As companies surge into the cloud to accelerate innovation and become end-to-end digital businesses, major tech vendors—both “legacy” and cloud-native—are overhauling everything from product lines to sales practices to embrace the new customer-centric model in enterprise computing: the hybrid cloud.

In yesterday’s Part 1 of this 2-part series—The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand?—I described the rationale among business leaders for balancing their aggressive deployment of cloud technologies with the pragmatic reality that plenty of on-premises systems are here for the long term. I also outlined the hybrid strategies and approaches of the three largest cloud-computing vendors in the world: Microsoft, Amazon and IBM.

Today’s second part will look at how 3 other cloud heavyweights—Oracle, SAP and Google Cloud—are positioning themselves for the hybrid-cloud revolution and the coming hybrid era.

1. Oracle: “Hybrid cloud is our foundation and focus.”

More than 3 years ago, Oracle chairman Larry Ellison predicted that in spite of the booming growth in cloud computing, large enterprises would require at least a decade of “coexistence” between modern cloud technologies and the reliable if not remarkable on-premises systems already running their global operations.

In an October 2015 article on Forbes.com, Oracle’s Michael Hickins outlined Ellison’s view of that “coexistence”:

Here’s what Oracle Executive Chairman and CTO Larry Ellison has to say about that: “Customers are telling us they want to do cloud where that’s appropriate, and they want to do on-premises where that’s appropriate, but they want to manage all of that as one single thing: easy to manage, fully compatible, with the ability to quickly and easily move workloads back and forth. You can say this will be a 10-year transition—and that’s certainly when the biggest changes will take place—but I think the coexistence will go on forever. This big period of transition and essential coexistence will be a huge issue over the next decade because customers really want the public cloud to look like their data center, and their data center to really look like their public cloud.”

And later in that same article, Hickins offered this perspective from another Oracle executive:

“Hybrid cloud is our foundation and focus,” Oracle Senior Vice President Steve Daheb told the Wall Street Journal. “I don’t know of any Oracle product that isn’t in the cloud already or won’t be there soon. Smaller and medium-size businesses are more public-cloud-focused. But enterprises and large enterprises say, look, we have tens of years and millions of dollars of investment in on our on-premises environment. Ultimately, what is the best solution? It will be hybrid.”

So for more than 3 years, Oracle has been openly endorsing the customer-centric idea that while the cloud might be fabulous in many respects, it’s just not realistic—for a variety of reasons ranging from regulatory issues to privacy concerns to plain old risk-aversion—to expect businesses to rip and replace everything they’ve invested hundreds of millions or even billions to deploy.

At the same time, it’s hard to overstate the magnitude of the challenge Oracle faces in converting its entire set of products and technologies—surely numbering several thousand SKUs—to the cloud, an undertaking that Ellison began more than 12 years ago.

So somewhere between the idealized vision of an all-cloud nirvana and the practical realities of the business world, Oracle realized that hybrid would be the way forward.

2. SAP: “Cloud-first company that preserves every customer’s right to a hybrid environment”

The situation with SAP has been a little more dramatic as CEO Bill McDermott’s bullish statements about being a “cloud-first” company have raised some questions among customers about SAP’s commitment to the on-premises workloads that currently run vast portions of the global economy.

As a result, McDermott and other SAP executives have been attempting to emphasize that the company will above all else preserve customer choice even as SAP itself continues its aggressive pivot into the cloud—and it’s interesting to note that just several months ago, SAP’s revenue for its cloud applications exceeded the revenue from the licensing of its traditional applications.

In a recent discussion about SAP’s values and its emphasis on building and sustaining trust, McDermott said, “There are other things we are doing to preserve trust in the merits of SAP. Think about cybersecurity—we’re investing everything we have. Choice of consumption—we’re a cloud-first company that preserves every customer’s right to a hybrid environment to protect their existing investments. And we are the most adopted technology in the enterprise, which is why we’re strengthening partnerships with consumer partners like Apple and Google.”

And early last year, at SAP’s annual Capital Markets Day, executive board member Jennifer Morgan, who is president of Americas & Asia Pacific Japan, offered a broad overview of how SAP is looking to preserve customer choice in a rapidly evolving marketplace.

“Our Digital Core—simply S/4 HANA. You can have it in the cloud or you can have it on premise—there’s choice… Customers all take a different journey: many want a hybrid journey, many are starting in the cloud, many are transitioning to the cloud. By having a consolidated sales motion, we simplify this and we focus on what’s right for our customers,” Morgan said.

“Less than 20% of our customers have moved onto S/4. Our pipeline is very robust and in addition to the existing customers moving onto S/4, last year about 1/3 of our new S/4 customers were net-new customers for SAP. So in addition to the runway we have from our existing base, we see a lot of new logos who are moving onto S/4—again, many in the cloud but some might start on-premise. We do see a lot more in the cloud.”

Having made the case that all options are available to customers, Morgan specifically emphasized that SAP’s sales team is pushing the cloud as an alternative over on-premises.

“And our sales force is very, very focused on cloud first,” Morgan said. “The incentives are in place to drive cloud, to drive the public cloud and we’ve got great collaboration. So we’ll continue to see great collaboration and great growth in this area of the business.”

