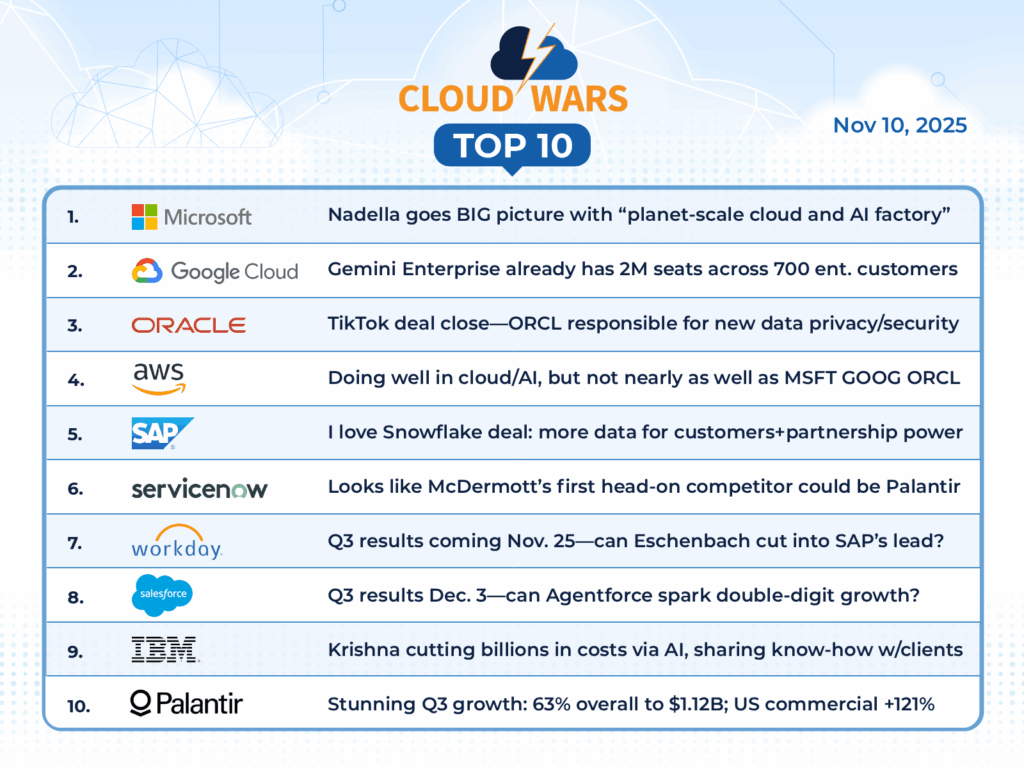

While much has been made of AWS’s reacceleration to 20% growth relative to Q2’s 17.5%, that impressive jump still pales in comparison to the heady growth rates of hyperscaler competitors Microsoft, Google, and Oracle.

These headlines were typical of how the AWS results were framed:

- “Amazon shares soar as AI boom fuels stellar growth in AWS cloud unit,” purred Reuters in its October 31 headline.

- “Amazon’s stock jumps as AWS cloud growth accelerates,” reported SiliconAngle.com.

Good for Amazon and AWS — it’s been a long time since the first digit in the quarterly growth rate for AWS was something other than a “1”. And in the broadest sense, to see a company with an annualized run rate of $132 billion post quarterly growth of 20% is impressive.

But, the problem for AWS is that it is operating in an industry that it created and for which it set the rules until the past few years when the brutal and inexorable appetites of The Innovator’s Dilemma began chomping hungrily on the one-time “king of the cloud.” And as I’ll demonstrate below, the numbers show that it’s fallen to the bottom of the hyperscaler heap in terms of appeal to customers here at the onset of the AI Revolution apply not only looking backward via quarterly revenue growth but also going forward, as measured by RPO/backlog figures for contracted business not yet recognized as revenue.

While AWS’s 20% Q3 growth rate looks great relative to what the company posted in previous quarters, and while that jump delighted a lot of investors, and while $33 billion in Q3 revenue shows that lots of customers are still fully committed to the AWS brand, the harsh reality is that AWS competitors Google Cloud and Oracle and Microsoft are sprinting into the AI Revolution while AWS is bumbling along in last place and is losing ground — lots of it — every single quarter to those speedy rivals.

