In a year crammed with bold moves into new categories, high-profile executive changes, extraordinary customer transformations, and energetic new approaches from “legacy” players, 2019’s biggest overall story of all is the enterprise cloud becoming the world’s leading platform for innovation, growth, and digital rebirth.

Across industries, geographies, and strategic imperatives, the cloud this year blew away any and all doubts about its global pre-eminence as the engine of vitality and opportunity for the digital economy.

So it was quite a challenge to sift through the 200+ analytical articles we posted this year to pick the 5% that made the biggest impacts across this boisterous and frothy industry.

And for the best of the Top 10, I chose one that centers on the company that might be not only the most-influential tech company in the world but perhaps the most-influential business of any kind: Microsoft.

In particular, an article of ours about Microsoft from mid-July stood out in my mind as the #1 story of the year because I felt it captured not only the breathtaking vision and ambition of this world-changing marketplace, but also a level detail and insight that demonstrates clearly how and why Microsoft has been #1 on the Cloud Wars Top 10 every week for the past 2 years.

Called Microsoft’s $50-Billion Moonshot: #1 Cloud Vendor Lays Out New Growth Plans, our top story of the year describes why I believe Microsoft will finish its current fiscal year (ending June 30, 2020) with cloud revenue of $50 billion.

For an industry still in its very early days, that’s a staggering number—and it’s also much larger (at least 25%) than AWS’s revenue will be for that period. In fact, it will likely exceed the combined cloud-revenue figures for Salesforce, SAP, Oracle and IBM. And just how exactly do Satya Nadella and his company intend to reach such heights? As befitting the #1 article of the year, all I can say is it’s quite a story.

The #2 story on our list of the top articles of the year is I Have Seen the Future of Enterprise Software, And It Is SAP Qualtrics. This one earned that lofty spot because it describes not only the massive changes within SAP since the acquisition, but also what I believe will be equally disruptive changes across the entire enterprise-software business.

Our #3 story is Google Cloud’s Thomas Kurian being named as the Cloud Wars CEO of the Year. It has been an extraordinary year for Kurian as he’s reinvigorated a high-profile company whose customer-facing capabilities lagged far behind its technological prowess.

For these and for each of our Top 10 Stories of the Year, we’ve also pulled together several related articles to give you additional perspective and insights on what shaped these tectonic moves in the market. Perhaps you’ll want to keep this meta-article as a guide to not just what happened in 2019, but where things are headed in the Cloud Wars.

Many thanks to all of you for your time, your readership, your comments, and your support throughout 2019, and I wish all of you a wonderful holiday season with your families and friends, and a fabulous 2020.

Now on with the Top 10 Cloud Wars Stories of 2019.

Cloud Wars

Top 10 Rankings — Dec. 23, 2019

| 1. Microsoft — Major IaaS deal w/#3 Salesforce follows Q1 cloud revenue of $11.6B |

| 2. Amazon —Usually the disruptor, Jassy disrupted by Salesforce-Microsoft deal |

| 3. Salesforce — Big Dreamforce dreams: How Benioff Plans To Defeat Oracle and SAP |

| 4. SAP — New co-CEOs unify priorities, push customer success |

| 5. Oracle — Ellison and SAP both claim #1 spot in enterprise apps—which will it be? |

| 6. Google — Thomas Kurian named CEO of the Year for driving customer-first culture |

| 7. IBM — Q3 cloud rev. up 14% to $5B; BofA says cloud has saved billions in IT costs |

| 8. Workday —Bhusri says Financials will become bigger than flagship HR business |

| 9. ServiceNow — Bill McDermott takes over as CEO as Q3 revenue reaches $900M |

| 10. Accenture — No longer breaking out cloud revenue but probably close to $10B |

1. Microsoft’s $50-Billion Moonshot: #1 Cloud Vendor Lays Out New Growth Plans

As described above, this piece—as well as the dozen or so Microsoft pieces below—offers some rich insight into how and why Microsoft’s become the world’s most-influential tech company.

Satya Nadella Admits: Microsoft Cloud Business Is Bigger than Amazon’s

Why #1 Microsoft Is Top Cloud Vendor: Cloud Now Drives 35% of Revenue

Microsoft-Oracle Shocker: Customers Win as #1 and #6 Vendors Pair Up

#1 Microsoft Puts Amazon and Google on Notice: We’re Just Getting Started

Why Microsoft Is #1 in the Cloud: 10 Ways It’s Getting Bigger, Stronger, Better

#1 Microsoft Cloud Revenue as Big as Salesforce, SAP, Oracle, IBM Combined

Microsoft Surge Continues with “Phenomenal Pipeline” of SAP Workloads Moving to Azure

Inside Microsoft’s Monster Q4: 10 Big Cloud Numbers

Microsoft Torches Google and Amazon on Big-Data Benchmarks, Says Microsoft

If #1 Microsoft Isn’t “Real” Cloud, Why Are World’s Largest Companies Buying It?

