Reinforcing its position as the world’s fastest-growing major cloud provider, Oracle defied any notion of restrained customer demand as Q2 cloud revenue soared 43% on robust growth across as all segments of its broad cloud business.

I find the Oracle ascendancy particularly meaningful for a few reasons that must be taken into consideration when evaluating what that rise means for not only Oracle but also for its customers, partners, suppliers, and its competitors:

- Vision matters. Oracle’s rocket ride to the top of the Cloud Wars Top 10 growth chart proves that, as I’ve noted before, the future is not written. Two years ago, no one outside of Oracle would have predicted that Catz and chairman Larry Ellison would hammer their way into the ranks of the other-worldly “Three Hyperscalers.” Yet, there they are.

- Innovation matters. How in the world did Oracle begin convincing what are now 22,000 customers to go with Oracle Cloud Infrastructure (OCI) — a relatively new and untested entrant — when those companies could have gone the safe route and picked from among three enormously successful incumbents: Amazon, Microsoft, and Google? There was little or no risk for those 22,000 customers to pick one of those three — yet they chose Oracle because of its innovative new cloud engineering. So size matters a lot, but perhaps innovation matters even more.

- Larry Ellison matters. Maybe lots of leaders could have strategized and executed this upheaval, and maybe lots of leaders would have looked at going directly against that deeply entrenched trillion-dollar trio and said, “We’ll be fine — all we have to do is beat them on innovation, engineering, and sales. No problem.” But I doubt it. Yet, that is exactly what Larry Ellison and Safra Catz did.

Oracle CEO Safra Catz — who yesterday was named Cloud Wars CEO of the Year — opened the Dec. 12 earnings call by putting the quarter into its appropriate stellar context:

“Simply put, we had an outstanding quarter. Total revenue [companywide, not just cloud] was more than $200 million above the high end of our guidance range and grew 25% in constant currency. Even excluding Cerner, total revenue grew 9% in constant currency. That’s higher than Q1 and on top of a revenue beat this time last year,” Catz said.

“The strength of the quarter is even more amazing given that the currency headwind was higher than what it was when I gave guidance with 6% for revenue and a 9.5 cents headwind for earnings per share, and yet we still exceeded the high end of my USD guidance for both total revenue and earnings per share.”

So first let me share some Oracle Q2 financial highlights, and then — with the assistance of CEO Catz — I’ll list the five reasons why Oracle’s the hottest major cloud provider in the world.

- Total cloud revenue including Cerner: $3.8 billion, up 43% (48% cc)

- Infrastructure: $1.1 billion, up 53% (59% cc)

- SaaS (Software-as-a-Service): $2.8 billion, up 40% (45% cc)

- Total cloud revenue excluding Cerner: $3.3 billion, up 27% cc

- SaaS: $2.2 billion, up 16%

- Cloud ERP (Enterprise Resource Management) and HCM (Human Capital Management): Annualized revenue of $5.9 billion, up 26% cc

- Fusion Cloud ERP: up 28%

- NetSuite ERP: up 29%

- Oracle Cloud Infrastructure: excluding legacy hosting services, up 69% in constant currency with annualized revenue of $3.8 billion

- OCI consumption revenue: up 88%

- Cloud@Customer consumption revenue: up 83%

- Autonomous Database: up 50%

- CapEx Spending: $2.4 billion in Q2 “as we continued to invest in our cloud to meet this accelerating demand with triple-digit IaaS [Infrastructure-as-a-Service] bookings growth the last couple of quarters,” Catz said. “We now expect to spend about this amount per quarter for the next few quarters as we build capacity for our customers’ needs.”

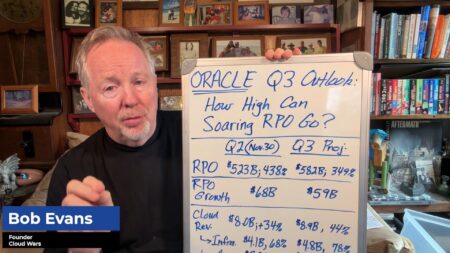

- Remaining Performance Obligation (RPO): current balance is $61.2 billion, up 68% in constant currency

- Guidance: Total revenue for Q3 including Cerner expected to grow 17% to 19% (21% to 23% cc)

- Total Q3 cloud growth including Cerner: guidance of 43% to 47% (46% to 50% cc)

- Fiscal-year total cloud growth *excluding* Cerner: “above 30% in constant currency,” Catz said

5 Reasons Behind Oracle’s Cloud Surge

As I mentioned above, I’m getting some help from Catz on this as she cited three specific reasons in her earnings-call remarks. Those make up the first three on my list below, and the final two are from me.

1. “First, more and more customers are recognizing our second-generation infrastructure cloud as being fundamentally better architected for higher performance, better security, and unmatched reliability versus the older first-generation hyperscale cloud providers,” Catz said.

2. “Second, customers appreciate the flexibility of our service and business model that enables them to deploy our technology where its serves them best, whether that be in the Public Cloud, in dedicated regions around the world, or in a true Cloud@Customer implementation,” Catz said.

3. “Third, customers recognize the value of an end-to-end integrated stack of

applications — both our horizontal apps like ERP and HCM and supply chain, and industry-specific applications that focus on their industries. All of it is on our Gen2 infrastructure which is designed perfectly for them as they move forward,” Catz said.

4. Autonomous Database continues to gain significant momentum and is in many ways the linchpin for customers intending to move significant workloads and infrastructure decisions to Oracle. Since Oracle is by far the leading enterprise database in the world, the accelerating momentum of its cloud-native Autonomous Database will have a massive pull-along effect.

5. “Hardware and software engineered to work together”: Larry Ellison’s line from the Sun acquisition 13 years ago was a bit ahead of its time but is paying off prodigiously now for Oracle as customers see significant benefit in performance and security for using the optimized combinations Oracle infrastructure, Autonomous Database, and SaaS (software as a service) apps, both horizontal and industry-specific.

Final Thought

Okay, Amazon and Microsoft and Google — there’s a new highly competitive hyperscaler in town and while it’s much smaller than your cloud businesses, it’s winning the hearts, minds, and wallets of many thousands of customers that might have, until recently, given that business to you.

Your move.

To see more Cloud Wars content, including all recorded sessions from June’s live Cloud Wars Expo, please register here for your Cloud Wars Expo on-demand pass. The on-demand pass, which is included with your Acceleration Economy subscription, gives you access to approximately 40 hours of invaluable educational content.