Google Cloud has alleged that Microsoft is charging European customers what amounts to a 5X premium if those businesses want to use Windows Server and other enterprise products on clouds other than Azure.

Now, this is one of those situations that can take you rapidly down some brain-rattling rabbit holes: lots of legal terms whose precise meaning is hard to discern; contractual obligations that verge on the inscrutable; and the Byzantine nature of European Commission regulations, policies, and interpretations.

On top of that, it’s certainly not lost on me that this complaint against Microsoft has been filed by a company (Google Cloud) that competes very directly against Microsoft — and whose interests are as non-objective as can be.

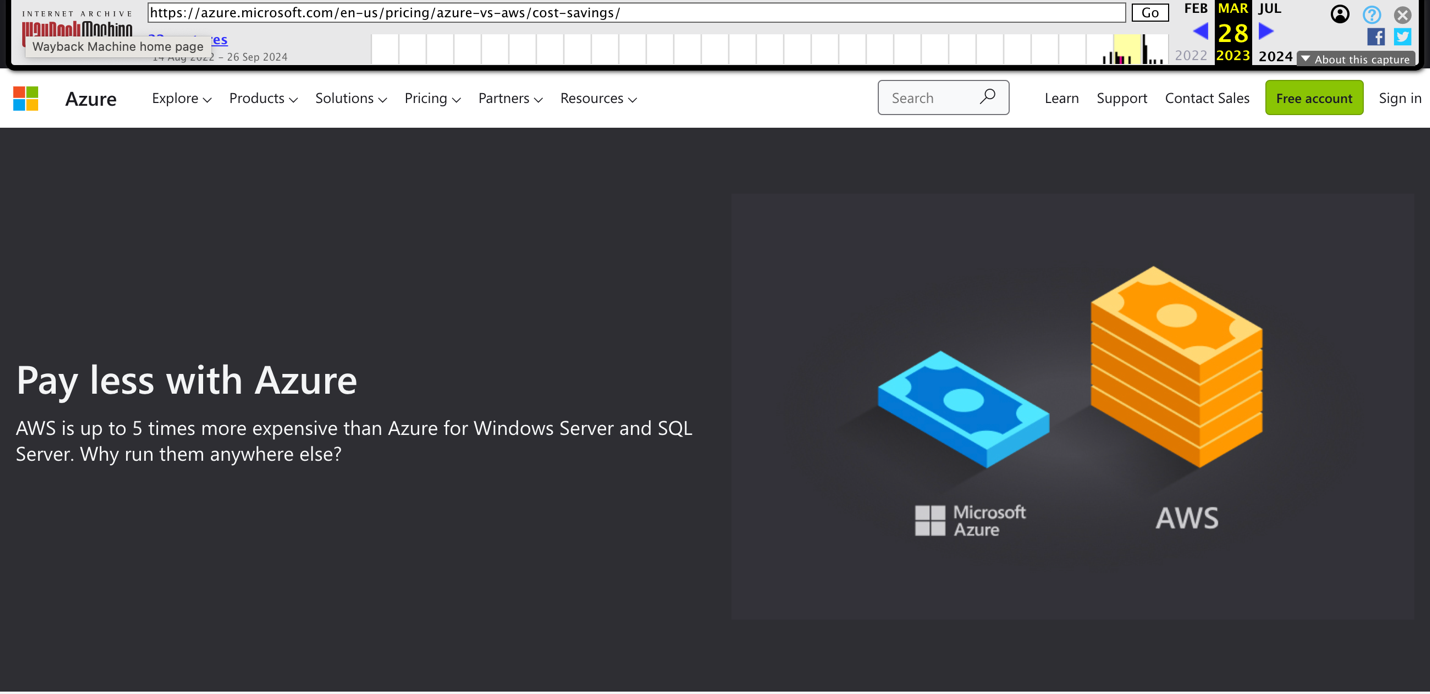

But let us, at least for the moment, set those details off to the side. Because beyond all the legalese and the contractese and the up-is-down logic the European Commission has been known to employ, what stood out most clearly to me about this contention from Google Cloud is that Microsoft itself — on its own web site — unequivocally states that while European customers are free to use its enteprise products on other clouds, the cost of doing so is 5X — or 400% higher —than what it be would be on Azure.

Late last month, Google Cloud published a blog post headlined “Google Cloud files complaint with European Commission regarding Microsoft’s anti-competitive licensing practices” and authored by Google Cloud VP/GM and head of platform Amit Zavery and EMEA president Tary Brady. Here’s an excerpt from that post:

Cloud-based computing is one of the most important developments in the European economy over the last decade. Moving to the cloud has reduced costs, delivered services with incredible reach, and laid the foundation for entirely new European companies. But legacy licensing practices that force customers onto a single vendor threaten Europe’s ability to take full advantage of this opportunity.

