Welcome to the Cloud Wars Minute — your daily news and commentary show, hosted by Cloud Wars Founder Bob Evans. Each episode provides insights and perspectives around the “reimagination machine” that is the Cloud.

This episode is sponsored by Acceleration Economy’s Generative AI Digital Summit. View the event, which features practitioner and platform insights on how solutions such as ChatGPT will impact the future of work, customer experience, data strategy, cybersecurity, and more, by registering for your free on-demand pass.

In this Cloud Wars Minute, Bob Evans reviews Google Cloud’s Q1 earnings results. He reports that the company is now at a $30 billion annualized run rate.

Highlights

00:47 — Over the last three years, the number of deals of $250 million or more has gone up 300%. Admittedly, the number of deals of $250 million or more started off at a low number, given that the current, enterprise-ready version of Google Cloud is only four years old.

01:12 — Revenue was up by 28%, to a total revenue of $7.5 billion. In that same period, Google Cloud’s competitor Microsoft grew 22%.

01:45 — The other “big news that came out in Q1” was that Google Cloud turned a profit for the first time in Q1. A year ago, the company lost $706 million in the first quarter. In Q1 of this year, Google Cloud had a profit of $191 million.

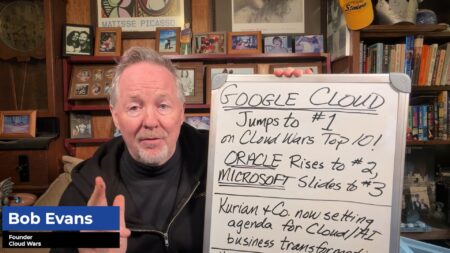

02:07 — Bob notes that these results are a culmination of everything that CEO Thomas Kurian has been leading over the last four years. He also notes that the company has been quite bullish on its latest product rollouts.

03:30 — The other thing Bob thinks is key to remember here is that Google Cloud, in its fully developed form, came into the cloud world only four years ago, and has managed to build a $30 billion run rate, taking that business away from the other hyperscalers, Microsoft and AWS.