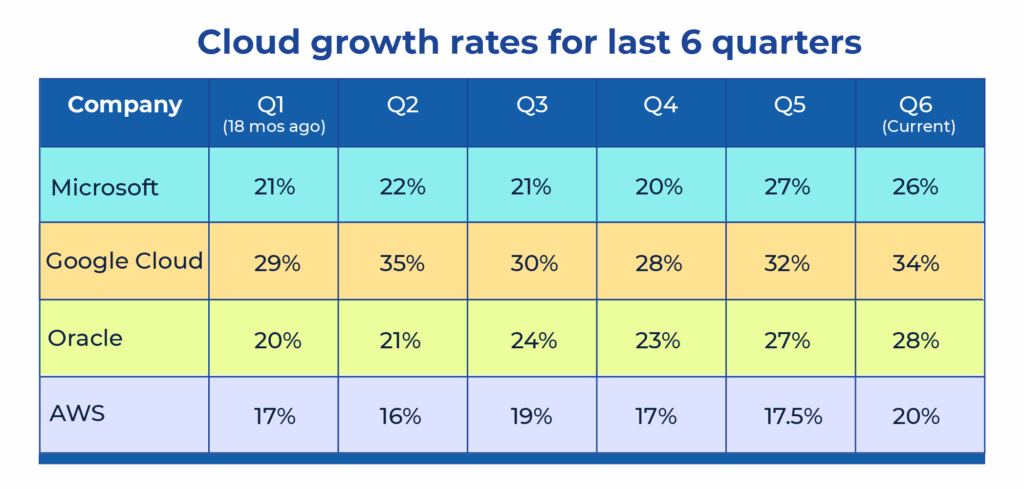

Look at the quarterly growth rates for the past six quarters for each of the four hyperscalers:

The story is not so much about Google Cloud and Oracle having higher growth rates than AWS because they’re both significantly smaller and thereby are more capable of cranking up big growth figures. That aside, the big issue is that while the others have all consistently been growing faster over that six-quarter stretch, AWS has bobbed up and down, making its Q3 acceleration look even better than it actually is.

On top of that, the whole overblown argument about how (supposedly) it’s no big deal that Google Cloud and Oracle are growing more rapidly than AWS because they’re smaller than AWS gets blown to smithereens when we contrast Microsoft’s cloud-revenue growth rates with those of AWS over that six-quarter span. After all, while Microsoft cloud revenue ($49.1 billion) is about 50% larger than that of AWS ($33 billion), Microsoft cloud revenue has consistently grown much more rapidly than AWS revenue in spite of that vast difference in size.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

Looking Ahead Tells a Similar Story

While quarterly revenue shows us what’s happened in the recent past, quarterly RPO or backlog numbers reveal the magnitude of future commitments across the four hyperscalers.

And once again, those forward-looking numbers for RPO and backlog show that AWS is the slowest-growing hyperscaler by far. Here’s a comparison that I first shared last week in AI Pipeline Shocker: Oracle and Google Cloud Blowing Past Microsoft, AWS“:

| RPO/Backlog | Sequential Growth (Q3 over Q2) | Year-over-Year Growth | Quarterly Cloud Revenue | |

|---|---|---|---|---|

| Oracle | $455B | 43% | 359% | $7.2B |

| Google Cloud | $155B | 46% | 82% | $15.2B |

| Microsoft | $392B | 6.5% | 51% | $49.1B |

| AWS | $200B | 2.5% | ??? | $33.0B |

Both Google Cloud and Oracle are exhibiting pipeline growth that dwarfs that of AWS, and that’s the case on both sequential and year-over-year comparisons. And in sheer dollar volume for that future business as measured by RPO or backlog, three points:

Oracle has amassed an enormous lead over AWS with the vast majority of that $455 billion coming in the form of cloud infrastructure, which is the very business that AWS pioneered in 2006 and dominated until the past few years.

AWS’s quarterly revenue of $33 billion is 117% larger than Google Cloud’s $15.2 billion, but the AWS backlog of $200 billion is only 29% larger than Google Cloud’s $155 billion. That shows that relative to their respective sizes, Google Cloud is winning a much larger percentage of future business than AWS is.

And finally there’s Microsoft’s enormous lead over AWS in RPO/backlog: $392 billion to $200 billion. So, whether measured against either (a) much-larger and faster-growing rival Microsoft or (b) smaller but much faster-growing rivals Google Cloud and Oracle, AWS is falling farther and farther behind the blazing paces being set by the other hyperscalers.

Final Thought

As I’ve said before, AWS could nominate itself for the role of Poster Child in the category of “Life Is Not Fair.” Because in any other industry on the face of the Earth, 20% growth and $33 billion in quarterly revenue would be seen as superb, unprecedented, unassailable.

But AWS isn’t in “any other industry” — it is, by dint of its own creation, a starring player in the Cloud Wars, which is the greatest growth market the world has ever known. And the comparative benchmarks that apply in other industries are utterly irrelevant in the Cloud Wars.

And, so we see that the once and former “king of the cloud” is now the plow horse attempting — and failing to keep pace with the thoroughbreds that are now racing into the remarkable future of the AI Revolution.