As SAP reported preliminary Q2 revenue growth of 21%, CEO Christian Klein revealed the vast potential of SAP’s month-old Industry Cloud by calling it out by name in referring to the company’s “growth drivers.”

In line with German financial regulations, SAP each quarter delivers preliminary results a couple of weeks before it reports its final quarterly numbers. And in its initial Q2 report released last week, Klein said this in describing areas of primary focus for the company: “In line with our strategy, we continue to invest in our growth drivers such as Industry Cloud.”

Now, it’s entirely possible that I’m reading more into this than it actually merits. But let me offer a few reasons why I feel this low-key but very intentional comment by Klein reveals a great deal about SAP’s emerging plans:

- As noted above, the Industry Cloud (a suite of applications featuring AI-driven industry-specific solutions) has only been on the market for about a month. So for it to be listed by CEO Klein among the company’s “growth drivers” that will surely receive significant investments, the Industry Cloud must be showing enormous potential in the early going.

- SAP said it expects to report Q2 cloud revenue of $2.33 billion, up 21%, which points to significant growth across SAP’s broad and rapidly expanding cloud portfolio. And from among those prime assets, Klein very specifically chose to call out the early high performance of Industry Cloud.

- In a similar way, the Q2 pre-announcement press release cited a handful of products that have contributed to the strong Q2 cloud-revenue backlog of $7.58 billion, up 20%. That backlog was driven by “continued high demand for digital supply chain, E-commerce, cloud platform, and Qualtrics solutions,” SAP said. All highly strategic products for SAP—yet only Industry Cloud was cited by Klein as among the overall “growth drivers.”

- In recent months, Klein has vigorously stated that SAP, even as it forges close relationships with hyperscalers in helping global customers move to the cloud, must retain the lead position in those partnerships rather than relinquishing that top spot. That’s particularly true in the cases of Microsoft and Google Cloud, who in addition to being IaaS hyperscalers also offer a growing range of enterprise applications. I’ve analyzed this firm stance by Klein and its ramifications closely because of the huge implications for customers:

- Hey Microsoft: Google Cloud Is Pushing You Out as SAP’s #1 Cloud Partner

- SAP Will Battle Microsoft & Google for Customer Control, Says CEO Christian Klein

- Google Cloud Helps Drive Triple-Digit Online Growth at Lowe’s

- Microsoft Top 10 Customers for Digital Transformation: the Satya Nadella Touch

- Google and SAP Fusing Cloud and AI in Next-Gen Apps for Industries

- Google Launches New Era in Cloud with AI-Powered Industry Solutions

- SAP and Microsoft Revolutionize the Cloud Market

At play here is the inevitable desire for primary positioning in the hearts, minds and wallets of big global customers. As the cloud has obliterated the old IT-industry model where hardware companies made the systems that ran SAP’s apps, SAP now finds that in the world of the cloud, those boundaries and assigned roles are not nearly so restrictive.

So for SAP, Industry Cloud can be a massive point of differentiation that gives it the unique and unmatched wherewithal to demonstrate very clearly to customers that SAP not only wants to hold the top spot in customer relationships, but has indeed earned to right to do so.

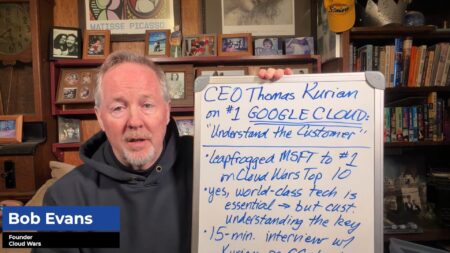

Cloud Wars

Top 10 Rankings — July 13, 2020

| 1. Microsoft — New top priority is converting Oracle’s on-prem database customers |

| 2. Amazon — Grabs lead in outer-space cloud race with Aerospace & Satellite unit |

| 3. Salesforce —Benioff’s Secret Weapon: Tableau Creates Analytics Powerhouse |

| 4. Google — Can Kurian displace Microsoft as SAP’s #1 cloud infrastructure partner? |

| 5. SAP — Klein vows to battle Microsoft, Google Cloud for strategic customer control |

| 6. Oracle — Vs. huge odds, Ellison makes Oracle legit IaaS rival to AMZN MSFT GOOG |

| 7. IBM — Deepens partnership w/ SAP to help customers survive digital revolution |

| 8. Workday — Bhusri hammers legacy IT, tops $1B for Q1, embraces MSFT & SFDC |

| 9. ServiceNow — McDermott riffs on Oracle & SAP, culture and even Grateful Dead |

| 10. Adobe — COVID + problems w/ Advtsg Cloud stunt fiscal Q2 growth to 5%: $826M |

Disclosure: at the time of this writing, SAP was among the many clients of Cloud Wars Media LLC and/or Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive and it’s great!