While I couldn’t keep up with how many times Marc Benioff said “incredible” on Salesforce’s Q3 earnings call last week, the inescapable reality is that all of the other enterprise-apps vendors in the Cloud Wars Top 10 are blowing Salesforce away in terms of revenue growth.

Why is that?

- Is it because Salesforce’s CRM category is shrinking?

- Is it because Salesforce’s CRM category is less relevant to customers?

- Is it because, as Salesforce prepares to turn 25 years old on March 8, that it’s lost its entrepreneurial flair and energy?

- Is it because the other major apps providers — Microsoft, Oracle, SAP, and Workday — can address more of their customers’ most-pressing needs as those businesses look for end-to-end solutions and visibility?

- Or is it because Benioff, one year ago, pivoted dramatically under intense pressure from major institutional investors to flip from high growth to high profits?

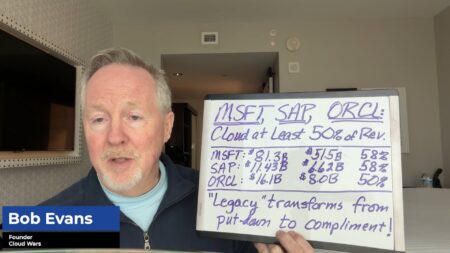

I’ll get to those questions in a minute, but first want to lay out the comparative numbers that are at the heart of this analysis. Here are the most-recent quarterly growth rates for the five enterprise-apps companies in the Cloud Wars Top 10:

- Microsoft Dynamics 365: 28%

- SAP: 23%

- Workday: 18%

- Oracle: 17% growth in cloud apps, 30% growth overall

- Salesforce: 11% (to $8.72 billion for the quarter ended Oct. 31)

Now, I want to be sure to recognize what Benioff and Salesforce have accomplished: With fiscal-Q3 revenue of $8.7 billion, Salesforce is clearly the largest enterprise-apps vendor in the world. SAP is a close second at $8.52 billion, but then there’s a big drop down to #3 Oracle at $3.1 billion, while Workday’s latest quarterly figure is $1.87 billion and Microsoft’s Dynamics 365 is probably in the range of $1.3 billion.

So there’s no question that Salesforce is the big dog in enterprise apps, and it’s clearly easier to grow at relatively high rates off smaller revenue bases.

But life in the Cloud Wars does not always conform to the laws of physics — it is, after all, the greatest growth market the world has ever known — and the Generative AI (GenAI) revolution is surely going to infuse this unmatched market with even more momentum.

So congrats to Benioff and Salesforce for that remarkable achievement.

But things change very quickly in this business, and that’s why I framed out those questions at the top of this piece. In an effort to better understand these market dynamics, I’d like to reprise those questions here along with my thoughts on each (those thoughts are in italics after each question).

- Is it because Salesforce’s CRM category is shrinking? Certainly not–and in the age of AI-powered digital business, customer experiences are even more vital than ever.

- Is it because Salesforce’s CRM category is less relevant to customers? Possibly–if, as competitors claim, it’s true that Salesforce is more oriented toward helping sales managers track the performance of their sales teams rather than driving superb customer experiences, then its relevance might be slipping.

- Is it because, as Salesforce prepares to turn 25 years old on March 8, that it’s lost its entrepreneurial flair and energy? There’s certainly something to this — Marc Benioff, while eternally young at heart, is closing in on 60, and the world looks very different to people who’ve reached that point in their lives than it does at 40 or 45 (trust me, I know this first-hand!).

- Is it because the other major apps providers — Microsoft, Oracle, SAP, and Workday — can address more of their customers’ most-pressing needs as those businesses look for end-to-end solutions and visibility? I think this is the biggest challenge to Salesforce — as vital as the CRM/CX category is, every CEO is looking for seamless end-to-end visibility and data harmonization across her/his company. And if those other apps vendors are able to deliver more meaningfully on that end-to-end vision, then they’re going to continue to get more share of wallet.

- Or is it because Benioff, one year ago, pivoted dramatically under intense pressure from major institutional investors to flip from high growth to high profits? Without question, this is what compelled Benioff — the quintessential high-growth champion — to drop that approach and pursue high margins above all else. There’s certainly a time and place for that — but it is, I believe, a precarious balancing act in the unique world of the Cloud Wars.

Final Thought

To me, the most striking change in this year-long transformation at Salesforce has been the reorientation of Marc Benioff’s expressions of love during earnings calls. Before the big switch, the focus of his outpourings of affection and gratitude was always, always, ALWAYS customers.

Now, it’s investors. And hey, for a publicly traded company with big and demanding institutional investors, there’s certainly nothing wrong with that.

But growth markets don’t behave the same way that stable markets do. And at some point, the unemotional reality of the math that shows that competitors are outgrowing you by 50% or 80% or 100% or more will have an impact that cannot be brushed aside.

Discover how AI has created a new ecosystem of partnerships with a fresh spirit of customer-centric cocreation and a renewed focus on reimagining what is possible. The Acceleration Economy AI Ecosystem Course is available on demand.