If it’s indeed true that I Have Seen the Future of Enterprise Software and It Is SAP Qualtrics, then what impact will the Qualtrics Effect have on leading SaaS companies Salesforce, Oracle and Workday?

Quick recap: I believe Qualtrics will profoundly shake up the enterprise-software business because it’s figured out a way to interconnect customer sentiment and real-time customer-experience data with immediate and real-time follow-on actions that help fix problems before they become serious and accelerate and expand positive momentum.

That breakthrough achievement is enhanced on a massive scale by the fact that Qualtrics and its experience-data solutions have been acquired for $8 billion by SAP, which over the past few decades has amassed more operational data for its enterprise customers than any other tech company in the world.

*******************

RECOMMENDED READING:SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

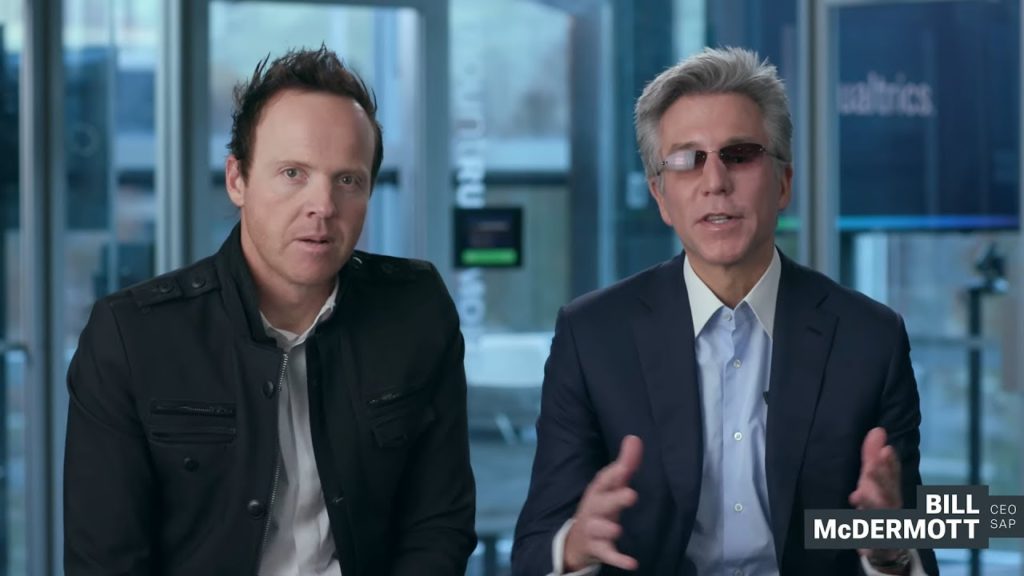

SAP CEO Bill McDermott: Qualtrics Is “Biggest Growth Opportunity I’ve Ever Seen”*********************

So the combination of all that operational data from SAP—the stuff that tells businesspeople “what” happened—with the experience data from Qualtrics that reveals “why” it happened will allow SAP and Qualtrics to interconnect the increasingly complex and fast-changing demand chain (experience data or “X data”) with supply chains that themselves must become smarter, faster and more flexible than ever before.

I believe this will trigger significant changes in how all enterprise-software companies create and position new products and services because business customers will begin to demand truly 360-degree views of what’s going on and what’s over the horizon for their companies. And that will extend beyond customers to also include employees, partners and other stakeholders.

In that context, it’s interesting to speculate about how three of the world’s top enterprise SaaS companies— Workday, with $2.8 billion in annual SaaS revenue; Salesforce, the #1 SaaS vendor with more than $13 billion in SaaS revenue; and Oracle, with about $4 billion in annual SaaS revenue—will respond to what I’m calling The Qualtrics Effect.

-

The Qualtrics Effect & Workday

On the company’s recent earnings call, CEO Aneel Bhusri was asked what’s driving the burning desire among business leaders for digital transformation across all facets of their organizations. And Bhusri’s reply was fascinating because it touched on not only Workday’s core areas of HCM and ERP but also by extension customer experience, and on how businesses must begin to look at the engagement spectrum across employees, customers and partners rather than in silos.

“Every company that sees the world through the lens of employee engagement and how important it is, is trying to engage their employees by getting better information into their hands to help create great employee experiences.

