Oracle this afternoon will report fiscal-Q3 cloud-infrastructure revenue growth of 51%, to $1.81 billion, according to my projections, as Oracle’s unique cloud technology continues to snatch big AI training as well as mainstream cloud clients from much larger hyperscalers Microsoft, Amazon, and Google Cloud.

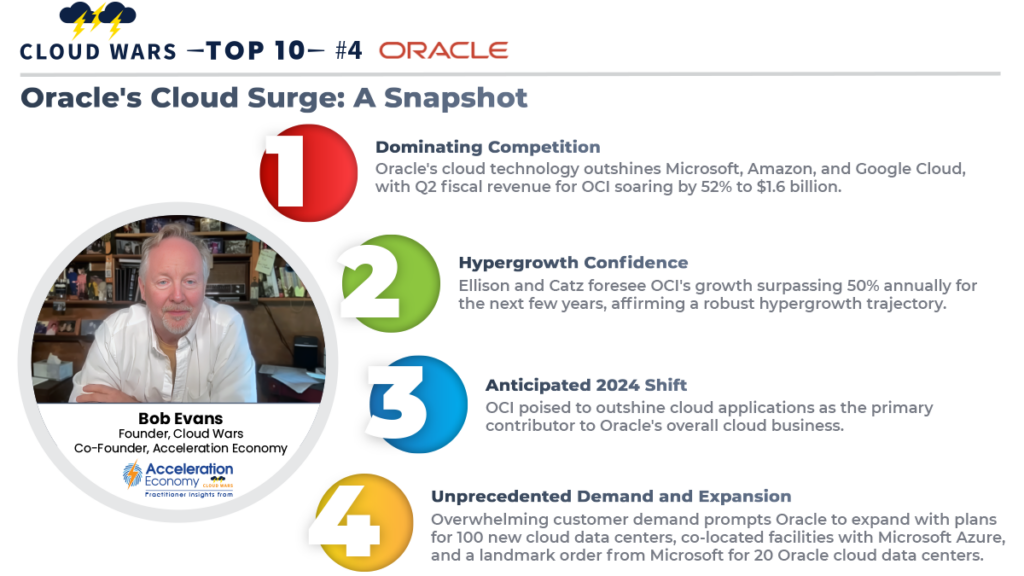

While Oracle’s cloud applications business is growing nicely and is currently twice the size of its Oracle Cloud Infrastructure (OCI) business, OCI has been on a tear over the past 18 months, with fiscal-Q2 revenue for the period ended Nov. 30 up 52% to $1.6 billion.

In Oracle’s Q2 earnings call three months ago, both chairman Larry Ellison and CEO Safra Catz were unconditionally bullish on the ongoing hypergrowth prospects for OCI, with Ellison saying he believes it can grow at or above 50% for each of the next few years.

In fact, I believe OCI this calendar year will overtake cloud applications as the bigger contributor to Oracle’s overall cloud business. For Q2, which Oracle reported in December, total cloud revenue was $4.8 billion, up 25%, with cloud apps generating $3.2 billion (+15%) of that total.

Here’s what I’m expecting when Oracle discloses its fiscal Q3 numbers later today:

- Total cloud revenue of $5.29 billion, up 29%;

- Cloud-applications revenue of $3.48 billion, up 20%; and

- Cloud-infrastructure revenue of $1.81 billion, up 51%.

A key factor behind my bullish outlook for Oracle Cloud — particularly on the infrastructure side — are the comments made during the Q3 earnings call by Ellison and Catz about customer demand outstripping Oracle’s ability to deliver adequate supply. And while clearly that’s a problem, I think we can all agree it’s a good problem — provided Oracle can crank up capacity incredibly fast.

That’s essential because, as Catz said on that Dec. 11 earnings call, customer demand for cloud infrastructure and GenAI services are “increasing at an astronomical rate.” Keeping with that otherworldly metaphor, Ellison said customer demand for OCI is “over the moon” as he offered some key details that I highlighted the day after those earnings were released:

- building 100 new cloud data centers;

- expanding 66 of its existing cloud data centers; and

- turning on 20 new Oracle cloud data centers that are co-located with Microsoft Azure facilities.

And perhaps the most telling revelation from Ellison was that final point about Microsoft putting in an order for 20 Oracle cloud data centers, which is an absolutely breathtaking development. Microsoft is far and away the world’s largest cloud vendor — but in spite of that, it placed a stupendous order with Oracle for unique cloud services and capabilities that Oracle and only Oracle could deliver. You can get the full details on that in my Dec. 18 analysis headlined “Larry Ellison’s Masterpiece: Microsoft Becomes Oracle’s Largest Customer.”