How Microsoft’s Revolutionary Partner Program Is Driving Hypergrowth in the Cloud

2. I Have Seen the Future of Enterprise Software, And It Is SAP Qualtrics

It’s ironic that the company that four decades ago created the classic Newtonian tool for operations—ERP—this year became the company to deconstruct classic ERP and begin remaking it with customer-side data and insights as well. In turn, that repositioning is happening across every major SaaS player in the Cloud Wars.

SAP’s Brilliant Transformation: And They’ve Only Just Begun

SAP Says HCM Is Dead—Can Qualtrics Transform it to HXM?

Attention Salesforce: SAP CX Revenue Surges 75%, Key Exec Jumps Ship

SAP CEO Bill McDermott: Qualtrics Is ‘Biggest Growth Opportunity I’ve Ever Seen’

SAP and Qualtrics’ $1.6-Trillion Opportunity: Exclusive Talk with SAP CEO Bill McDermott

The SAP Qualtrics Effect: How Salesforce, Oracle and Workday Should Respond

SAP Qualtrics CEO Ryan Smith: ‘I Was Alone for 17 Years—I Know What That’s Like’

3. The CEO of the Year Is Google Cloud’s Thomas Kurian

Simply put, the perfect new leader for a high-potential company at the ideal time. The high-value capabilities Kurian is helping Google Cloud unleash will force every other vendor in the Cloud Wars to get better. Much better. And quickly.

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

Inside Google Cloud’s Breakout $2B Quarter: 10 Key Insights

Inside Google Cloud’s Resurgence: 10 Key Messages from CEO Thomas Kurian

Google ‘Anthos’ and New CEO Turn Up the Heat On Microsoft and Amazon

Google Cloud’s Strategy: Helping Customers Achieve the Unachievable

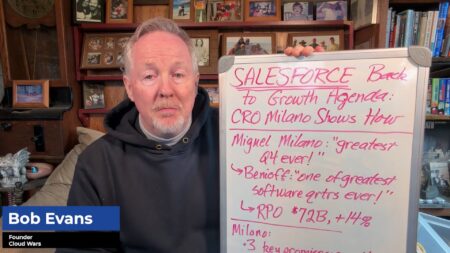

4. How Salesforce Plans to Defeat Oracle and SAP While Scaling to $35B

I pulled about 14 slides from Salesforce’s 64-slide “Investors Day” presentation to outline Marc Benioff’s unique blend of vision, insight, and passion that has enabled Salesforce to achieve levels of growth unmatched by any other publicly traded company in history.

Salesforce vs. SAP: Who Will Lead the Customer-Experience Revolution?

Salesforce’s New Strategy: All-In on ‘Customer 360,’ Powered by MuleSoft

Why Salesforce Is the World’s #1 SaaS Vendor: 360-Degree Scale

Attention Workday, SAP and Oracle: Is Salesforce Jumping into HCM?

Amazon Jilted as Salesforce and Microsoft Pair Up for IaaS and Teams

Salesforce, Pivoting to Data, Showcases Game-Changers MuleSoft and Tableau

Salesforce Invades SAP: Links Sales + ERP Data for Manufacturing

5. Life After SAP: Bill McDermott’s 10-Point Plan to Triple ServiceNow’s Revenue

After a highly successful decade running SAP, McDermott has jumped over to ServiceNow as it approaches its first billion-dollar quarter. Here’s how he plans to blow that out to a $10-billion company in a very short time.

Can SAP Icon Bill McDermott Turn ServiceNow into $10-Billion Cloud Powerhouse?

How Bill McDermott Rescued SAP in its Darkest Hour: Courageous Leadership

ServiceNow’s Breakthrough Strategy: Create ‘Systems of Action’

ServiceNow Set to Unveil ‘Killer App’ as Market Cap Surpasses $50 Billion

6. Machine Learning More Disruptive than Cloud, Says Workday CEO Aneel Bhusri

Strong words from one of the true pioneers of the SaaS industry and a long-time passionate advocate for the cloud. But Bhusri, who says that inside Workday he’s known as “the Pied Piper of ML,” says the disruption is only just beginning.

