In case you thought one of the tech industry’s most bitterly contested rivalries was slowing down, both SAP and Oracle are making it perfectly clear that they’re just getting warmed up in their mutual quests to be the world’s #1 apps provider.

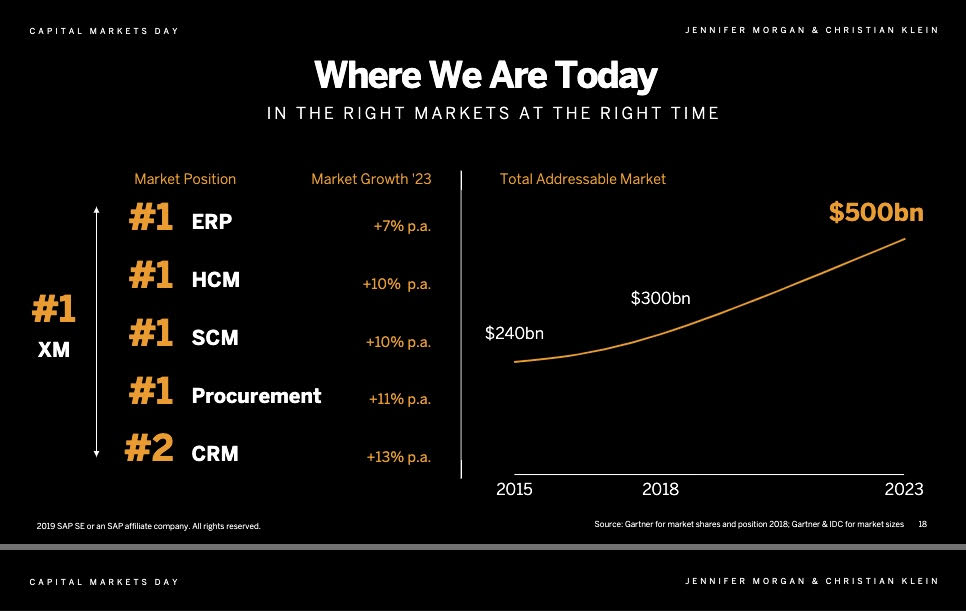

At SAP’s Capital Markets Day with financial analysts earlier this week, newly named SAP co-CEO Christian Klein opened his remarks with a slide showing that SAP is #1 in ERP, HCM, SCM, Experience Management and Procurement, and #2 in CRM.

But two months ago, Oracle chairman Larry Ellison offered a very different view of what’s happening in the enterprise-applications space. (For details, read my analysis in Oracle Will Dethrone SAP as World’s #1 ERP Vendor, Vows Larry Ellison.)

So is SAP or Oracle really #1? And why does that matter?

- First of all, both companies have recently undergone dramatic leadership changes. And business customers are eager to understand if the new leaders will pursue the same agendas as their predecessors. The tragic death of Oracle CEO Mark Hurd several weeks ago leaves a huge vacancy Oracle has yet to fill atop its sales and marketing organization, while CEO Safra Catz continues to oversee operations and strategy. And Ellison is still Ellison—as long as he has anything to do with Oracle, SAP will retain its Moby Dick status. At SAP, longtime CEO Bill McDermott will be stepping down at year-end to become CEO at ServiceNow, paving the way for SAP to install Klein and Jennifer Morgan as co-CEOs. For more on this, please see As SAP, Oracle and ServiceNow Lose Leaders, Who Wins CEO Shuffle?

- Every mid-sized or large company in the world is racing to the cloud. And while Salesforce.com remains by far the largest provider of SaaS applications, both SAP and Oracle have huge apps businesses that span the on-premises environments customers currently depend upon and the SaaS environments toward which they’re moving.

- Both Oracle and SAP are looking to fill out their product lines in areas where they’re both strong—particularly ERP—while also moving into vibrant new spaces. For SAP, that’s Experience Management via its $8-billion acquisition of Qualtrics last year. For Oracle, that’s cloud ERP, where Ellison has claimed to have market share of more than 90%.

The Vendors in SAP and Oracle’s Rear-View Mirrors

- SAP and Oracle are both significant players in HCM, but each faces intense competition there from SaaS leader Workday. Both companies have more work to do before the “we’re #1 claim” carries much weight in HCM.

- Both claim to be #2 behind Salesforce in CRM, but that segment of the market is evolving rapidly beyond its traditional scope. At the same time, Salesforce is showing clear signs of wanting to expand beyond its traditional focus on CRM and has begun dabbling in some categories typically associated with ERP and HCM. I dig into that in Attention Salesforce: SAP CX Revenue Surges 75%, Key Exec Jumps Ship.

Closing Thoughts

Competition is a very wonderful thing. As we always say here at Cloud Wars, the ultimate winners when the tech titans battle are the business customers who get to reap the fruits of that intensified innovation.

At this point, I think SAP is doing a better job of focusing its competitive energies on ensuring great outcomes for customers. Morgan pounded on that point in her presentation this week to financial analysts, and Klein certainly echoed the theme.

I think we should expect to hear Oracle adopt more of that same customer-centric tone rather than some of its high-energy talk about beating the competition, in ways that seem isolated from what that means—or doesn’t mean—for customers.

Cloud Wars

Top 10 Rankings — Nov. 11, 2019

| 1. Microsoft — Q1 cloud revenue of $11.6B = 35% of company’s total revenue! |

| 2. Amazon — As growth rate falls behind MSFT, will AMZN expand into SaaS? |

| 3. Salesforce — Is Benioff planning to switch more databases from Oracle to AWS? |

| 4. SAP —Microsoft deal drives growth as Q3 cloud revenue tops $2B for new CEOs |

| 5. Oracle — Ellison: Autonomous DB growth “so extraordinary, we’re not forecasting” |

| 6. Google — No Q3 cloud revenue details, but “significant growth” across the globe |

| 7. IBM — Cloud + industry expertise powers huge partnership w/ Bank of America |

| 8. Workday — CEO Aneel Bhusri says Oracle, SAP can’t match it in Fortune 100 mkt. |

| 9. ServiceNow —Bill McDermott takes over as CEO as Q3 revenue reaches $900M |

| 10. Accenture —$9B cloud business up 23% in ‘18 |

Disclosure: at the time of this writing, SAP and Oracle were clients of Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!