For years, in the productivity software space, Microsoft has locked customers into Teams, even when they preferred other providers. Now, the company is running the same playbook to push companies to Azure, its cloud platform. Microsoft’s licensing terms restrict European customers from moving their current Microsoft workloads to competitors’ clouds – despite there being no technical barriers to doing so – or impose what Microsoft admits is a striking 400% price markup.

I clicked on the link embedded within the last three words of that excerpt and was taken to a page on the Micrsoft website showing this graphic with text stating, “AWS is up to 5 times more expensive than Azure for Windows Server and SQL Server. Why run them anywhere else?”

Farther down on that same page, Microsoft makes this statement: “Other cloud service providers may claim to have similar savings to the Azure Hybrid Benefit, but you’ll need to repurchase your Windows Server license on those clouds. And only Azure offers free extended security updates for Windows server 2012/R2.” Google Cloud’s complaint centers on that “need to repurchase your Windows Server license on those clouds,” because Microsoft charges much higher fees for customers wanting to use a cloud other than Azure.

That discrepancy — which, as Microsoft itself says, can result in other clouds being “up to 5 times more expense than Azure for Windows Server and SQL Server” — lies at the heart of the Google Cloud complaint. From the Google Cloud blog post, here’s the excerpt in which authors Zavery and Brady offer their views on how and why that discrepancy is damaging to customers. And it specifically addresses a big policy and pricing change that they claim Microsoft did not have in the on-prem world but has initiated in the cloud era to make it more difficult and/or expensive for customers to use those products on other clouds:

“Windows Server is a must-have workhorse in many IT environments, serving as the backbone for applications, files, and services. And it has already added billions of dollars to Microsoft’s revenues. When businesses and governments originally paid for Windows Server licenses, they had the right to run them on any hardware they wished — and did so for many years on machines from HP, Dell, Lenovo, and others.

“However, as cloud computing took off and promised to bring new benefits to European businesses, customers wanted to move their previously purchased licenses to other cloud providers, and in some cases to multiple clouds, to provide additional resiliency and security. Initially, Microsoft allowed them to do this. But as Azure faced more competition, Microsoft introduced new rules that severely limited customer choice.

“One of the most significant restrictions occurred in 2019, when Microsoft adopted new licensing terms that imposed extreme financial penalties on businesses wanting to use Windows Server software on Azure’s closest competitors, such as Google Cloud and AWS. Microsoft’s own statements indicate that customers who want to move their workloads to these competitors would need to pay up to five times more. And for those who choose to keep running Windows Server on competitors’ cloud platforms (despite the cost difference), Microsoft introduced additional obstacles over the last few years, such as limiting security patches and creating other interoperability barriers.”

To buttress its claims that these Microsoft licensing practices have led to higher costs for European cloud customers, Google Cloud cites research from Professor Frédéric Jenny, a French economist and chairman of the OECD Competition Committee. Google Cloud points to a press release from a European trade group called CISPE.Cloud, which stands for Cloud Infrastructure Service Providers in Europe. That press release from June 2023, headlined “The Billion Euro Unfair Software Licence Tax on EU Customers” and highlighting Jenny’s work, says in part, “Professor Jenny’s Report: Unfair Software Licensing Practices: A quantification of the cost for cloud customers, reveals more than 20% surcharges on the price of software creating excess costs of one billion Euros for just one of the numerous Microsoft ‘must-have’ software.”

AI Copilot Summit NA is an AI-first event to define the opportunities, impact, and outcomes possible with Microsoft Copilot for mid-market & enterprise companies. Register now to attend AI Copilot Summit in San Diego, CA from March 17-19, 2025.

Final Thought

I generally avoid wading into matters involving litigation, policy disputes, and contractual wrangling because they often are at best peripheral to what’s going on in the real world and are instead a sideshow where much is said but little of consequence happens.

In this case, however, I have decided to highlight the Google Cloud complaint because it appears to be quite straightforward — although Microsoft has certainly disagreed with others who’ve expressed that opinion — and has direct and specific impact on customers, competition, and business innovation.

Three months ago, as this process was chugging along but well before Google Cloud filed the Sept. 25 complaint described in the Sept. 25 blog post, Microsoft filed a response to the European Commission “working papers” on “competitive landscape, committed spend agreements, and egress fees.” I attempted to work my way through it but gave up on page 4 when I read this subhead: “The missed starting point: there is no well-defined counterfactual or definition of what a well-functioning cloud market is if not the market that exists today.”

Sorry, but that strikes me as an absolutely perfect reason for the creation of the bromide, “Life’s too short.”

On the other hand: if that subhead makes your heart beat faster and strikes you as a line of thinking into which you’d love to delve, then I wish you all the best — just click here and zoom ahead to page 4. Bonne chance!!