As the AI Revolution rocks the global economy and the insatiable demand for high-value business data soars, the world’s two largest enterprise-applications companies are recasting themselves to customers as platform providers with massive data and AI capabilities fueled by their applications.

For the customers of SAP, Salesforce, Oracle, Workday, Microsoft, and other enterprise-apps providers, this transformation– this hyperevolution–will prove to be every bit as momentous as the massive shift to the cloud that’s become a global phenomenon over the past handful of years.

That’s because the move unlocks for businesses vast potential for waves of business innovation, re-imagined business models, growth opportunities, and entirely new ways of engaging with employees, customers, suppliers, and partners.

And nowhere will that shift come to light more clearly than in the next wave of competitive battles between Salesforce and SAP, which are not only the world’s two largest providers of enterprise applications but also both rapidly remaking themselves so that their primary value proposition to customers is all about data and AI-powered innovation–particularly agents–rather than just applications.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

While the stakes across the entire software industry are steep, they are even loftier for Salesforce and SAP due to both their current scale and reach and also their ambitions in the data-cloud and agentic AI spaces:

- Next week, Salesforce will release its fiscal-2025 results and is expected to post fiscal-year revenue of about $37.9 billion for the 12 months ended Jan. 31.

- Last month, SAP reported calendar-2024 total revenue of $36.2 billion

Behind Benioff’s bullishness on agents

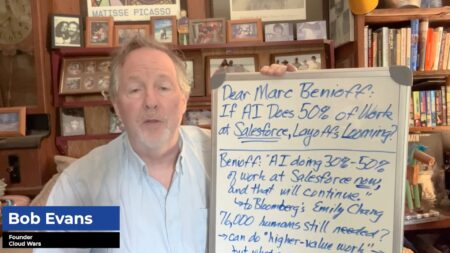

While the CEOs of every Cloud Wars Top 10 company have been bullish on AI in general and agents in particular, Salesforce’s Marc Benioff has been the most visible and passionate advocate for agentic AI, stating that his company already has thousands of customers paying for its Agentforce services. You can get Benioff’s first-hand takes on his thinking behind Agentforce from my recent video interview with him, and also in my related analysis headlined Salesforce CEO Marc Benioff: Agentic AI Will ‘Thrill Customers Out Of Their Minds’.

Benioff has also been boldly out in front on framing the future of what we’ve until now called “applications vendors” as he’s talked passionately about Salesforce becoming a company whose primary value proposition to customers is bound up in the Salesforce Data Cloud and the Agentforce agents that feed off of that Data Cloud. A big factor in Benioff’s thinking is that his company needs to reaccelerate its growth trajectory, which has slipped to 8% as customer demands for its widespread app clouds is far below tra

Klein Leads SAP Into Data Cloud Category

The hyperevolution unfolding at SAP takes a different path because SAP’s apps business is currently booming, with overall Q4 cloud revenue up 27% to $4.9 billion while its Business Suite (formerly Cloud ERP Suite) revenue was up 35% to $4.1 billion.

Klein is attempting to parlay that momentum in apps with a powerful new partnership with Databricks to form the SAP Business Data Cloud, which promises to harmonize for customers not only SAP data but also non-SAP data. With that ambitious foundation in place, SAP is also accelerating its rollout of new agents to be managed and optimized by its Joule “orchestrator,” and has also rolled out an Agent Builder leveraging all of the impressive new capabilities within the Business Data Cloud. For more on those moves by SAP, please see my two recent analyses:

- SAP Data-Cloud Launch Pushes ‘Apps Vendor’ Category Closer to Retirement and

- SAP Data Cloud: Apps Now Exist to Feed AI Initiatives

Final thought

While my focus today has been on these two heavyweights and their early approaches to the new post-applications reality, Oracle will also be a major player in the worlds of agents and data, while Workday has rolled out several new agents to optimize HCM and Financial workflows for customers.

And of course Microsoft is complementing its big early position around Copilots with a major commitment to agents as well.

And there’s no doubt that as the Agent Wars intensify, the biggest winners will be the customers.

Ask Cloud Wars AI Agent about this analysis