(UPDATE: Dear readers: I’ve updated this article to reflect a new Q3 revenue projection for Google Cloud because in the original version, I used the wrong quarterly figure upon which to base my projection. I’m very sorry for the error.)

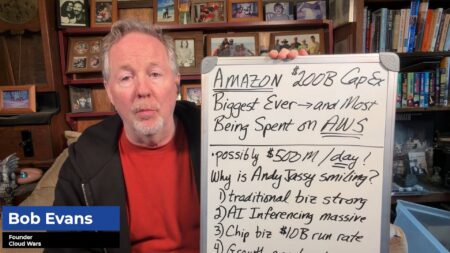

As the world’s top cloud-computing vendors ride the digital surge and help drive the digital revolution, I’m predicting the following Q3 cloud-revenue figures: Microsoft $20.5 billion, Amazon $15.3 billion, Google $5.2 billion, and IBM $7.3 billion.

On my weekly Cloud Wars Top 10 rankings, Microsoft is #1, Amazon is #2, Google is #3, and IBM is #9. (Revenue is only one of the factors that determine the rankings.)

A bit more detail on those estimates—they’re actually guesses, but people like me who make these guesses call them “estimates” to create the illusion of superior insight—including growth rates:

- Microsoft: year-ago Commercial Cloud revenue of $15.2 billion; I’m predicting +36% to $20.5 billion;

- Amazon: year-ago AWS revenue of $11.6 billion; I’m predicting +32% to $15.3 billion;

- Google: year-ago Google Cloud revenue of $3.44 billion; I’m predicting +52% to $5.2 billion; and

- IBM: year-ago IBM Cloud revenue of $6 billion; I’m predicting +22% to $7.3 billion.

SAP has already released preliminary Q3 results, with cloud revenue up 20% to $2.77 billion. Within that number, S/4HANA Cloud had a particularly strong quarter as we detailed in Mocked by Oracle, SAP Cloud ERP Revenue Jumps 46%; Backlog Up 60%.

ServiceNow will also be reporting Q3 results later this month. Bill McDermott’s company has been among the fastest-growing of all the Cloud Wars Top 10 companies and I expect them to report that Q3 cloud revenue has risen 36% to $1.5 billion from the year-ago $1.1 billion.

The other four companies in the Cloud Wars Top 10—Salesforce, Oracle, Workday, and Snowflake—do not report on the calendar quarters, and we’ll offer estimates of them as their earnings dates approach.

RECOMMENDED READING

Trillion-Dollar Cloud: McKinsey Raves about Cloud’s Massive Potential

Mocked by Oracle, SAP Cloud ERP Revenue Jumps 46%; Backlog Up 60%

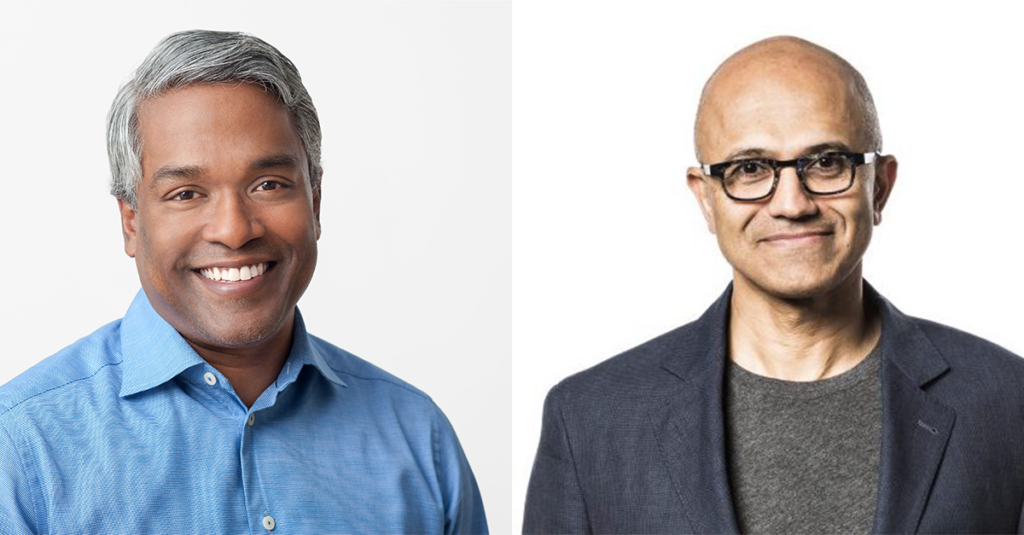

3 Ways Google Cloud CEO Kurian Differentiates from Microsoft, Amazon

How Oracle and SAP Could Put a Big Hurt on Salesforce

Market Cap Madness: Google, Salesforce, Microsoft, Oracle Soar in 2021

Will Google Cloud and Tesla Torpedo the Insurance Industry?

Oracle Calls Out Salesforce Yet Again—Can Larry Ellison Succeed This Time?

RECENT PODCAST EPISODES

Why Loyalty Is Badly Misunderstood | Anschuetz on Leadership

The Acceleration Economy Analyst Network | Courneya on Acceleration

Digital Twins, Data Pipelines and the Future | Ammirati on Innovation

Disclosure: at the time of this writing, Microsoft, Google Cloud, and SAP were among the many clients of Cloud Wars Media, Dynamic Communities, and/or Evans Strategic Communications LLC.

Subscribe to the Industry Cloud Newsletter, a free biweekly update on the booming demand from business leaders for industry-specific cloud applications.