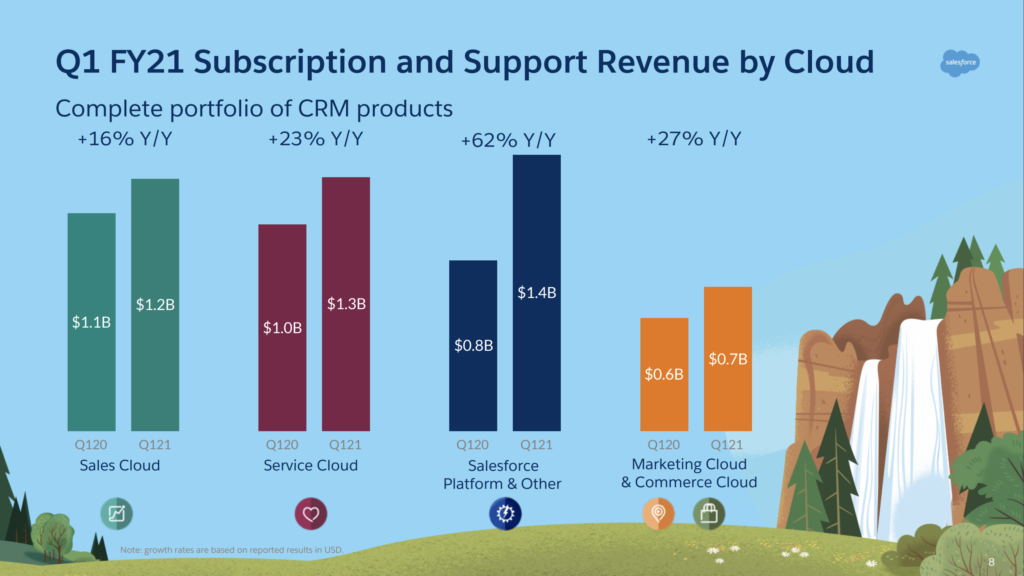

While Salesforce has been known as a SaaS powerhouse for its entire 21-year existence, its largest and fastest-growing business is now “Platform and Other” as the shape of the enterprise cloud continues to evolve.

As shown in the graphic above from Salesforce’s fiscal-Q1 earnings presentation (it’s slide #8), the business unit called Platform and Other has shot past Marc Benioff’s foundational clouds for Service, Sales, Marketing and Commerce.

So while it might rattle your perception of who Salesforce is and what it does, the numbers are quite clear. With Q1 revenue of $1.4 billion and a growth rate of 62%, Platform and Other is the new big dog at Salesforce.

That’s a profound development for Benioff’s company, which is #3 on the Cloud Wars Top 10 behind #1 Microsoft and #2 Amazon. And it’s a very clear indicator that the world’s top cloud vendors are doing everything possible to be able to offer more-complete solutions to customers as the cloud becomes the new IT foundation for the digital economy. (You can see some of Benioff’s high-level comments about his fast-evolving business in a piece I posted last week called Marc Benioff Delivers: “The Best I’ve Ever Seen Salesforce Perform”.)

Growth and evolution from Mulesoft, Tableau and Einstein AI

The rise of Platform and Other also points to the huge contributions that recent acquisitions MuleSoft and Tableau, as well as the booming growth of Salesforce’s Einstein AI services, are making.

Benioff cited all three of those businesses in his vivid description of Salesforce’s landmark deal with AT&T, which is likely the largest deal Salesforce has ever done. Here’s what he said:

Every customer touch point: the AT&T truck pulls up to my office or my home, that’s going to be Salesforce; I walk into the AT&T store and that’s going to be Salesforce. I’m getting an email from AT&T and that’s going to be Salesforce; and I’m on the phone with the AT&T call center and that’s going to be Salesforce. We’re going to make sure that they have that Customer 360-enhanced data, and when we’re integrating all that data MuleSoft is going to connect AT&T’s different back-end systems, Tableau is giving them the ability to understand customer preferences and Einstein is going to help them serve more intelligent recommendations and route service cases.

Benioff peppered his opening remarks with references to Tableau and the role it has played in turning Salesforce into a data-services company that can add great value to all the data streaming out of its best-selling apps.

And while MuleSoft might not have the sexiest name in the tech business, that moniker surely reflects its, uh, workhorse contributions (if I may mix a mulish metaphor) in letting Salesforce customers integrate data from all of their disparate systems to yield that single view of the customer.

Benioff’s comments on Tableau and Mulesoft

“Tableau, well, they were amazing,” Benioff said on the call. This was in reference to the innovations spun out by the Tableau team during the COVID-19 crisis, which overlapped most of Salesforce’s fiscal Q1.

“They built this incredible free analytics platform, the Tableau Data Hub, tracking the virus, and it is now being used by dozens of states in the U.S. and in countries around the world. You can see it at public.tableau.com.

“With Tableau Data Hub, New York State posted a set of Tableau dashboards that provide a daily look at the latest testing and confirmed case data at both a state and county level and that data is also used by Governor Cuomo during his daily briefings.”

Salesforce changing—and thriving—in the current moment

While neither Benioff nor CFO Mark Hawkins cited the ascendancy of Platform and Other to the top of the Salesforce revenue chart—to my knowledge, that detail was revealed only in the graphic at the top of this article—Benioff on a few occasions cited the speed and agility of the Salesforce platform as a major competitive differentiator.

“We’re able to do all this because of our Salesforce platform provides the agility, the flexibility, and the speed to create solutions not in months or years, but in weeks or even days,” Benioff said.

“And with everyone sheltered in place, we saw tremendous growth also in our Commerce Cloud’s weekly order volume and our Einstein Bot sessions. Both were up more than 100% since February 1, and Einstein predictions increased 5 times over this time since last year.”

So here’s how Salesforce’s four major businesses stack up in terms of revenue and growth rates for the 3 months ended April 30:

- Platform and Other: $1.4 billion, up 62%, with 25 points of growth attributed to “significant M&A”;

- Service Cloud: $1.3 billion, up 23% with 2 points from significant M&A;

- Sales Cloud: $1.2 billion, up 16% with 4 points from significant M&A; and

- Marketing Cloud and Commerce Cloud: $700 million, up 27% with 4 points from significant M&A.

RECOMMENDED READING

Marc Benioff Delivers: “The Best I’ve Ever Seen Salesforce Perform”

How Salesforce Plans to Beat Oracle and SAP While Scaling to $35 Billion

Workday Hammers Legacy Model, Tops $1B, Embraces Salesforce & Microsoft

Will Workday Whack Oracle and SAP Again on Earnings Call?

Microsoft Top 10 Customers for Digital Transformation: the Satya Nadella Touch

Bill McDermott Unplugged: ServiceNow CEO Riffs on Oracle & SAP, Culture, Grateful Dead

Microsoft Flexes Trillion-Dollar Muscles: Competitors Sweat, Customers Swoon

How Goldman Sachs Is Becoming a Technology Company

Larry Ellison Picks Amazon’s Pocket—Again—as Cloud Momentum Builds

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive and it’s great!