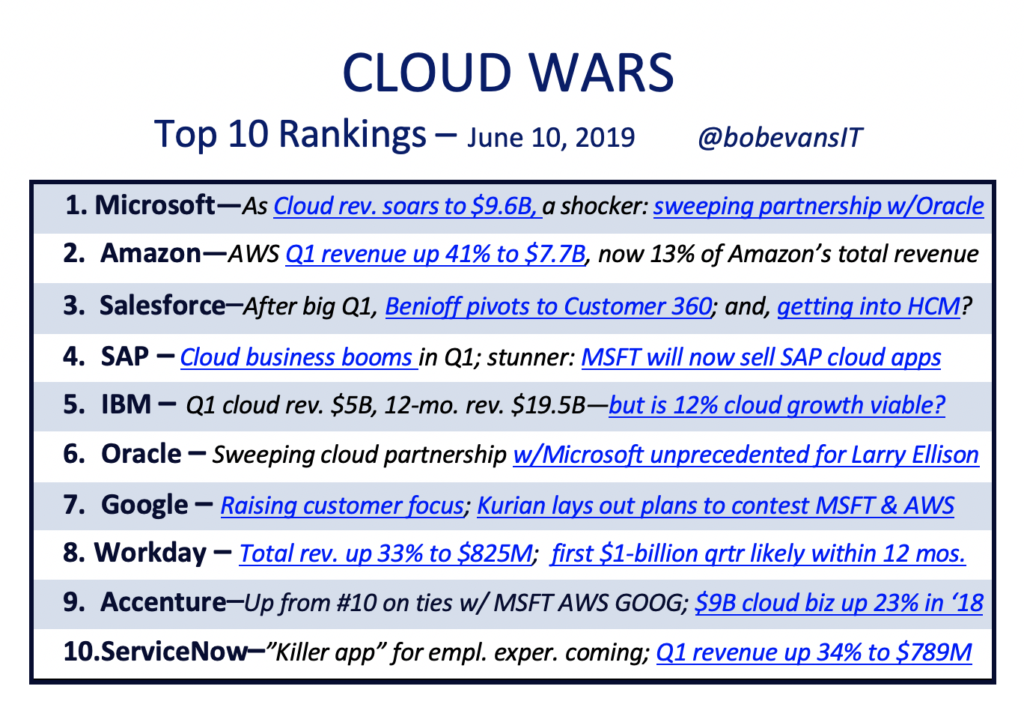

As the enterprise cloud becomes without question the foundation for digital business, how are the world’s top cloud-computing vendors stacking up? Let’s pass out some grades for the vendors making up the Cloud Wars Top 10.

#1 Microsoft.

Its Azure cloud continues to grow at breathtaking rates (for the 3 months ended March 31, Azure revenue was up 73%). It’s begun selling SAP’s cloud applications as Azure becomes the leading cloud platform for SAP workloads. And its commercial-cloud business retains hypergrowth status (revenue up 41%) even as it’s reached a $40-billion annualized run rate. Microsoft’s got the broadest range of cloud services in the market, its hybrid strategy is second to none, and its vertical-industry expertise is broader and deeper than ever before. On top of all that, last week’s announcement of Microsoft’s alliance with Oracle is completely brilliant and will be a huge benefit for customers. GRADE: A+ (And for more detail, check out Why Microsoft Is #1 in the Cloud: 10 Ways It’s Getting Bigger, Stronger, Better.)

#2 Amazon.

While AWS continues to rule the infrastructure side of the cloud—a category that AWS created, leads, and in which it’s pushing relentless innovation—the company has got its hands full as it tries to move more aggressively up the software stack into the database world. By the end of this year, says CEO Andy Jassy, parent Amazon will be completely off of the Oracle Database and running on AWS’s data-management tools. The company’s ability to make that momentous shift without a hitch will go a long way in determining if it can match Microsoft’s 40%-plus growth rates in the cloud and keep a stranglehold on the #2 spot in the Cloud Wars. For insight on some big customer wins, please see Amazon CFO Touts Big AWS Wins at Volkswagen, Ford and Lyft. GRADE: A

#3 Salesforce.

While you’ve gotta tip your hat to a $13-billion company that manages to maintain a growth rate of 25% or better, it’s fair to ask if Salesforce has been outflanked by SAP in positioning itself for the next wave of digital-business opportunity. While Salesforce is the unquestioned leader in CRM and related clouds, has SAP leapfrogged Marc Benioff by acquiring Qualtrics and redefining the competitive space by pushing Experience Management as the growth driver business executives care most about? Well, Salesforce came out swinging last week as Marc Benioff said the company was completely repositioning around its “Customer 360” initiative and product strategy. On top of that, Benioff was explicit in stating that “employee experience” will become a core part of Customer 360, marking Salesforce’s first foray into the employee rather than customer market. GRADE: A-

#4 SAP.

