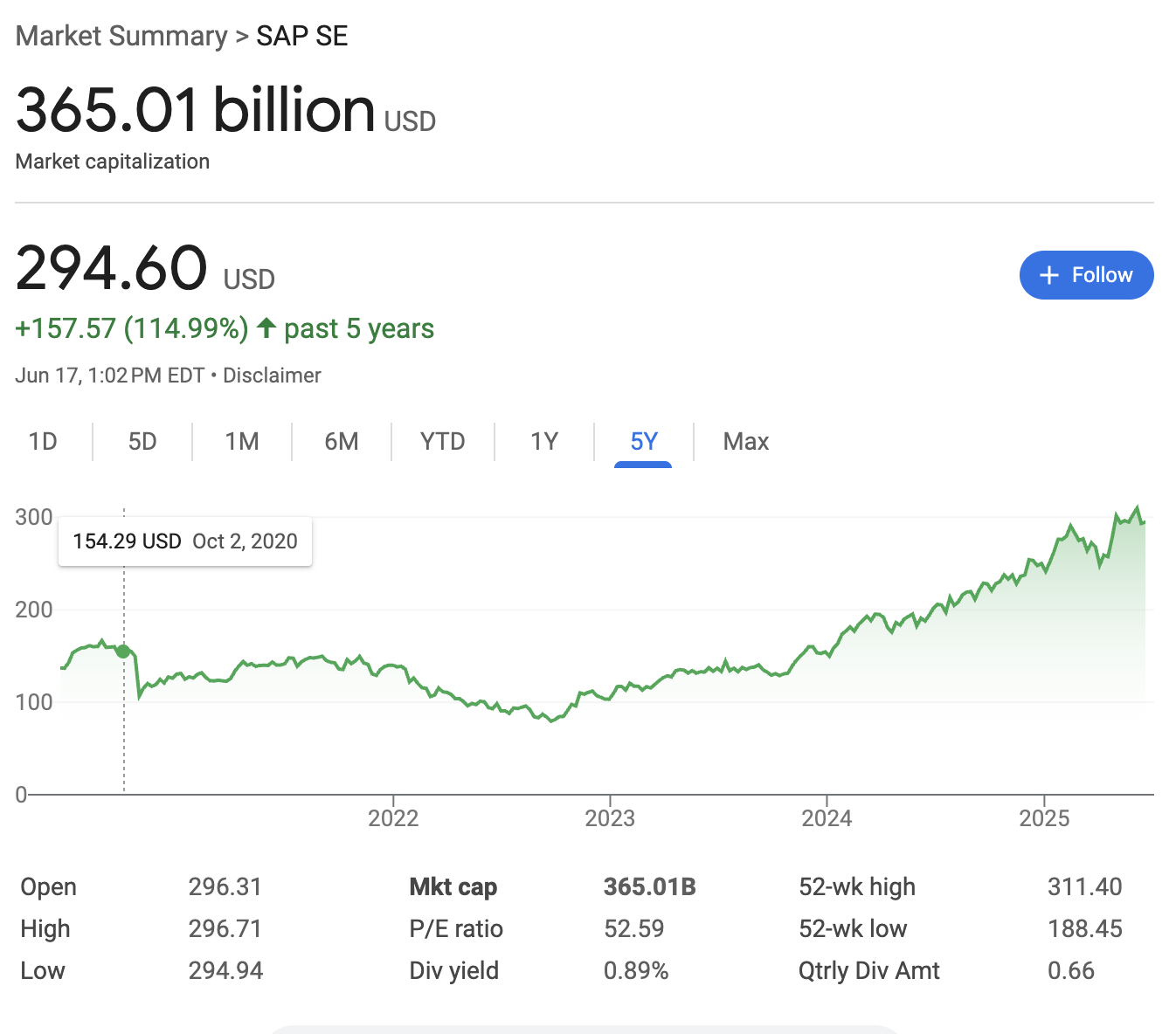

- driven SAP’s market cap to unprecedented heights, with that figure now at $365 billion; and

- made SAP the most-valuable company in Europe by a wide margin.

