Despite the massive economic toll being wrought by COVID-19, Microsoft’s strong Q1 cloud-revenue growth indicates that the 5 largest cloud vendors could defy the pandemic’s impact and generate cloud revenue of $150 billion in 2020.

This is admittedly a totally speculative endeavor, but I think it’s worthwhile given the vast uncertainty about what’s in store for the global economy in the months ahead.

While Microsoft delivered results that would be seen as impressive even in boom times, its enterprise-cloud revenue of $13.3 billion for the first quarter reflected 40% growth over the same period a year earlier (Microsoft’s fiscal Q3).

And while Azure revenue for that period soared 61% in constant currency, one remarkable detail in Microsoft’s quarterly results stood out most. “In the third quarter of fiscal year 2020, COVID-19 had minimal net impact on the total company revenue,” the company said in its earnings press release.

That “minimal net impact” is extremely likely to change in the current quarter, even though it’s Microsoft’s fiscal fourth quarter and traditionally its highest-revenue period for its fiscal year ending June 30. The economic devastation of the nationwide and global lockdowns will surely be felt in this quarter, even for a company of Microsoft’s strength and resilience.

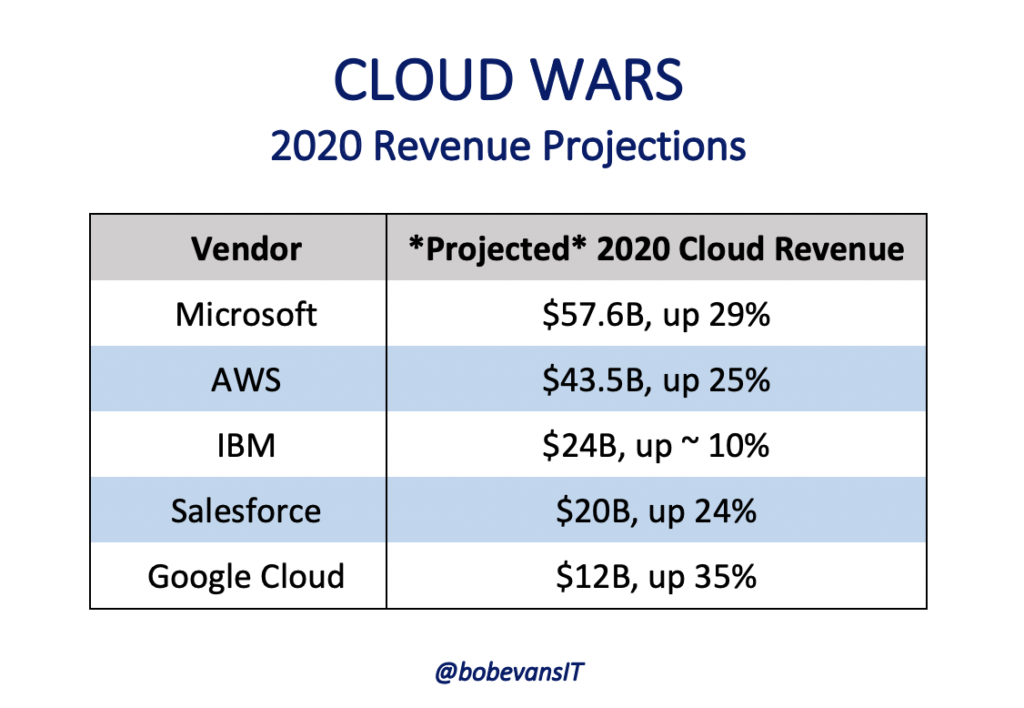

So, per the table at the top of this article, I’ve modeled calendar-2020 revenue projections for each of the five largest cloud vendors in the world. Those, in descending order, are Microsoft, AWS, IBM, Salesforce and Google Cloud.

The big dog is of course Microsoft, which has been #1 on my Cloud Wars Top 10 rankings for more than 2 years. And for this current quarter—which again is Microsoft’s fiscal Q4 and traditionally its strongest of the year—I’m going with an extremely bearish assumption and pegging its cloud-revenue growth at just 11.5%. That contrasts sharply with Microsoft’s cloud growth rates over the past 5 quarters, which have been (starting with the most recent) 40%, 41%, 39%, 42% and 43%.

So after its 40% cloud growth for the first quarter of this year, I’m going bearish and assuming that Microsoft and all of the other big 5 cloud-revenue players will post lower-than-normal growth rates for the rest of the year. I sure hope the actual numbers for every company are better. But this exercise gives us a look at some results that I believe have room for upside.

Microsoft

If Microsoft can post cloud-growth rates of 11.5% in the current quarter, 30% in calendar Q3, and 32% in calendar Q4, it will finish the year with cloud revenue of $57.6 billion. That would represent an increase of 29% over the $44.7 billion it generated in calendar 2019.

AWS

For calendar 2019, the Amazon cloud unit generated revenue of $35 billion. If it can grow its cloud revenue throughout 2020 at 25%—which is much lower than its usual range of 35% to 40%—it will finish the year with $43.5 billion in cloud revenue.

IBM

The numbers here are a bit harder to nail down because of the Red Hat acquisition. But I’m going to use a broad brush and say that if IBM is able to grow its cloud revenue for calendar 2020 at about 10%, it will finish the year with about $24 billion and perhaps closer to $25 billion in cloud revenue.

Salesforce

Marc Benioff’s company closes out the first quarter of its fiscal 2021 today. It will be fascinating to see what type of impact the economic slowdown has had—or hasn’t had—on the world’s largest SaaS vendor. My guess is that Benioff will find a way to keep his company on or close to its original projections, which would mean that it will finish calendar 2020 with revenue of about $20 billion, up about 20% from 2019.

Google Cloud

Currently the fastest-growing of this group, Thomas Kurian’s company earlier this week posted Q1 revenue of $2.8 billion, up 52%. That followed growth for calendar 2019 of 53% to $8.9 billion. If Google Cloud can manage 35% growth for 2020, its revenue for the year will be $12 billion—and that projected growth rate would be the largest among these 5 largest cloud vendors.

The cloud revenue grand total

So if we add up those projected numbers, the total is $157 billion in calendar-2020 cloud revenue for the world’s 5 largest cloud vendors. We’re clearly seeing increased sentiment for the cloud in the wake of COVID-19 and its related impacts:

the WFH Revolution that’s going to continue way beyond when the virus is fully contained;

the need for greater business resiliency and adaptability;

the desire to move away from or get out of the sunk-cost model of data centers;

the ability to deliver the new types of collaboration software that have become the norms;

the ability to deliver virtual shopping and other types of experiences to consumers; and

the desire to enhance cybersecurity in a world that’s changing not just rapidly but in profound ways.

As I’ve said a couple of times, all of my projections above are guesses. As a guy said recently on TV, “All models are wrong—the difference is, some can be useful.”

I hope you find mine to be at least thought-provoking and perhaps even useful as well.

RECOMMENDED READING

Google Outpaces Microsoft, Amazon in Cloud-Revenue Growth at 52%

How IBM’s New CEO Plans to Beat Microsoft, Amazon & Google in Cloud

SAP, Oracle and Salesforce Agree on One Thing: co-CEO Model Is Dead

Microsoft Will Stomp Amazon in Cloud Revenue, but Media Will Insist Amazon #1 in Cloud

Marc Benioff: The Extraordinary Ascendancy of a Global Leader

Zoom Picks Oracle for Cloud Infrastructure; Larry Ellison’s First YouTube Video

As SAP CEO Flies Solo, 10 Insights into Christian Klein and SAP’s Future

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive and it’s great!