The Qualtrics deal comes as SAP has become the fastest-growing SaaS vendor in the Cloud Wars Top 10. Its cloud-revenue growth rate last quarter was 41%, and an even more-impressive 48% in constant currency. SAP’s not only claimed Experience Management as the big value driver for customers over the next few years, but has also tightened its strategic partnership with #1 Microsoft to offer businesses optimized plans for moving their huge and mission-critical SAP workloads to the Azure cloud (see SAP and Microsoft Revolutionize the Cloud Market). And while SAP’s cloud business is today only half the size of Salesforce’s, it’s growing faster and has the massive installed base of SAP’s on-premises customers to build upon. For a perspective from the top, please check out SAP and Qualtrics’ $1.6-Trillion Opportunity: Exclusive Talk with SAP CEO Bill McDermott. GRADE: A

#5 IBM.

Alone among the Cloud Wars Top 10, IBM has witnessed a leveling-off in its cloud business in spite of the booming demand among corporate customers. And like a student who shows great promise in the first half of the school year but gets a bit loss as the work become more demanding, IBM is struggling to keep up with its aggressive competitors. For Q1, IBM said its cloud revenue was up 7% in GAAP numbers, and up 12% in constant currency. The only thing that’s keeping IBM at #5 is the sheer volume of its cloud business: just under $20 billion for the past 12 months. But unless it can find a way to kickstart higher growth numbers, IBM will begin sliding down the ranks of the Cloud Wars Top 10. GRADE: C

#6 Oracle.

Ever the non-conformist, founder Larry Ellison is looking to rewrite the rules of the cloud business. How? By fusing major portions of the IaaS layer and PaaS layer by offering a breakthrough platform service—the Oracle Autonomous Database—with the requirement that it run on Oracle’s next-gen infrastructure. You want the cool new database? Then you’ve got to choose Oracle infrastructure over AWS, Microsoft and Google Cloud. Meanwhile, as the SaaS landscape shifts behind strong moves by other SaaS vendors, Oracle needs to show some of its own innovation to keep up. And the stunning cloud partnership with Microsoft could be a game-changer for Larry Ellison and company. GRADE: B

#7 Google Cloud.

Here we have the brainy kid who until very recently didn’t worry much about turning in homework on time, liked to skip class to hang out with the cool upperclass students, and was always cited for not living up to her/his potential: a classic underperformer. All that seems to be changing under new CEO Thomas Kurian and with 3 key achievements. First, the launch of the new Anthos hybrid platform. Second, the commitment to dramatically boost sales and go-to-market capabilities. And finally, the hiring of former SAP field-operations executive Rob Enslin. Plus, last week’s acquisition of Looker gives Google Cloud great new credibility in analytics and BI. For more detail, please check out Inside Google Cloud’s Strategy: Helping Customers Achieve the Unachievable. GRADE: B+

#8 Workday.

Earlier this week, Aneel Bhusri’s company posted revenue for its fiscal first quarter of $825 million, up 33.4% from a year earlier and demonstrating Workday’s ability to continue to compete and win against much-larger rivals Oracle and SAP. Workday’s beginning to describe its unique value, across both its Financial/ERP applications as well as its flagship HCM apps, in terms of “plan, execute, analyze.” Pairing relentless innovation with an equally relentless commitment to customer success, Workday’s on a $3.5-billion annualized run rate and has a market cap of $48 billion. In other words, it has the momentum and financial heft to continue competing against, and partnering with, the world’s biggest tech companies. GRADE: A

#9 ACCENTURE.

With annual cloud revenue of more than $10 billion, Accenture’s parlayed its close partnership with just about every vendor in the Cloud Wars Top 10 with its own cloud technology and services aimed at accelerating and simplifying businesses’ journey to the cloud. I think Accenture has great potential to rise in the Cloud Wars because of its unique positioning. The company is partner to almost all (certainly not IBM), industry expert, strategic visionary, and emergent tech powerhouse, proving there’s huge opportunity in the cloud beyond the IaaS that so many people mistakenly believe represents the whole market. GRADE: B+

#10 ServiceNow.

A company that a few of the biggest players in the Cloud Wars Top 10 would love to acquire, ServiceNow has quietly (but not too quietly) hit an annualized run rate of more than $3 billion with a market cap of almost $50 billion by carving out a unique space that doesn’t force it to bang heads constantly against much bigger players. Promising to “make work, work better,” ServiceNow bills itself as a provider of digital workflows that are becoming the central nervous systems of corporations in the digital economy. With new emphasis on the creation of great customer experiences and great employee experiences, ServiceNow has been a stellar though quiet performer. For more detail, please check out ServiceNow Set to Unveil ‘Killer App’ as Market Cap Surpasses $50 Billion. GRADE: A-

All in all, a pretty impressive report card. But given that the grades are for the world’s top cloud-computing companies, they’d darned well better be pretty good. Because businesses in every industry and in every region of the world are betting their futures on the ability of these cloud vendors to help them remake themselves as digital powerhouses that can move at the speed of their customers, innovate on the fly, and deliver world-class customer experiences.

Note: this analysis is adapted from Cloud Wars Newsletter #33, which hit inboxes on May 30. You can read that issue in full here—or, to subscribe to the Cloud Wars Newsletter (exclusive, free, and great!), click here.

Disclosure: At the time of this writing, Microsoft, SAP, IBM and Oracle were clients of Evans Strategic Communications LLC.