From the perspective of SAP CTO Bjorn Goerke, hybrid and multi-cloud are clearly the way to go. In this YouTube conversation with Constellation Research’s Ray Wang, Goerke states emphatically that SAP embraces the hybrid model (and thanks to WebProNews.com for transcription):

“We’re massively going for the expansion into this multi-cloud world. We strongly believe that hybrid clouds will play a major role in the coming years. If you also follow what the hyperscalers are doing, Amazon was the last one to announce an on-premises hybrid support model. We strongly believe that the world will remain hybrid for a number of years and we’re going in that same direction with the SAP Cloud Platform. We announced partnerships with IBM and ANSYS already and there will be more coming. We’re totally committed to the multi-cloud strategy driving the kind of choice for customers that they demand.”

3. Google Cloud: Embracing and expanding into the on-premises world.

Six months ago, Google engineering superstar Urs Holzle, senior vice-president for technical infrastructure, made Google Cloud’s position on hybrid unmistakably clear when he said, “We are ending the false dichotomy between on-premises and the cloud” during the rollout of its on-premises version of the Google Kubernetes Engine.

Calling the consistency offered by hybrid a “natural choice for businesses,” Holzle said, “Whether you are modernizing code or writing new microservices, you have one way to deploy, one way to secure, one way to audit,” according to coverage of the release of GKE On-Prem in DataCenterDynamics.com.

Immediately after that product launch, CNBC attributed it to Microsoft’s growing success in the cloud market on the strength of its extensive hybrid capabilities. According to CNBC, “The findings suggest Microsoft is posing more competition to the public cloud market leader, Amazon. They come as Amazon and Alphabet‘s Google release products that address a key area that Microsoft embraced before they did: “hybrid cloud,” which means customers can use a mixture of cloud services and software they run in their own data centers, and manage both with a common set of tools.”

So just in the past six months, the enterprise-cloud business units of two of the world’s largest, most-influential and most-valuable corporations have openly embraced the hybrid model to complement their cloud-native cores. Along with Amazon’s rollout of its Outpost on-premises services described in yesterday’s article, Google Cloud used its annual Next customer conference in late October to aggressively expand and showcase its hybrid services and technologies that allow customers to easily and securely span the worlds of cloud and on-premises.

On the Google Cloud website, the lead page on hybrid solutions carries the headline “Innovate on your terms and at your pace” and offers this overview: “If your workloads and apps can’t fully migrate to the cloud, you can take full advantage of innovative Google Cloud tools while maintaining existing systems with a hybrid cloud strategy. Management tools such as Stackdriver and Apigee can provide a single viewpoint of your applications and APIs across your cloud and on-premises infrastructure. Whether you’re in the early stages of migration or are looking to modernize your current setup, seamlessly extend, expand, and evolve your technology footprint over time with Google Cloud.”

Perhaps most important of all, in November Google Cloud named former Oracle executive Thomas Kurian as its new CEO. Kurian led all of Oracle’s product development—cloud and on-premises—and if anyone understands the interplay between those two environments better than Kurian, I’ll give you six months to identify that person.

Conclusion: Who will be the biggest winners in this industry-wide commitment to customers?

That’s the simplest question in the world: business customers will reap enormous benefits from tech vendors’ efforts to not only create great new cloud-based services and capabilities, but also ensure those modern solutions work elegantly with the old workhorses that still for the most part run the global economy.

For at least the next few years, anyway.

Disclosure: At the time of this writing, Oracle and SAP are clients of Evans Strategic Communications Inc.

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!

*******************

RECOMMENDED READING FROM CLOUD WARS:

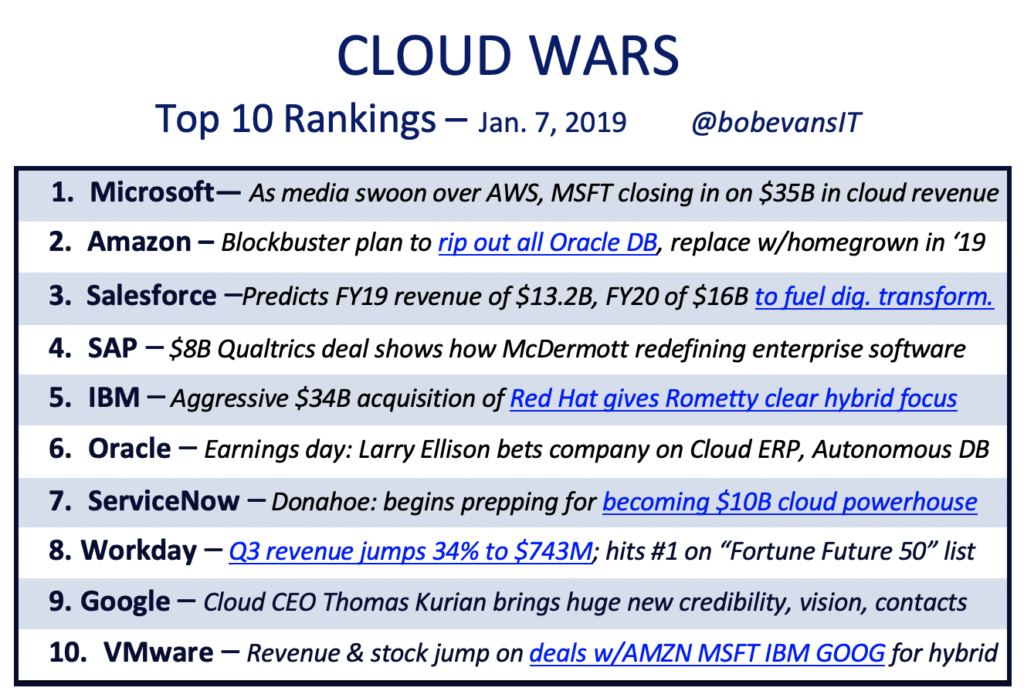

The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019

*********************