While all those achievements are fundamental to the new esteem in which both SAP and Klein are held by corporate CEOs and government leaders across the globe, that last point — about SAP’s ascendancy to the top of the list of Europe’s most-valuable companies — takes on particular significance in understanding the “new” Christian Klein.

Does Europe Need Its Own Hyperscalers?

For the past several years, European government leaders have become increasingly concerned about issues involving data privacy, data sovereignty, potential risks behind AI, and the cumulative impact those factors are having and will have on the competitive capabilities of European companies.

Some of those public-sector leaders as well as corporate CEOs believe there’s another significant risk factor to add that list: the absence of any Europe-based hyperscaler to provide the cloud and AI services that have become such a powerful force within the rapidly changing global economy.

So I was intrigued to see, in a recent article on theregister.com, that Klein had tackled head-on that “where are the European hyperscalers?” question while speaking at an investors conference. From that article:

“The only thing I would caution against in Europe is this: the competitiveness of Europe’s car industry or chemical industry will not be by building 20 different datacenters in France and try[ing] to compete against the US hyperscalers. It’s completely crazy, and that is sovereignty completely done in the wrong way. We need the best here in Europe to apply AI, to apply intelligent software to do be the best to produce much better, much faster, better cars, and be way more efficient running our supply chains,” he said.

Klein said there was huge pressure on energy prices in Europe, so building more data centers was not a good solution.

Don’t Fall for the Easy Solution

While it could have been easy for Klein to join the loud voices calling for Europe to build its own network of hyperscale data centers, it would also have been foolish. To come even close to matching the capabilities of the four U.S.-based hyperscalers — Microsoft, Google Cloud, AWS, and Oracle — European governments and corporations would have to pony up at least $100 billion and probably more like $150 billion.

And they’d have to spend that much not just one time but every single year for the next decade or so because for annual CapEx, AWS is spending about $100 billion, Microsoft $80 billion, Google Cloud $75 billion, and Oracle more than $25 billion. And they’re already up and running and have mastered the extraordinarily complex science of such initiatives, whereas the Europeans would have to start from scratch.

Plus, as if that wasn’t daunting enough, don’t forget the final sentence in the excerpt above: “Klein said there was huge pressure on energy prices in Europe, so building more data centers was not a good solution.”

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

Klein the Elder Statesman

Rather than pursue that course — one that I believe would have resulted in complete disaster for European governments, corporations, and ultimately taxpayers — Klein instead urged them to think more broadly and more strategically:

“The competitiveness of Europe’s car industry or chemical industry will not be by building 20 different datacenters in France and try[ing] to compete against the U.S. hyperscalers. It’s completely crazy, and that is sovereignty completely done in the wrong way.”

Rather, he advised, Europe needs to hold the feet of the U.S.-based hyperscalers to a very hot fire to ensure that they meet the demands and requirements of European businesses and regulators on data privacy, data security, data sovereignty, data residency, and more.

And that is exactly the right approach because the competition among those four hyperscalers to gain new customers and keep existing ones is as intense as any industry has ever seen. In this buyer’s market, Klein is saying, don’t waste time spending trillions of dollars trying to do something that others are already doing superbly — instead, leverage the output of those hyperscalers to re-imagine, optimize, and expand the markets where Europe is already so strong: automobiles, chemicals, and many more.

Final Thought

By refusing to dodge tough decisions, Christian Klein has earned this new level of respect and regard. Shortly after he took over as CEO, he announced to the world that SAP was changing its business model to subscriptions for the cloud, and overnight SAP’s stock price was battered. Since that day in late 2020, SAP’s market cap has tripled under Klein’s leadership.

I hope the European leaders will take Klein’s advice about not committing hundreds of billions and then trillions to try to recreate hyperscale capabilities that will, without question, be wildly different by the time such a copy-and-paste effort would be complete.

Whether they do or not though, the CEO of the most-valuable company in all of Europe has given them a very good chance to do the right thing.

Ask Cloud Wars AI Agent about this analysis