Exclusive 1:1 with Aneel Bhusri: Machine Learning Changes Everything

Workday Says High-Flying Financials Business Will Surpass Flagship HCM

Workday’s Path to a $1-Billion Quarter: 10 Key Insights

Why High-Flying Workday Is Pushing ML over M&A

Workday CEO: Oracle and SAP Can’t Match Us in Fortune 100

How Workday Helps Walmart Modernize Employee Engagement: the New HCM

Workday Cranks Up the Heat on Oracle and SAP in Cloud ERP Wars

7. Remarkable Transformations by Huge Corporations

In 2019, some of the world’s largest and most-successful companies took huge steps toward ensuring they’re in position to extend that success into the digital age. And at the center of all these efforts is the CEO’s #1 priority: create fabulous experiences for customers.

The Ultimate Digital Transformation: Microsoft Helps Kroger Become Tech Company

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Inside Walmart’s Digital Transformation: 30 Tangible Steps on its Journey

Amazon and Lyft: Is $100 Million a Year a Bargain or Bungle?

Marriott International’s Brian King On Busting Processes to Delight Customers

The Customer-Centric CIO: How Dean Del Vecchio Created Culture of Innovation

Why Customers Love AWS: Enabling Major Transformation at Guardian Life

From Financial Services to Manufacturing, Here’s the #1 Priority for CEOs

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Microsoft-SAP Juggernaut: Huge Pharma Moving All SAP Workloads to Azure

How Microsoft, Amazon and Workday Are Driving Machine-Learning Revolution

Inside Microsoft’s Billion-Dollar Cloud Deals: Driving ‘Innovation Agendas’

8. Microsoft Begins Selling SAP Applications As Cloud Ecosystem Evolves

Revealed during SAP’s Sapphire event in May in a conversation I had with SAP co-CEO Jen Morgan and Microsoft EVP Judson Althoff, this breakthrough agreement marked a new level of strategic collaboration among major players in the cloud business. Microsoft’s openness to such agreements is a primary reason it’s #1 on the Cloud Wars Top 10.

SAP Rides Microsoft Deal to First $2-Billion Cloud Quarter as McDermott Era Ends

SAP and Microsoft Revolutionize the Cloud Market

Why Microsoft’s Beating Amazon: Cloud Deals with SAP, Oracle and ServiceNow

9. Attack of the Killer Database: Oracle Autonomous DB “Will Replace Everything”

Rarely has a product with so little quantifiable revenue impact been the source of such lofty promises for future piles of gold. But Larry Ellison’s made a fabulous career out of achieving what others said was not possible. If he can parlay some of that potential into cold hard cash, the Autonomous Database could indeed become what Ellison has promised: the most-successful product in the company’s history.

Hello, IBM and Microsoft: Larry Ellison’s Big Plans for Oracle Autonomous Database

Oracle Autonomous Database: Overhyped or Tech-Industry Game-Changer?

How Oracle Is Becoming a Cloud Powerhouse: Larry Ellison’s All-In Bet on Autonomous Database

Oracle’s Blowout Q4: Autonomous Database Looks Like a Huge Success

Oracle Will Dethrone SAP as World’s #1 ERP Vendor, Vows Larry Ellison

10. IBM Cloud Unleashes its True Competitive Advantage: Tech Plus Industry Expertise

The tech industry is a more interesting and more innovative place when IBM’s operating at full strength. In the second half of 2019, the iconic company showed signs of riding the cloud to new levels of relevance and capability. Can IBM continue to blend pieces of its far-flung empire to deliver what customers need?

IBM Bets Its Future on Hybrid Cloud as IBM Cloud Revenue Tops $19 Billion

IBM Cloud Grows 14% and Drives Sweeping Internal Transformation

Look Who’s Driving Disruptive Innovation in the Cloud: IBM!

IBM’s $33-Billion Bet on Red Hat: The Stakes Are Enormous

IBM Cloud Wins Huge Deal with BNP Paribas, Possibly Worth $2 Billion

IBM Sales Leader: “Every Discussion Is About Cloud”

Can IBM and Red Hat Deliver on Big Cloud Promises? 3 Key Questions

IBM Says We’re #1 With “Most Open” Cloud

IBM’s $34-Billion Payback Plan for Red Hat

11. Bonus: Cloud Wars Analyses of Industry-wide Trends and Challenges

Grading the World’s Top 10 Cloud Vendors: The Cloud Wars Report Card

Cloud Revenue Surging to $158 Billion for Top 10 Vendors in 2019

Cloud Revenue Super-Surge: Salesforce and SAP to Top $51 Billion for 2023

Top 3 Tech Battles in 2020: Microsoft vs. Google, Salesforce vs. SAP, Amazon vs. Oracle

Disclosure: at the time of this writing, SAP, Oracle, Google Cloud, IBM and Workday were clients of Evans Strategic Communications LLC and/or Cloud Wars Media LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!