As Workday continues to compete successfully against much-larger rivals Oracle and SAP in the red-hot cloud ERP and HCM markets, Workday is using its nimbleness to complete customer deployments at what it says are far lower costs than those of its larger rivals.

For decades, enterprise-tech applications vendors have grudgingly had to admit that for every dollar business customers spend on their software, those customers have also had to spend some hefty multiple—usually tagged 3x and 5x—of that amount on integrating the new apps into the existing environment.

But Workday says its focused efforts on simplifying and accelerating those SaaS deployments for customers have led to results that it believes its far-bigger competitors simply can’t match.

If that turns out to be the case, and if Workday is able to fully operationalize that innovation across its business, it will create a powerful differentiator and competitive advantage that Oracle and SAP will have no choice but to match.

In that context, Workday’s cloud-native status is probably a major factor here because ever since the company was founded exactly 14 years ago this month, its very existence was predicated on its ability to be able to help customers weave its SaaS applications into their on-premises environments.

In essence, Workday has been dealing with this challenge for its entire life, and has had to make it an absolute top priority.

Describing Workday’s deployment approach during the company’s earnings call last week, CEO Aneel Bhusri said, “While there’s always room for improvement, we’ve taken down [the deployment cost] in medium-sized enterprises from $3 spent on integration for every $1 on software to closer to $1 to $1.

“And we think that’s pretty much best in class—and I think that’s why our win rates in the medium enterprise have gone up so significantly,” Bhusri said.

Earlier in the call, Bhusri again alluded to the deployment advantage he feels Workday has gained in this reply to an analyst’s question: “I think you’re accurate on us having a great quarter for medium enterprise—and while we had a great quarter across all parts of our business, medium enterprise in particular grew faster than large enterprise, just given the number of accounts out there.

“And I think it’s a testament to our lower-cost deployment model in that segment of the market really taking hold.”

*******************

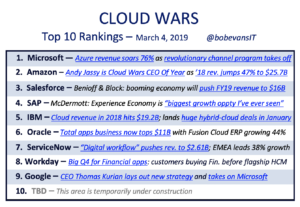

RECOMMENDED READING FROM CLOUD WARS:The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019*********************

While that method has been in place primarily in the US, Workday is starting to expand it around the world, said Chano Fernandez, co-president and EVP of global field operations.

“We’ve seen strong growth and as we’ve said in all of these calls, they usually are generally biased to the full platform, and it’s clearly a testament to the go-lives, the business value, and clearly the lower implementation costs we make possible,” Fernandez said on the call.

“So now we’re more focused on driving that same basic implementation method outside of the U.S. and applying it internationally as we go into FY ’20 and beyond.”

Here at Cloud Wars, we’ll check in with Oracle and SAP to offer their perspectives on their own deployment models and their views about the level of priority that business customers are placing on that element.

For now, it’s clearly a theme that Workday is taking to heart, and Bhusri put it into a broad context when he offered an overview of all of the things Workday must continue to do well in its new fiscal year, which began Feb. 1.

“As we look forward to fiscal year 2020 and beyond, we will continue our relentless focus on innovation and expect to see continued momentum from our growing family of applications. We’re confident in the pipeline we have built and the sales execution model we have in place. As such, we expect fiscal-year ’20 to be another strong year of growth.”

Disclosure: At the time of this writing, Oracle and SAP are clients of Evans Strategic Communications.

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!