As Amazon continues to stomp Oracle in the public-cloud infrastructure market and prepares to rip and replace the Oracle Database with its home-grown technology, Larry Ellison is attempting to audaciously redefine the cloud industry to play to Oracle’s dominant strengths instead of its Amazon-era weaknesses.

Ellison is planning to fuse the software-centric cloud segment where Oracle is potentially strongest—PaaS—with the hardware-centric cloud segment where Oracle is weakest—IaaS—in a bid to leapfrog Amazon as cloud computing continues to take hold as the dominant enterprise-technology model for digital business.

That PaaS/IaaS fusion is one that leading research firm Gartner says will soon take hold across the industry—and Ellison and Oracle are looking to jumpstart that move as a means to reframe the competitive landscape in the cloud. And we’ll get to that in a moment.

Today, Oracle is without question the dominant player in the corporate database market, with hundreds of thousands and perhaps even millions of Oracle Database instances running around the world.

So it would be perfectly logical for the companies running those on-premises databases to want to move many of them to the cloud via Oracle’s new and technically advanced Autonomous Database.

But to get the cloud-optimized Autonomous Database, those business customers will also have to sign on for Oracle’s fledgling cloud infrastructure services (IaaS) because the self-driving database only runs on Oracle hardware.

And that’s a scenario that has Oracle founder Ellison more than a little excited.

“As we pair our new Autonomous Database with our new Generation 2 Cloud Infrastructure, we expect to not only hold on to our 50% database market share—we expect to increase it,” said Ellison in his prepared remarks on Oracle’s recent earnings call.

“That means millions of databases will move to the Oracle Cloud.”

Ellison expanded on that theme during the Q&A portion of the call, emphasizing that the full power and business value of the Autonomous Database requires that it run on Oracle systems, either in a public or private cloud.

“Again, don’t believe me—read the Gartner report,” said Ellison, referring to the research firm’s recent ranking of Oracle Autonomous Database as the unquestioned leader. “The Oracle Autonomous Database has the biggest technology lead we’ve ever had in the database world, from a technology standpoint.

“The problem is, we have to deliver that Autonomous Database on first-class cloud infrastructure to be successful in the cloud business. We need more than just a great database—we already have the best database—but we also need first-class infrastructure to run that database on. And we now, finally, have that with our Generation 2 Cloud.

“And with the combination of the Oracle Autonomous Database and the Generation 2 Cloud, you’ll see rapid migration of Oracle from on-premises to the Oracle Public Cloud and to the [private-cloud] Oracle Cloud at Customer,” Ellison said.

“So as I said in my opening remarks, we think we’re not only going to hold on to our 50% share, we’re going to expand it.”

Ellison later said that “thousands” of customers are currently running trials with the Autonomous Database, and that while he expected them to be most impressed by the cost-savings it offers because it doesn’t require human labor to oversee it, business customers have been even more impressed by the productivity gains the self-driving technology delivers.

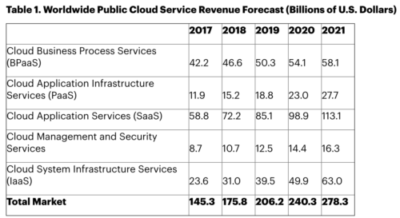

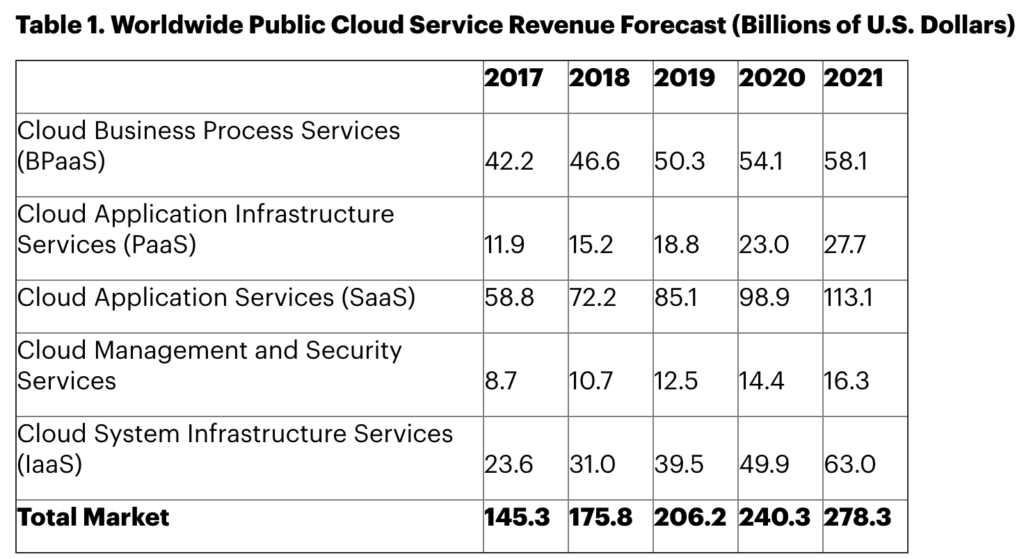

Oracle’s intention to interlace its PaaS and IaaS services more tightly reflects a major trend that research firm Gartner is projecting for the cloud industry. In a cloud-market forecast for 2019 released last year, Gartner offered the following perspective on the need for IaaS providers to offer sophisticated PaaS services as well:

By 2022, Gartner expects that 90 percent of organizations purchasing public cloud IaaS will do so from an integrated IaaS and platform as a service (PaaS) provider, and will use both the IaaS and PaaS capabilities from that provider.

“Demand for integrated IaaS and PaaS offerings is driving the next wave of cloud infrastructure adoption,” said Sid Nag, research director at Gartner. “We expect that IaaS-only cloud providers will continue to exist in the future, but only as niche players, as organizations will demand offerings with more breadth and depth for their hybrid environments. Already, strategic initiatives such as digital transformation projects resulting in the adoption of multicloud and hybrid cloud fuel the growth of the IaaS market.”

So: Ellison is looking to recast the competitive landscape in Oracle’s favor by turning its weakness in the cloud—IaaS—into a strength by blurring the lines between IaaS and PaaS, where Oracle’s database dominance gives the company huge potential.

To be sure, Amazon doesn’t see it playing out this way, and fully expects that its fast-growing capabilities in database will strengthen its overall PaaS offerings and allow it—not Oracle—to capitalize on the increasingly more intimate interplay within the Cloud Wars.

One sure winner in this competition will be the business customers who stand to benefit enormously from the wicked competition for their cloud business as not only Oracle and Amazon but also Microsoft, IBM SAP, Google Cloud and others continue to unleash new waves of business innovation via their dazzling new cloud services and capabilities.

Disclosure: At the time of this writing, Oracle is a client of Evans Strategic Communications Inc.

*******************

RECOMMENDED READING FROM CLOUD WARS:

The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019

*********************

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!