Return on Investment (ROI) is one critical business driver that companies must consider as they pursue AI initiatives and it’s one that isn’t always clearly defined as they plan use cases, initiate pilots, and determine where AI fits within their overall tech strategy.

New research from Google Cloud that focuses on the ROI of AI delves into ROI from the perspective of use cases, vertical industries, and business growth — all of these questions and much more. In this report, I’m going to highlight some of the most compelling findings in the Google Cloud research on these topics and more.

In the meantime, I urge readers to review the full report; it’s based on responses from nearly 3,500 senior business leaders.

Growth in Usage and Leading Use Cases

The data show what leaders know anecdotally: there’s a surge in use of AI technology including agents, as well as an expanding roster of horizontal and vertical use cases.

In fact, 39% of those responding to the survey say their organization has launched more than 10 AI agents. That’s not quite on par with predictions there will be a copilot for every user and an agent for every process, but it’s important to keep in mind that we’re still in the early days of this technology, and even having 10 agents in place reflects an aggressive rampup. A full 52% of organizations using GenAI currently have AI agents in production.

Now let’s look at use cases from horizontal business process and vertical industry perspectives.

Among current AI agent use cases that span vertical industries, there are four that I’d like to highlight; I view these as delivering some of the highest business value and, in some cases, they don’t get the same level of attention as, say, sales or human resources. They are:

- Customer service and experience, the most widely used agentic AI use case at 49% of respondents. This one is often discussed and it’s a huge opportunity for many companies, and the numbers bear out that organizations are sizing on that opportunity.

- Security ops and cybersecurity, near the top at 46%. Agents presents a wide range of opportunities to automate manual processes and create new levels of defensive scalability.

- Product innovation and design: 43%. This use case garners less attention from my perspective, but the percent of companies employing agents in this context is encouraging in that it represents a more advanced function that’s central to competitiveness and business success.

- Software development: 40%. This result isn’t surprising, given all the attention on software development. In fact, it validates the potential for agents to speed time to market for new software functionality.

In the following sections, I’ll share more detail and analysis on customer service and security use cases. Meantime, here’s the full ranking of top cross-industry AI agent use cases:

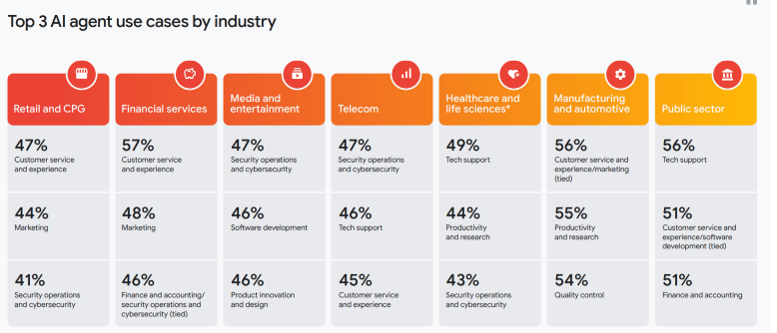

Shifting to a vertical industry perspective, the fields with the highest rates of adoption are telecom (56%), manufacturing and automotive (also 56%), public sector (somewhat surprisingly because that industry rarely operates at the leading edge, 55%), media and entertainment (54%), and financial services (53%).

Taking those findings a step further, the study provides excellent insight on the top agentic AI use cases within verticals. The full chart (below) is worth a look but I’ll note that:

- Security operations and cybersecurity top the list in telecom and media/entertainment

- Customer service is the top use case in financial services, manufacturing, and retail/CPG

- The public sector’s top use case is tech support

Key Use Case: Security

Cybersecurity — from threat detection to security ops — is a prime application of AI agents to remove repetitive work, sort through vast amounts of data to identify actual security threats, proactively combat hacking, increase operations scalability, and more.

In fact, we’ve analyzed many security initiatives, products, and services that aim to stop AI-powered attacks with AI. It’s clear that security teams need to equip themselves with the same underlying technology that’s making attackers more effective and efficient.

The Google Cloud research finds 49% of respondents report that AI has created meaningful impact on security posture, with 77% reporting improved ability to identify threats. While that second figure is impressive, it’s important to note that it’s actually down five percentage points from last year. A new finding (with no comparative data) is that 74% of leaders report improved intelligence and security response integration thanks to AI. Other findings that can be seen as positive but nonetheless show year-over-year declines:

- 61% of respondents report a reduction in time to resolution (-10% YoY)

- 53% report a reduction in number of security tickets (-12% YoY)

It’s critical that all business leaders work proactively with their security teams to understand how AI can protect and simultaneously enable their business from a security standpoint. These findings show there’s progress being made, albeit progress that’s uneven at times.

Key Use Case: Customer Experience

As noted above, customer experience is the most widely used horizontal use case for agentic AI, in use among 49% of respondents.

It’s not only the usage of AI to serve customers that’s impressive: 63% report improved customer experience, up from 60% in 2024. More than half — 51% — of leaders reporting improved customer experience say that improvement is between 6% and 10%. That’s a solid result — but it’s down from 53% in 2024.

A key vertical that is tapping AI for customer experience is retail/CPG, where 68% of leaders report AI has added value to customer experience (up sharply vs. 57% in 2024).

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

What’s the Payback?

The research finds that among those who are early AI adopters, 74% report ROI within the first year, and that figure is identical to when the survey was fielded one year ago.

One of the most clear-cut, and compelling, indicators of ROI comes when companies not only streamline operations or grow productivity, but actually grow revenue. In those scenarios, I suspect there’s a powerful combination of AI and human factors at work — not just AI replacing repetitive human work.

In 2025, 56% of respondents reported business growth due to AI — a finding that is positive on its surface, but important to note it compares with 63% in 2024. My take: we should not expect a straight line of progress with a technology moving as quickly as AI; instead, there will be forward progress and setbacks, especially as companies identify and drive tangible use cases, and as they develop more sophisticated ROI measurement approaches.

Drilling into the actual revenue increase amounts, 15% of companies reported annual revenue increases of 1% to 5% from AI initiatives, up slightly from 14% of companies in 2024. And more than half — 53% — said revenue grew between 6% and 10%, up slightly from 52% last year. Those reporting 10+% revenue gains were down to 31%, vs. 34% last year.

Look Ahead

This analysis closes with two findings that speak to steps companies can take to position themselves for AI success in 2026 and beyond: allocating resources to AI, and having top executives lead the AI charge.

The data show that for those companies deemed early adopters, 39% of their total IT spend is allocated to AI vs. 26% among respondents overall. In addition, 88% report ROI now on at least one AI use case, vs. 74% in other organizations.

For many organizations, it undoubtedly represents a leap to allocate nearly four of every 10 tech dollars to AI technology that is so early in its maturity cycle, but these figures and those presented above give insights that can help in driving AI outcomes.

From an organizational and business leadership perspective, among organizations with “comprehensive” C-suite sponsorship, 78% see ROI on AI, vs. 72% without that level of C-suite leadership. That finding raises an important question: which ROI camp would your company — and your C-suite — prefer to be in?

Ask Cloud Wars AI Agent about this analysis