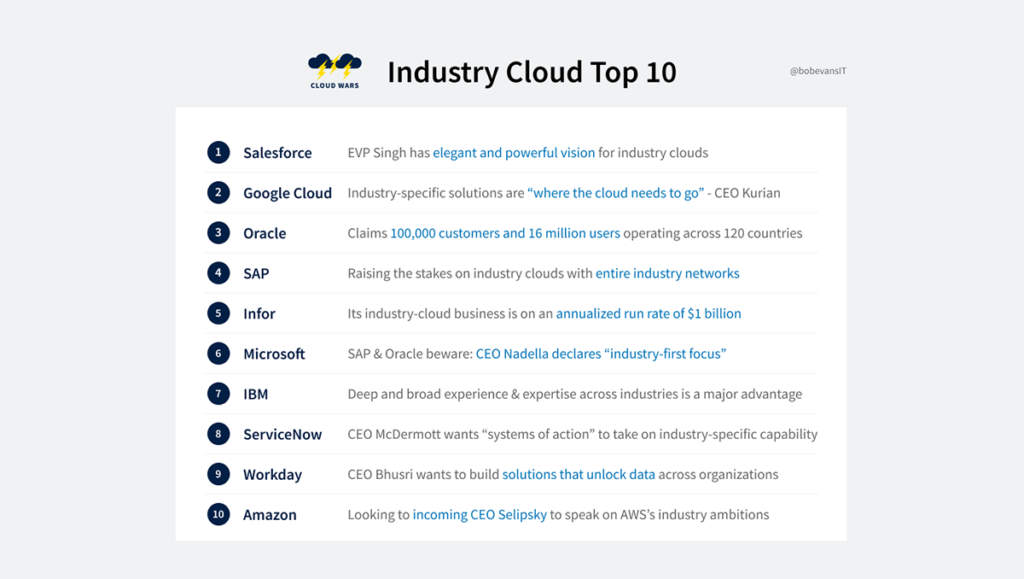

As industry-specific solutions have unquestionably become the cloud’s Next Big Thing, we here at Cloud Wars are delighted to introduce our new weekly rankings of the leading providers in that dynamic space: the Industry Cloud Top 10.

This new Industry Cloud Top 10 list, plus our new biweekly news and analysis report called the Industry Cloud Newsletter, are designed to help you keep up with the dizzying pace of change and depth of innovation that has marked the past several months.

In today’s edition of that Industry Cloud Newsletter, I offer this perspective on how rapidly and radically this market segment is evolving: “I’ve never seen the entire tech industry coalesce as aggressively and as rapidly around a single trend as what’s happening now with industry clouds. In just the past six months or so, we’ve seen every company on the Cloud Wars Top 10 dramatically accelerate its plans and positioning around vertical-market capabilities.” If you want to get a great return on an investment of 45 seconds, then just sign up for the Industry Cloud Newsletter: it’s free, it’s exclusive and it’ll give you some unique insights into what could become the cloud’s next trillion-dollar category.

This new Industry Cloud Top 10 ranking will complement our long-running and widely followed Cloud Wars Top 10 list, and both are updated weekly. As you’ll see below, while 9 of the Cloud Wars Top 10 make the Industry Cloud Top 10 list, the relative positioning of the providers is dramatically different across the two lists.

Now, what factors have I evaluated to come up with the Industry Cloud Top 10? Here are the primary ones:

- Revenue, although few companies are disclosing that publicly.

- Vision: how well do the providers align their offerings with the deepest needs of customers?

- Scope and scale: how big and broad are the vendor’s vertical ambitions? Are they playing at the margins, or looking to become full-spectrum drivers of transformation, innovation, and growth for customers and themselves?

- Customer examples: are these references transformational or tactical? Do customers tell stories of cost-cutting and efficiency gains—both of which are perfectly fine—or do they talk about reimagining their futures and developing the ability to do things that dazzle customers and were never before possible?

- CEO focus: how frequently does the CEO talk about industry clouds or industry-specific solutions? Is it a strategic imperative, or a tactical possibility?

Against that backdrop, here’s my first iteration of the Industry Cloud Top 10. We’ll be updating these rankings on a weekly basis, exactly as we do with our original and widely cited Cloud Wars Top 10 rankings. And I’m anticipating there will be a fair amount of mobility within the Industry Cloud Top 10 as it’s still an emerging market and one that all of the major players insist is a strategic imperative.

For more detail on each provider in the Industry Cloud Top 10 and my outlooks on the various companies, be sure to check out today’s special edition of the Industry Cloud Newsletter, which is devoted to the rollout of the Top 10.

#1 Salesforce: annualized run rate of more than $2 billion for industry clouds

#2 Google Cloud: AI- and ML-driven industry-specific solutions are top priority for CEO Thomas Kurian

#3 Oracle: already has 100,000 industry-cloud customers and 16 million users in 120 countries

#4 SAP: huge commitment to industry clouds paired with big higher-level vision for “industry networks”

#5 Infor: a quiet giant in the field with industry-cloud run rate of about $1 billion

#6 Microsoft: probably won’t be #6 for long as Nadella has declared “industry-first focus”

#7 IBM: cloud SVP Boville has scrapped general-purpose approach to cloud and is driving industry-specific clouds

#8 ServiceNow: McDermott has talked about need for industry focus since taking CEO job 20 months ago

#9 Workday: its “plan, execute, analyze, repeat” framework will work beautifully in fast-changing vertical markets

#10 Amazon: AWS website says they’re all over industries, but they declined to discuss

I’d love to hear your thoughts on the market overall, as well as your impressions of how this list matches up with how you see the various players.

And this list is further proof that in the Cloud Wars, the biggest victors are the customers, who get the enormous benefit of the unbridled and often savage competition that results in those customers having a wide-range of world-class options.

RECOMMENDED READING

Oracle Vs. SAP: Like King Kong Vs. Godzilla, the ERP Battle Rages On

Has Oracle Climbed to #3 in Booming New Cloud Category?

IBM Cloud Bounces Back with Q1 Cloud Revenue up 18% to $6.5 Billion

SAP Raises Stakes on Salesforce, Google, Oracle with Huge Bet on Industry Networks

Cloud Vendors Confront ‘Highest Risk’ Projects: Database Migration

Cloud Wars Top 10 2021 Revenue to Hit $241 Billion: Microsoft $75B, Amazon $60B, IBM $28B

Infor Leapfrogs Microsoft, Oracle, SAP: $1 Billion in Vertical Apps

Microsoft Versus Amazon: Who Will Be King of the Cloud for Q1?

Disclosure: at the time of this writing, Google Cloud, Oracle, and SAP were among the many clients of Cloud Wars Media LLC and/or Evans Strategic Communications LLC.

Subscribe to the Industry Cloud Newsletter, a free biweekly update on the booming demand from business leaders for industry-specific cloud applications.