“And so part of the transformation is, from an HR perspective, looking at HR as people engagement and employee engagement and, in some cases, partner engagement as opposed to traditional administrative applications the way they were thought of 20 years ago,” Bhusri said.

“HR and finance together are going from being viewed as back-office operations in the world of client/server to front-office business partners to the CEO today. And finance is very focused on helping the business make the right decisions along the way to grow the business and make the business more profitable. And it’s just a different mindset than the way client/server systems were implemented 20 years ago where it was just about automating business processes and making sure you could generate the right statutory reports. It’s pretty massive.”

What Workday should do: already a customer-obsessed company, Workday needs to find some way to interconnect its extensive and market-leading HCM solutions and also its ERP applications with some type of externally driven data reflecting customer behavior, choices and expectations. I’m not saying Workday should enter the field of CRM or CX—Bhusri has repeatedly said Workday’s close partnership with Salesforce covers that—but as The Qualtrics Effect takes hold among business customers, the new marketplace realities will, I think, force Workday to interlace its solutions and insights in some way with what’s happening on the customer side.

-

The Qualtrics Effect & Salesforce

On the company’s recent earnings call, co-CEO Marc Benioff hammered home relentlessly and convincingly his reasons for why Salesforce is “the customer company” and why customer-side CEOs are turning to Salesforce to drive their own digital transformations. But as you look at the very impressive metrics he tossed out on the call about the scope and scale of Salesforce’s business, see if you spot any comments

about customer-experience data or how to use it to drive smarter decisions:

“Just look at some of the daily milestones our customers have helped us achieve with our Intelligent Customer Success platform: every single day, more than 3 million sales opportunities and 3.2 million leads are created in our Sales Cloud; 9.7 million cases are logged in our Service Cloud; and 1.9 billion emails are sent out from our Marketing Cloud,” Benioff said.

“Every single day, Einstein Analytics creates 44 million reports and dashboards, and Einstein AI generates more than 6 billion predictions. And, during the recent holiday-shopping season, in one single day our Commerce Cloud processed more than 4.2 million orders and supported 690 million E-commerce page views.”

What Salesforce should do: No doubt, Salesforce will tell you that the Qualtrics capabilities are trivial and are no match for the scale at which Salesforce operates, and that Einstein Analytics does everything Qualtrics does and more.

And maybe Salesforce is right—but I don’t think so. Because Salesforce—the undisputed and relentlessly high-performing category king of CRM—has created an industry and the descriptors and metrics and expectations that define that industry.

But what if that industry’s changing? What if business customers now want their software vendors to be able to tell them not just *what* customers are doing, but why they’re doing that? Can Salesforce deliver that?

If Salesforce can, it’s not talking about that capability—so it either needs to recast how it describes what it can do and get that customer-experience story out there, or it needs to buy or build its way into this dynamite new sector of the market.

-

The Qualtrics Effect & Oracle

With its earnings coming out in two days, Oracle’s been fairly quiet recently, but it’s interesting to note that several years ago when it began to build out its customer-engagement suite of applications, Oracle specifically eschewed the “CRM” designation dominated by Salesforce (it’s even the company’s stock symbol) and went instead with the designation “CX.”

So, at least in terms of the name of its suite of products aimed at customer engagement, Oracle’s got the term “experience” out there. And while parts of its extensive suite of applications do touch on the customer-experience side of that business, Oracle’s CX business is much more oriented to the seller side and to the commerce end of the spectrum.

What Oracle should do: Oracle’s strength is its breadth of products across all three major SaaS categories: HCM, ERP and CX. Oracle needs to find a way to begin what doing SAP started a year ago and drove home with the Qualtrics acquisition in November 2018: find ways to create new and high-value business insights by linking the supply-side data in their ERP business with customer-oriented data from their CX business.

And, in case there’s any company out there that has even a semblance of what Qualtrics has put together, Oracle should swoop in and buy that company before someone else does.

Because The Qualtrics Effect has changed the dynamics of the software business in profound ways, and very soon business customers will begin expecting—and demanding—nothing less.

Disclosure: At the time of this writing, SAP and Oracle are clients of Evans Strategic Communications LLC.

*******************

RECOMMENDED READING FROM CLOUD WARS:The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019*********************

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!