As we head into the home stretch of a year in which extraordinary personal disruption has led to digital-business hyperevolution, the 5 most-influential enterprise-cloud vendors will be the primary drivers of still more rapidly accelerating innovation.

So as we make the turn into Q4, here are a few thoughts on the 5 world-shaping tech vendors making up the top half of my Cloud Wars Top 10 rankings: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 Google Cloud, and #5 SAP.

#1 Microsoft

With $51 billion in enterprise-cloud revenue for its fiscal year ended June 30, Microsoft is far and way the largest cloud vendor in the world. Under Satya Nadella’s leadership, Microsoft has also forged more alliances with other major cloud providers than any of its peers. On top of that, Nadella has shifted the value proposition around the Azure cloud so that the company’s largest deals—some reportedly of $1 billion or more—are framed as “partnerships” with customers embarking on top-priority initiatives into AI, new business models, and more.

At the same time, however, Microsoft has to redouble its efforts to assure customers that Azure can handle the heaviest and most-demanding workloads for the world’s largest corporations, which would be put at great risk if Azure stumbles even momentarily.

#2 Amazon

It does what it does better than anyone in the world, and it’s been doing that since it created the IaaS category 15 years ago—by every measure, a phenomenal success. But as the other big players move more and more up the stack into rich platform services and even industry-specific applications, is Amazon going to be able to make similar moves? (For more on that, please see Look Out, Google Cloud and SAP: Microsoft Jumping into Red-Hot Industry Solutions.) Or will it choose to stay rooted in the core IaaS business where its capabilities are unmatched?

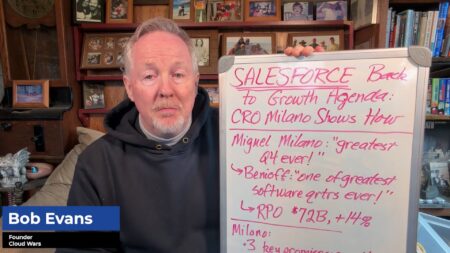

#3. Salesforce

As his company bears down prepares to crack the $20-billion mark this calendar year, Marc Benioff has his company innovating and executing at levels beyond anything Salesforce has achieved in its storied history. Benioff’s Customer 360 is becoming a standard—the standard?—against which all CRM value propositions are measured, and he’s pushed the company aggressively into the high-priority areas of data analytics and integration via the acquisitions of Tableau and MuleSoft. This is a company that right now is as hot and as—to use Benioff’s word—“relevant”—as any company in any industry in the world.

If Salesforce has a challenge, it is that other big SaaS vendors—principally SAP—are looking to boost the new category of CX over the traditional CRM in the hope that they can position CRM as the customer-facing approach of the past versus that of the more-dynamic CX future.

#4 Google Cloud

The fastest growing of the Top 10 cloud companies, Google Cloud is not only deepening and extending its traditional roots in IaaS and PaaS, but is also pushing into a highly strategic and high-potential category of industry-specific solutions. This—along with its Anthos multi-cloud platform—pushes Thomas Kurian into dynamic new areas and greatly enhances the value propositions it can offer to business customers in every industry.

Kurian’s biggest challenge right now is to keep the accelerator firmly jammed to the floor as he’s got his company brilliantly positioned for the surge to the cloud that’s only in its early stages.

#5 SAP

In the middle of October, SAP will unveil its new CX strategy and positioning, and CEO Christian Klein will no doubt use that occasion to position his company as the one and only enterprise-software company with end-to-end suites across both the internal-operations side with its world-renowned ERP solutions and the external-facing customer-experience side with CX. On top of that, SAP appears to be only months away from unifying all of its LOB apps under the HANA architecture, an achievement that will provide significant business value for customers. I expect we’ll also begin to hear much more from SAP about its Industry Cloud, which has the potential to deliver huge new levels of both operational and customer-centric value for businesses, plus significant revenue growth and ongoing industry leadership for SAP.

Final Thought

Later this month, each of these 5 except Salesforce will be releasing Q3 results, and I expect each will exceed market expectations as the pandemic has clearly proven to be an accelerant for business journeys into the cloud. The key for 2021 will be to not only maintain the momentum for what they’re currently offering and how they’re offering it, but also to innovate relentlessly and in close concert with business customers who must move more rapidly and decisively and precisely than ever before.

RECOMMENDED READING

Can Oracle Snatch Trillion-Dollar Hybrid Market from Microsoft and IBM?

Larry Ellison’s 3-Point Plan to Beat Amazon: Autonomous, Performance, Security

The Audacious Larry Ellison Flips Oracle Cloud Strategy Upside-Down

Market-Cap Madness: ServiceNow at $90 Billion Halfway to Oracle and SAP at $180 Billion

Salesforce’s Marc Benioff Dishes Tough Love to Passive CEOs: ‘Get Out of Paralysis!’

The Magic of Marc Benioff: 10 Key Drivers Behind Salesforce Q2 Surge

Best Software Acquisition of All Time Was Salesforce Buying Tableau: Marc Benioff

What Did Oracle, Salesforce and SAP All Scrap But Workday Just Revived?

Snowflake CEO: Cloud Is ‘Biggest Thing Ever in the World of Computing’

Disclosure: at the time of this writing, Google Cloud and SAP were among the many clients of Cloud Wars Media LLC and/or Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive and it’s great!