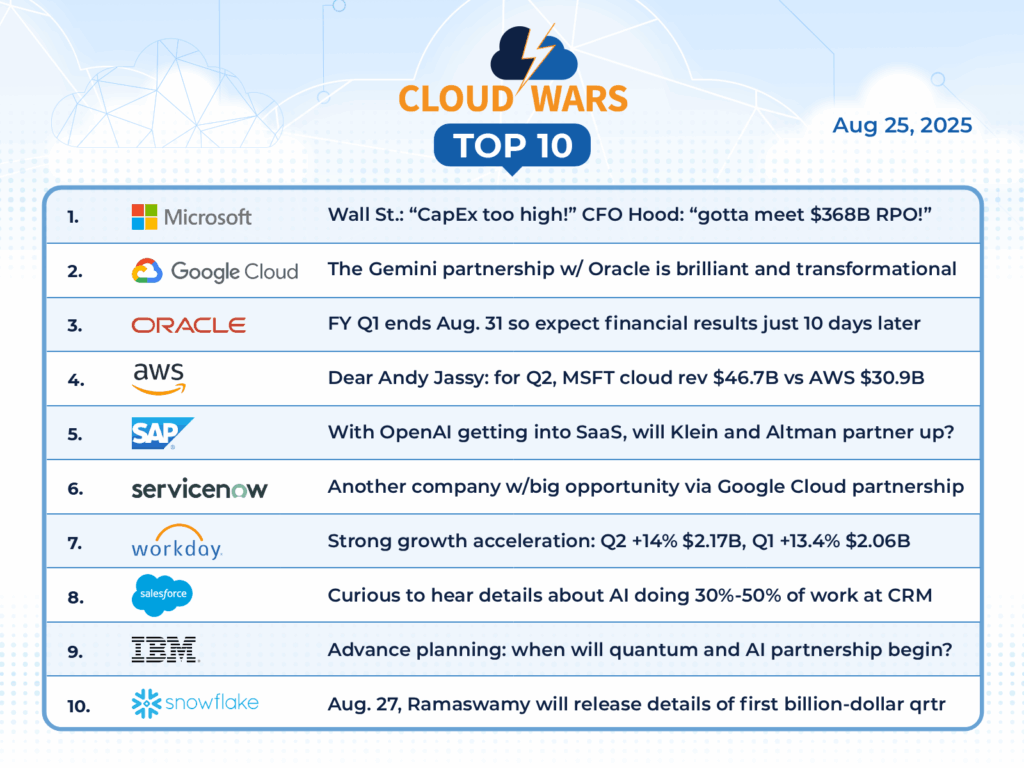

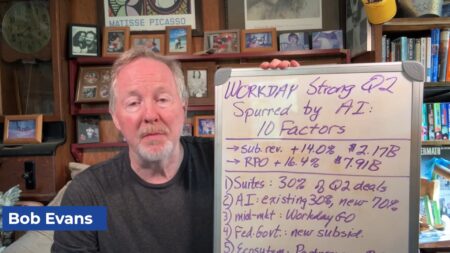

With 70% of core customers using its Illuminate AI solutions and 70% of net-new sales including AI solutions, Workday delivered accelerating Q2 growth of subscription revenue, up 14% to $2.17 billion, and current RPO, up 16.4% to $7.91 billion.

Before sharing 10 key reasons behind that strong performance, I’d like to share the perspectives of Workday CEO Carl Eschenbach on an AI-related issue that’s generated an enormous amount of discussion: Are the rapid advances in AI capabilities spelling the end of SaaS?

“I think this whole concern around AI disruption and the potential negative impact on seat-based models is completely overblown,” Eschenbach said last week during the Q&A portion of Workday’s fiscal-Q2 earnings call.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

“In fact, for Workday, we’re going to leverage our entrenched position in the market and our strong customer base and we’re going to be one of the go-to providers for AI solutions in the enterprise.

“In fact, for quite some time, even going back to early last year, we have talked about our headcount in our customer base was moderating,” Eschenbach said, “but on a net basis, again this quarter, our headcount growth in our customer base was up year over year.”

Eschenbach then rattled off some compelling stats to back up his contention about Workday’s unique position:

- 11,000 customers, including 65% of the Fortune 500;

- a gross retention rate in the “high 90s”;

- more than 70% of Workday customers have adopted its Illuminate AI solution;

- 30% of sales to existing customers included an AI SKU;

- more than 70% of net-new customers are buying an AI SKU; and

- Q2 revenue growth for net-new AI SKUs was up 100%.

“And this is why,” Eschenbach concluded, “we at Workday and in this case I personally believe this whole AI-disruption to seat-based models is a bit overblown at this point.”

With that context in mind, let’s look at 10 growth drivers I’ve extracted from Workday’s Q2 results and from Eschenbach’s comments during the Q2 earnings call.

1. Customers moving to full suites. In Q2, 30% of Workday deals included both Financials and HCM.

2. Customers embracing AI solutions. For existing customers, 30% of deals included at least one AI solution, while for net-new customers that figure soars to 70%.

3. Mid-market customers are coming aboard. Eschenbach has formed a new business unit called Workday Go for mid-sized and emerging enterprises, with purpose-built engagement models, pricing, and timetables aligned to the needs of companies in those categories rather than Workday’s traditional approach to large multinationals.

4. Federal government a big opportunity. Eschenbach has led the creation of a new subsidiary called Workday Government targeted at the sweeping transformations taking place across federal agencies under the new administration. “We are building a very specific cloud environment for them with higher levels of security that they are seeking from us,” he said.

5. Ecosystem spurring customer demand. Partners generated more than 20% of net-new ACV in Q2, matching similar performance in Q1.

6. Customers want to leverage their HCM and Financials data for AI. “Workday Illuminate is fueled by the largest and cleanest finance and HR dataset,” Eschenbach said. “With more than 75,000,000 users under contract and a trillion transactions processed last year alone, Workday has a deep understanding of how people work and how to make work better.”

7. Customers are tapping into innovation via Workday Marketplace. More than 100 apps created by Workday partners are now live on its Marketplace, up from 50 just six months ago. These third-party apps, built on the Workday Extend platform, address specific and vital customer requirements.

8. Strong customer demand in Germany and UK. Eschenbach said new leadership in Europe are winning major accounts even in territories that have traditionally been dominated by SAP.

9. Strong commitment to India. Eschenbach has hired a new president for India, Sunil Jose, who is building a significant team and ecosystem, and Workday is building a data center there to meet country-specific needs.

10. Steep demand for Contract Intelligence apps. A fairly recent acquisition, Evisort, is growing 100% from one quarter to the next, Eschenback said, emphasizing that’s not a year-over-year comparison.

Final Thought

Competing against much-larger apps vendors including SAP, Oracle, and Microsoft, Workday has to pair superb execution with lightning-fast innovation. These Q2 numbers indicate Eschenbach and Workday are up to that significant and ongoing challenge.